The Indian market saw profit-booking after hitting fresh record highs during the week, though a rally in PSU banks limited the losses.

The S&P BSE Sensex slipped below 51,000 and the Nifty50 15,000 after hitting fresh highs of 52,516.76 and 15,431.75, respectively.

The Sensex and Nifty lost more than a percent in the week ended February 19, while BSE midcap and smallcap indices outperformed with gains of 0.63 and 1.23 percent, respectively.

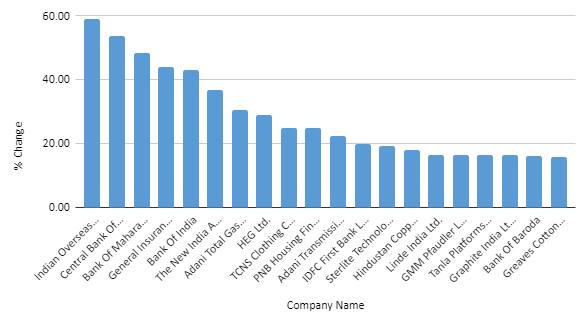

The S&P BSE 500 index declined 0.5 percent but about 45 stocks rose 10-60 percent. These included Indian Overseas Bank, Central Bank of India, Bank of Maharashtra, General Insurance Corporation of India, Bank Of India, New India Assurance Company and Adani Total Gas.

The likely privatisation of some PSU banks and insurance companies helped the market to limit the losses.

Consolidation continued as increasing volatility and weak global cues forced investors to the sidelines, leading the Nifty to close below 15,000. PSU banks and mid-cap stocks that outperformed the market during the week attracted selling pressure on February 19, experts said.

The broader markets—NSE midcap 100 and BSE smallcap indexes—were both in the green, said Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities.

“The US 10-year bond yields have risen from below 1 percent to 1.29 percent building in the economic impact of the USD 1.9 trillion stimulus package. In India, too, the 10-year bond yields have moved up from the recent low of 5.76 percent to 6.13 percent which could mainly be linked to the higher fiscal deficit estimates,” he said.

The domestic 10-year bond yields were expected to be in the 6-6.75 percent range, he said. It remained to be seen if the Nifty would hold 15,000 in the near term. The next major support for the index was the 50-DMA placed at 14,321, he added further.

"As the index managed to breach to its strong support of 15k mark, which will acts as an immediate resistance now. So above 15k mark, we may see some relief otherwise, we may see more downside levels of 14,900-14,750. On the other hand, 15,100-15,170 will act as a strong hurdle on the higher side," said Rohit Singre, Senior Technical Analyst at LKP Securities.

During the week, foreign institutional investors (FIIs) bought equities worth Rs 4408.26 crore, while domestic institutional investors (DIIs) sold Rs 6,283.73 crore worth of shares. However, in the February month till now FIIs bought equities worth of Rs 23,874.67 and DIIs sold equities worth of Rs 16,638.46 crore.

Technical outlook

Indian equity markets continued to move in tandem with international indices, especially those of the US. A sudden rise in domestic as well as global bond yields was a prime hindrance that moderated the enthusiasm of equity market participants.

Investors should be cautious with benchmark indices and take note of any major movements in global markets, experts said.

Markets are expected to remain dull and range-bound in the absence of any major positive triggers, said Nirali Shah, Head of Equity Research, Samco Securities

Investors should count on the opportunity to alter their portfolios by withdrawing monies from the weaker quality stocks and invest in quality bets only on dips, she said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.