Aggregate FDI from China from April 2000 to September 2020 stands at $2.43 billion.

Aggregate FDI from China from April 2000 to September 2020 stands at $2.43 billion. Continuing tensions at the border and measures adopted by the government to check investments by Chinese firms and funds have significantly impacted the flow of investments from China into India over the past year.

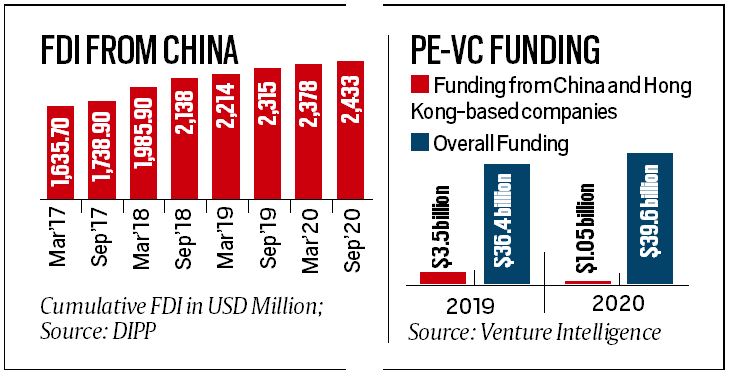

Data from Venture Intelligence, which looks at private company financials, transactions, and their valuations in India, show that private equity and venture capital funding from funds based in China and Hong Kong fell sharply to $1.05 billion in 2020, compared to $3.5 billion in 2019.

For context, overall private equity and venture capital (PE-VC) investment in Indian companies increased to $39.6 billion in 2020 from $36.4 billion in the previous year.

Foreign direct investment (FDI) data also show a notable slowdown in inflows from China in the six-month period ended September 2020. During April-September 2020, FDI from China amounted to $55 million, the lowest from that country in any six-month period over the last three years. In the six months immediately preceding this period (September 2019 to March 2020), FDI inflow was a little higher at $63 million.

The biggest increase in FDI flows from China in the last three years was seen in the six-month period between October 2017 and March 2018, when it grew by $247 million. Aggregate FDI from China from April 2000 to September 2020 stands at $2.43 billion.

FDI flows from Hong Kong too, have slowed. The territory, which was the 12th largest source of FDI into India until September 2018, slipped to 14th position by the end of September 2020.

The government amended FDI rules for Chinese investors in April last year, switching from the automatic route to the approval route, triggering concern among not only Chinese investors, but businesses as well. Chinese companies that have business establishments in India have been going slow on growth plans in the country.

The head of a Chinese automobile company in India told The Indian Express that the tensions at the border have introduced concern over their plans in India. Sponsors are now cautious about their plans for India, this official said.

Indian start-ups have pointed to the need to look beyond the Chinese who have traditionally been the key investors in India’s Internet economy. This is especially after the government banned scores of mobile apps with Chinese links, including popular ones like TikTok, CamScanner, PubG, and Shein.

“This (change in FDI norms) has created an issue of predictability, whether our investor will be able to actually make the promised fund infusion. This is why it’s better for the ecosystem to look at other options including investors within India,” a co-founder of a Bengaluru-based fintech start-up said.

Indian carmakers, and companies in industries that import components from China, are reworking their business plans.

A senior official with a leading automobile manufacturing company said, “Over the last 12-18 months, large companies across the automotive industry and other sectors that import components from China, have been working to find replacement suppliers from Indonesia, Thailand and Vietnam, besides developing local sourcing of these components. While local sourcing will take time, a lot of work has happened on finding replacement suppliers in other countries.”

Companies in India that work closely with partners based in China, are uncomfortable as well.

“Chinese investors and businesses are definitely cautious after what has happened over the last one year. The automatic investment route has been withdrawn, and we understand that even the approval process is not smooth, and the message is clear,” Vinod Sharma, MD, Deki Electronics, said.

Many Indian manufacturers who import components from China are now preferring to source them locally because of the geopolitical tensions and risks to the chains, he said.

Geopolitical tensions have, in fact, been identified by companies as a major impediment to investing in India. In filings last year for a proposed initial public offering, Alibaba Group’s financial services arm Ant Financial noted that “geopolitical tensions, protectionist or national security policies could, among other things, hinder our ability to execute our cross-border payment business strategies, make investments that develop new growth initiatives and technologies, or even divest from our current investees, and put us at a competitive disadvantage relative to local companies in other jurisdictions”.

It added that a change in foreign investment regulation in India “led to our further evaluation of the timing of our additional investment in Zomato, a restaurant aggregator and food delivery start-up based in India”.