With the Indian market indices NIFTY 50 and S&P BSE Sensex hitting all-time high and recovering the losses from the market crash, most mutual funds have witnessed improvement in performance.

However, there are still many actively managed funds that have been unable to catch up with the benchmark. Therefore, Passive investing strategy is increasingly becoming popular among mutual fund investors. Passive funds are less complex and it tracks a particular benchmark to replicate the composition and generate returns.

In the last couple of years, mutual funds have launched passive funds that track various categories (equity, debt, gold), themes (ESG, global), sectors (pharma, IT), as well as other innovative products to help investors create a diversified portfolio.

Both actively managed funds and passively managed funds have pros and cons each. The major difference is that, actively managed funds make it possible to beat the benchmark and exhibit better returns while the passively managed funds will be similar to the benchmark performance.

--- Advertisement ---

WATCH NOW: The Great Indian Wealth Project

Our special event on the Great Indian Wealth Project is Live.

You can join us immediately by clicking the link below.

The Great Indian Wealth Project Event Page

In just minutes from now, we're going to reveal:

– Details on a powerful mega trend that is playing out in India right now

– Details of our #1 stock pick to ride this mega trend

– And how to potentially accumulate Rs 7 crore in wealth over the long-term

Click Here to Join Us Right Away...

------------------------------

In the wake of passive funds gaining popularity, Kotak Mutual Fund has launched Kotak Nifty Next 50 Index Fund. It is an open-ended scheme replicating/tracking Nifty Next 50 index, to achieve the investment objective to generate returns that are commensurate with the performance of the Nifty Next 50 Index.

However, there is no assurance that the objective of the scheme will be realized.

| Type | An open ended scheme replicating/ tracking Nifty Next 50 index | Category | Index Fund |

|---|---|---|---|

| Investment Objective | The investment objective of the scheme is to replicate the composition of the Nifty Next 50 and to generate returns that are commensurate with the performance of the NIFTY Next 50 Index, subject to tracking errors. However, there is no assurance that the objective of the scheme will be realized. | ||

| Min. Investment | Rs 5,000 and in multiples of Re 1/- for purchases and Rs. 0.01 for switches. Additional Purchase Rs. 1000/- and in multiples of Rs. 1 for purchases and Re 0.01 for switches | Face Value | Rs 10/- per unit |

| SIP/STP/SWP | Available | ||

| Plans |

|

Options |

|

| Entry Load | Not Applicable | Exit Load | Nil |

| Fund Manager | - Mr Devender Singhal - Mr Satish Dondapati |

Benchmark Index | Nifty Next 50 Index TRI |

| Issue Opens: | February 17, 2021 | Issue Closes: | February 24, 2021 |

Kotak Nifty Next 50 Index Fund will follow passive investment strategy with investments in stocks in the same proportion as in NIFTY Next 50 Index.

The investment strategy would revolve around reducing the tracking error to the least possible through rebalancing of the portfolio, taking into account the change in weights of stocks in the index as well as the incremental collections/redemptions from the Scheme.

A small portion of the net assets will be held as cash or will be invested in debt and money market instruments permitted by SEBI/RBI including TREPS or in alternative investment for the TREPS as may be provided by the RBI, to meet the liquidity requirements under the Scheme.

Watch Now: 3 Little-known Stocks We are Super Bullish On

The NIFTY Next 50 Index represents 50 companies from NIFTY 100 after excluding the NIFTY 50 companies. The NIFTY Next 50 Index represents about 10% of the free float market capitalization of the stocks listed on NSE as on March 29, 2019.

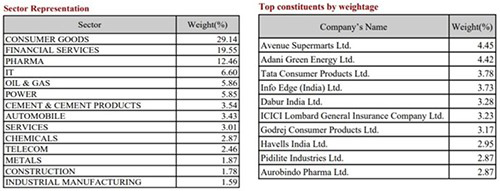

Below mentioned is the list of Top constituents and sector by their weightage as of now.

