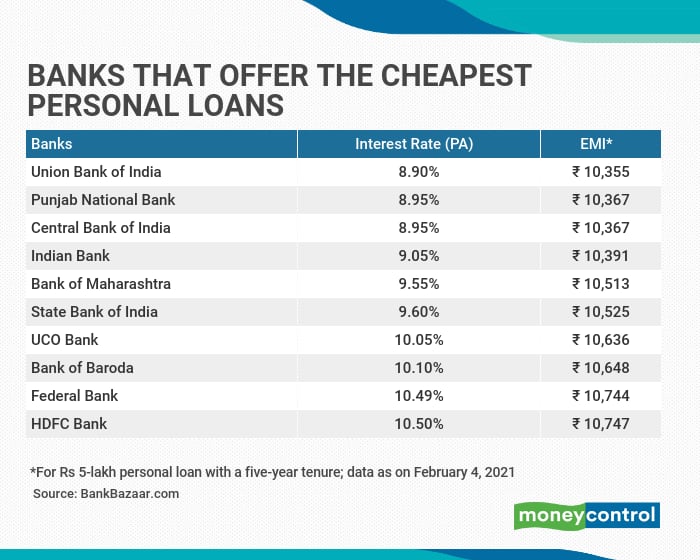

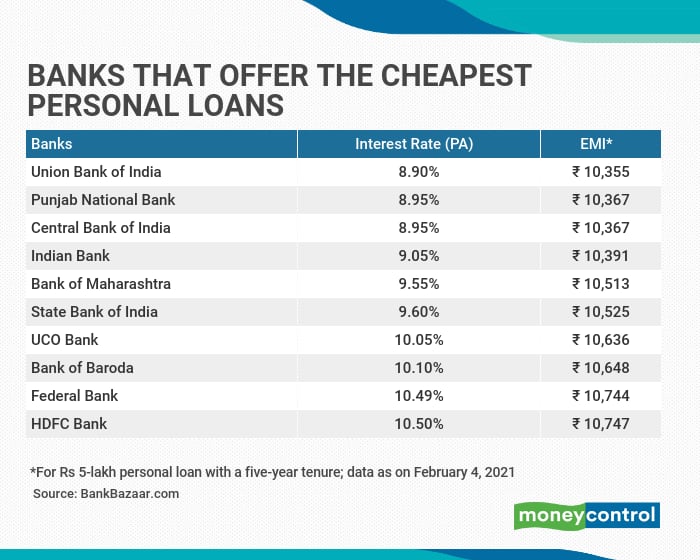

Union Bank, Punjab National Bank offer the lowest interest rates on personal loans

The rates on personal loans range from 8.9-10.5 percent

Moneycontrol PF Team

February 22, 2021 / 02:12 PM IST

Public sector banks continue to lead the charge by continuing to offer lower interest rates on loans across categories compared to what private banks do . The difference between the cheapest personal loan from a state-owned lender and a private sector bank is as wide as 159 basis points, as per data compiled by Bankbazaar.com.

Union Bank of India offers the cheapest personal loan at the rate of 8.9 percent per annum, followed Punjab National Bank at 8.95 percent. Private sector banks Federal Bank and HDFC Bank, the costliest on the top ten list, charge 10.49 percent and 10.5 percent respectively. Eight out of the ten banks on the list happen to be government banks.

A note about the table

The Interest rate on personal loans for all listed (BSE) public and private banks considered for data compilation. Banks for which data is not available on their websites are not considered. Data collected from respective banks’ websites as on February 4, 2021. Banks are listed in ascending order on the basis of interest rate, that is, bank offering lowest interest rate is placed at the top and highest at the bottom. EMI is calculated on the basis of interest rate mentioned in the table for a Rs 5-lakh loan with a tenure of five years (processing and other charges are assumed to be zero for EMI calculation).

Interest and charges mentioned in the table are indicative and may vary depending on these banks’ terms and conditions. You, as a borrower, might be charged a much higher rate if your credit score is low or if the bank’s credit assessment team perceives you as a risky borrower, depending on several factors such as your income and profession.

_2020091018165303jzv.jpg)