India's central bank governor told investors on Wednesday to trust the bank to manage the government's massive borrowing programme, after the bond market suffered a sustained sell-off following the 2021/22 budget announcement earlier this month.

The Reserve Bank of India's assurances that it will ensure ample liquidity have failed to calm investors' nerves over the larger than expected 12.06 trillion rupees borrowing requirement, and the central bank has rebuffed their calls for a open market operations calendar.

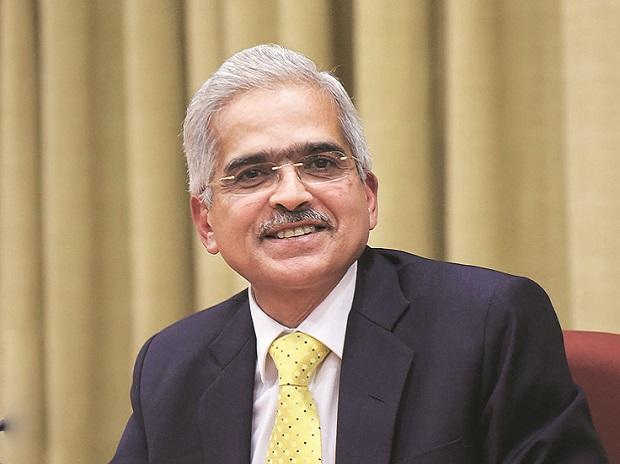

"The market should trust the RBI," Governor Shaktikanta Das told news channel CNBC-TV18 in an interview on Wednesday.

"I think our forward guidance has been much more explicit than it has been ever before," Das said. "There are some subtle messages also which the market should read."

Investors, however have wanted to see more evidence of the RBI's direct support for the market, than verbal assurances.

The benchmark 10-year bond yield, at 6.17%, was up 22 basis points since its low last week. And the comments from Das left it unchanged.

Das said the RBI was seeking "an orderly evolution of the yield curve" and stressed there was no plan to withdraw liquidity prematurely, which could stifle growth.

"We don't want to create an impediment to the process of revival of economic activity," he said.

Das said the RBI conducted more than 3 trillion rupees worth of open market operations in 2020/21 and there would be a similar amount next year.

"We will make available liquidity at the appropriate times, and we will see that the borrowing program goes through, you know, in a very orderly manner," he said.

"It was largely a reiteration of his previous communication. Market may have required a more concrete 'here and now' to move today," said

Suyash Choudhary, head of fixed income at IDFC Asset Management, said Das had largely reiterated the RBI's earlier messages, and the market may have needed more concrete action to react.

"But I would think the reiteration is helpful," Choudhary said, before adding, "Although it seems reasonably clear that they aren't defending a particular yield, rather they are interested in an orderly adjustment."

(Additional reporting by Nupur Anand in MUMBAI and Manoj Kumar in NEW DELHI; Editing by Simon Cameron-Moore)

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU