UK jobless rate rises to 5.1% for first time since 2016 – business live

Good morning, and welcome to our rolling protection of the world financial system, the monetary markets, the eurozone and business.

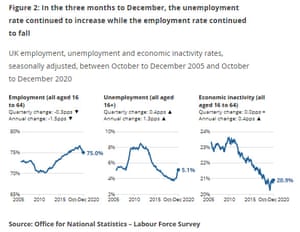

Britain’s unemployment rate has risen to its highest degree since early 2016, because the Covid-19 pandemic continues to hit the labour market – significantly youthful staff.

But, there are additionally indicators that the roles market is stabilising, with a small improve within the variety of payrolled staff in December and January, and a pick-up in vacancies.

The UK jobless rate rose to 5.1% within the final three months of 2020, in accordance to the newest official labour market figures. That’s up from 5% a month earlier — and simply 3.8% on the finish of 2019.

It’s the very best in virtually 5 years, however the jobless rate remains to be decrease than throughout the monetary disaster a decade in the past (with the furlough scheme cushioning the affect of the lockdown.).

The Office for National Statistics stories that since February 2020, the variety of payroll staff has fallen by 726,000 — displaying the size of final 12 months’s job losses.

Encouragingly, although, 83,000 extra individuals had been in payrolled employment in January than in December, the second month-to-month improve in a row after the November nationwide lockdown.

PA Media

(@PA)#Breaking The variety of UK staff on payrolls elevated by 83,000 final month however has fallen by 726,000 since February 2020 due to the affect of the pandemic, in accordance to the Office for National Statistics (ONS) pic.twitter.com/QyEaVVZKMC

Office for National Statistics (ONS)

(@ONS)There had been 28.3 million staff paid via payroll in January, up 83,000 on December.

However, this was nonetheless 726,000 fewer than in February 2020, earlier than the pandemic began to have an effect on the roles market https://t.co/JnDniCrnUb pic.twitter.com/8UU8SQWB7D

The variety of vacancies additionally rose on the finish of 2020, however there are nonetheless solely three-quarters as many alternatives as a 12 months in the past.

Employees initially of their careers have born the brunt of the pandemic job losses, because the ONS says:

New evaluation by age band exhibits that the 18 to 24 years age group has seen the best lower in payrolled staff since February 2020.

The ONS additionally stories that, in October to December 2020, there have been 32.39 million individuals aged 16 years and over in employment, 541,000 fewer than a 12 months earlier. This was the biggest annual lower since May to July 2009.

Here are the important thing factors from the report:

- In January 2021, 83,000 extra individuals had been in payrolled employment compared with December 2020; that is the second consecutive month-to-month improve.

- In January 2021, 726,000 fewer individuals had been in payrolled employment compared with February 2020.

- The UK employment rate, within the three months to December 2020, was estimated at 75.0%, 1.5 share factors decrease than a 12 months earlier and 0.3 share factors decrease than the earlier quarter.

- The UK unemployment rate, within the three months to December 2020, was estimated at 5.1%, 1.3 share factors larger than a 12 months earlier and 0.4 share factors larger than the earlier quarter.

- The redundancy rate, within the three months to December 2020, was estimated at 12.3 individuals per thousand staff.

- The Claimant Count elevated in January 2021, to 2.6 million; this contains each these working with low revenue or hours, and people who aren’t working.

- There had been an estimated 599,000 vacancies within the UK in November 2020 to January 2021; that is 211,000 fewer than a 12 months in the past and 64,000 greater than the earlier quarter.

Office for National Statistics (ONS)

(@ONS)Our newest labour market statistics have been printed for October to December 2020 https://t.co/1DgbObMBLB pic.twitter.com/VCjyNs4y06

More response to observe…

Also developing

Worries about rising inflation and predictions of a commodities super-cycle are driving the markets proper now, with copper costs at their highest degree in over 9 years.

America’s prime banker, US Federal Reserve chair Jerome Powell, will testify to Congress later right now. He’s anticipated to inform US Senate banking committee that the Fed stays dedicated to its stimulus programme. But, with US authorities bond yields rising, might the Fed be compelled to tighten coverage prior to deliberate?

The agenda

- 7am GMT: UK unemployment report for the three months to December

- 10am GMT: Eurozone inflation report for January

- 11am GMT: CBI distributive trades survey of UK retail in February

- 2pm GMT: US home value index for December

- 3pm GMT: US Federal Reserve chair Jerome Powell testifies to Congress