The market closed higher on the Nifty50 for the first time in the last six consecutive sessions, supported by auto, metals and select banking and financials stocks. Overall it was a volatile session.

The BSE Sensex was up 7.09 points at 49,751.41, while the Nifty50 gained 32.10 points to close at 14,707.80 and formed a bearish candle which resembles a Spinning Top kind of pattern on the daily charts.

"The body of small negative candle was formed with minor lower and upper shadow and this candle was placed beside the long negative candle of Monday. Technically, this pattern indicates a temporary halt in the downside momentum and one may expect further weakness from here or from minor highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short-term trend of Nifty continues to be negative and one may expect some more weakness in the coming sessions. The next lower levels to be watched are 14,350-14,250 and there is a higher chance of sharp upside bounce emerging from the lows. Immediate resistance is placed at 14,850," he said.

The broader markets outpaced frontline indices and the market breadth was in favour of bulls. About 1,153 shares advanced against 753 shares declining on the NSE. The Nifty Midcap 100 and Smallcap 100 indices gained around a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,621.57, followed by 14,535.33. If the index moves up, the key resistance levels to watch out for are 14,824.27 and 14,940.73.

Nifty Bank

The Nifty Bank index declined 140.30 points to end at 35,116.90 on February 23. The important pivot level, which will act as crucial support for the index, is placed at 34,834.97, followed by 34,553.04. On the upside, key resistance levels are placed at 35,539.87 and 35,962.83 levels.

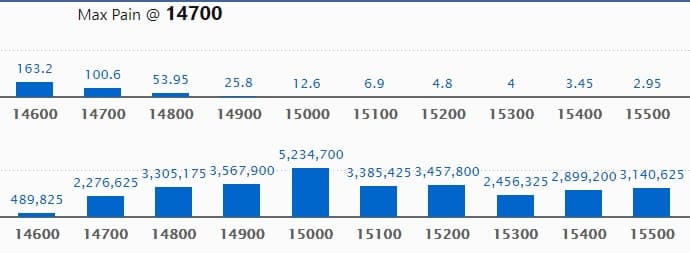

Call option data

Maximum Call open interest of 52.34 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 14,900 strike, which holds 35.67 lakh contracts, and 15,200 strike, which has accumulated 34.57 lakh contracts.

Call writing was seen at 14,700 strike, which added 8.09 lakh contracts, followed by 14,900 strike which added 7.59 lakh contracts and 14,800 strike which added 7.41 lakh contracts.

Call unwinding was seen at 15,500 strike, which shed 9.56 lakh contracts, followed by 15,300 strike which shed 3.03 lakh contracts.

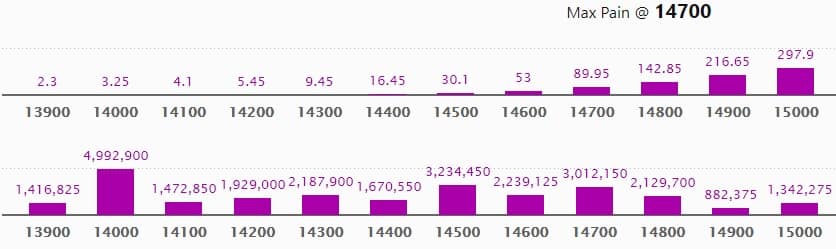

Put option data

Maximum Put open interest of 49.92 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the February series.

This is followed by 14,500 strike, which holds 32.34 lakh contracts, and 14,700 strike, which has accumulated 30.12 lakh contracts.

Put writing was seen at 14,700 strike, which added 10.64 lakh contracts, followed by 14,300 strike, which added 9.66 lakh contracts and 14,600 strike which added 5.11 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 4.56 lakh contracts, followed by 14,900 strike which shed 3.64 lakh contracts and 15,100 strike which shed 1.05 lakh contracts.

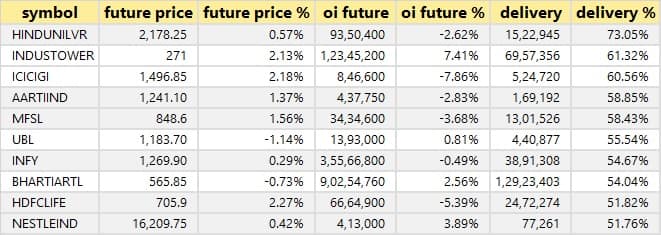

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

43 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

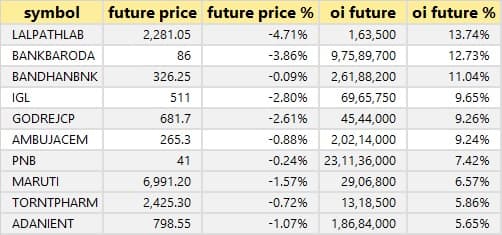

15 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

32 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

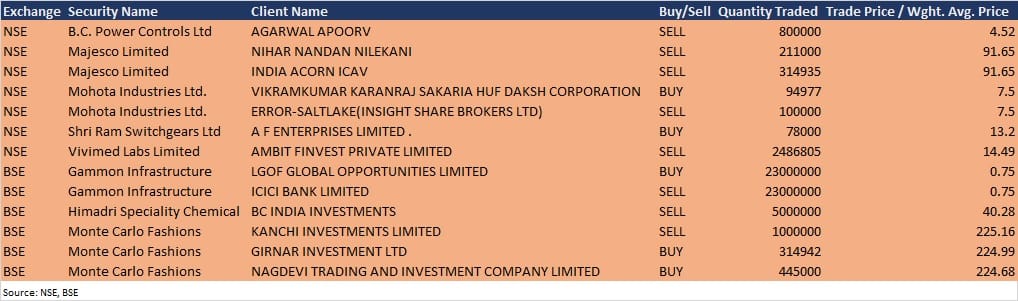

Bulk deals

(For more bulk deals, click here)

Board Meetings/Analysts Meetings

Coal India: The board to meet on March 5 to consider the second interim dividend.

Stocks in the news

Tata Consumer Products: The company will replace GAIL India in Nifty50 Index from March 31, 2021.

Pfizer: Brazil approved Pfizer's COVID vaccine for widespread use.

Sanofi India: The company approved a final dividend of Rs 125 per share and a special dividend of Rs 240 per share.

NTPC: The company executed a share purchase agreement with GAIL, to buy GAIL's 25.51 percent shareholding in Ratnagiri Gas and to exit from Konkan LNG.

SPARC: US FDA sought a new phase-3 study on cancer drug Taclantis.

Mazagon Dock: The company signed MoU with Mumbai Port Trust in Maritime India Summit 2021.

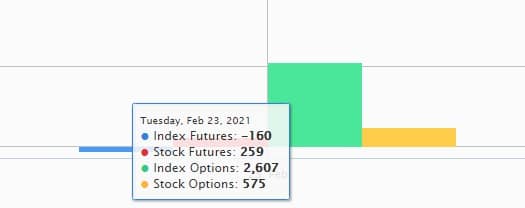

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,569.04 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 216.67 crore in the Indian equity market on February 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and Punjab National Bank - are under the F&O ban for February 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.