The scheme apart from investments in stocks in the same proportion as in NIFTY Next 50 Index, it will invest up to 5% of its assets in units of debt and money market securities to meet the liquidity requirements under this scheme.

Under normal circumstances, the asset allocation will be as under:

| Instruments | Indicative Allocations (% of Net Assets) |

Risk Profile High/Medium/Low |

|

|---|---|---|---|

| Minimum | Maximum | ||

| Equity and Equity related securities covered by the NiftyNext 50 Index* | 95 | 100 | Medium to High |

| Debt and Money Market Securities# | 0 | 5 | Low to Medium |

Kotak Nifty Next 50 Index Fund will be managed by Mr Devender Singhal and Mr Satish Dondapati

Mr Devender Singhalis Fund manager at Kotak Mahindra Asset Management Company Ltd. He has over 18 years of experience in equity research and fund management and his qualifications include BA (H) Mathematics and PGDM (Finance).

Prior to joining Kotak AMC Mr Singhal was associated with the PMS divisions of Kotak, Religare, Karvy and P N Vijay Financial Services. Currently schemes managed by him are; Kotak Asset Allocator Fund, Kotak PSU Bank ETF, Kotak Debt Hybrid Fund, Kotak Nifty ETF, Kotak Banking ETF, Kotak Sensex ETF, Kotak NV 20 ETF, Kotak India Growth Fund Series 4

Mr Satish Dondapati is Fund Manager- ETF at Kotak Mahindra Asset Management Company Ltd. He has over 12years of experience in ETF and his qualification is MBA (Finance). Prior to joining Kotak AMC, he worked with Centurion Bank of Punjab in the MF product team.

Currently schemes managed by him are; Kotak Sensex ETF, Kotak PSU Bank ETF, Kotak Nifty ETF, Kotak Banking ETF, Kotak NV 20 ETF, Kotak Gold ETF.

As a significant number of actively managed mutual funds have turned out be underperformers in the past couple of years, Index funds have been gaining momentum. Unlike actively managed funds, index funds do not have to limit their exposure to single stock. Thus, they can benefit immensely when there is rally in index heavyweights.

Kotak Nifty Next 50 Index Fund will invest in the Nifty Next 50 Index stocks, which is a part of NIFTY 100 after excluding the NIFTY 50 stocks. These are large-cap stocks that may provide stable returns in medium term to long-term investment horizon.

The fund's performance will depend on the market conditions and benchmark performance of Nifty Next 50 Index. The fund manager has a limited role to play, tracking the underlying index and implementing any changes in the investment portfolio. Consequently, the performance of the fund will mirror the performance of the underlying index, subject to tracking error.

It is noteworthy, that this is similar to investing in direct equity and is prone to volatility.

If you are looking to benefit from the growth potential of next 'blue-chip' stocks, you can consider investing in Kotak Nifty Next 50 stocks, after considering its suitability based on your risk appetite, investment horizon, and financial goals.

PS: At PersonalFN, we arrive at top rated funds using our SMART Score Model. If you wish to select worthy mutual fund schemes, I recommend subscribing to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

If you are serious about investing in a rewarding mutual fund scheme, Subscribe now!

Author: Mitali Dhoke

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

Rahul Shah on how one should invest with a big market crash looming.

In this video, I'll show you how to allocate your capital as a day trader.

I have put down the exact blueprint to accumulate several crores in safe long-term wealth, in a guide - Eight Steps to Your Eight Figure Fortune.

A stocks from this tax-privileged sector has unusual upside for decades.

Zhong Shanshan and his fellow 24 Chinese billionaires could soon have Indian counterparts in 2021.

More Views on NewsHang on to high quality smallcaps. The smallcap revival is just the beginning.

An Indian company founded three decades ago in a garage caught my attention...

In this video, I'll cover your queries on intraday trading and also share my view on how to decide stop losses and target prices.

In this video, I'll show you why you should hold on to your long positions.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!