Holding debt funds? If you’re the worrying kind, the past few weeks must have set you off wondering whether something is going wrong. Debt fund returns across the board – from the ultra short to short to long-duration schemes – have had a rough run. Should you be troubled by this development? Here’s explaining.

Return trends

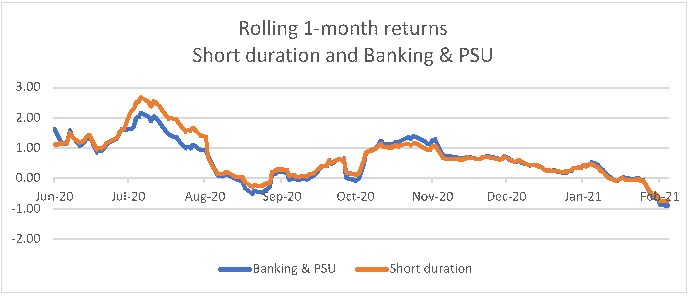

Consider banking & PSU funds. This category sported an average one-year return of above 10 percent as recently as in January. Returns have been in double-digits for much of 2020. This has now dropped to 7.7 percent, after the category began slipping into losses in the one-month periods since the last week of January. Short duration funds have also seen similar falls.

Gilt funds too have witnessed a steady erosion in returns over the past three weeks. The effect here is more pronounced with one-month losses of over 1 percent on an average. The gilt category has seen other instances of falls earlier as well, such as in April and August 2020. However, in those times, the decline was short-lived and returns rebounded as bond yields continued to decline on RBI's actions.

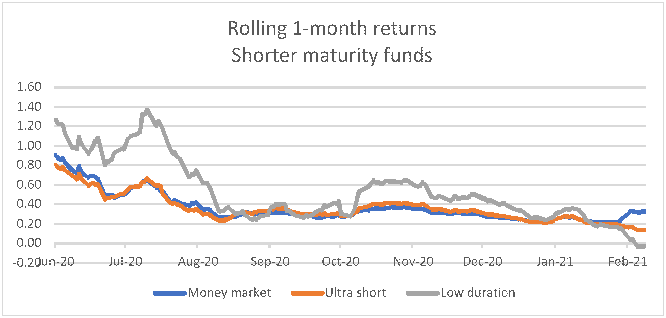

On the other end of the spectrum, the very short duration categories – low duration, ultra short, and money market – have not been spared either. Though the category average hasn’t dropped into losses on a weekly or monthly basis, returns have been significantly lower than three months or six months ago.

Different developments

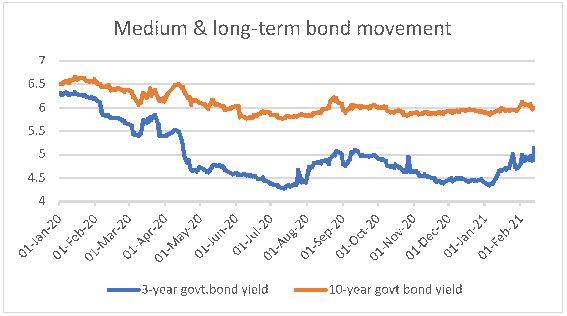

Now, 2020 was an eventful year for the debt market. One, the repo rate was reduced from 5.15 percent to 4 percent, breaking through earlier floors. Two, the Reserve Bank undertook extraordinary measures to both infuse liquidity in the market and keep rates low. Bond yields, therefore, fell through the year, barring a brief period in March-April 2020.

But that scenario is slowly changing now, with many factors pulling in different directions. For one, the Reserve Bank has withdrawn some of the extraordinary liquidity measures it took. Second, retail inflation was sticky at 6-7 percent from April last year, which meant that the Monetary Policy Committee also needed to be careful about further lowering rates. Third, the Budget retained the government’s borrowing at the same high level as it was in the pandemic-hit year; a flood of borrowing typically drives yields up.

All this meant that the hitherto lower bond yields paused their downward trend and started to trend higher. Bond markets also have to contend with RBI activity in managing overall rates, which adds to yield movements.

Bear in mind that interest rates and bond prices have an inverse relationship. When rates rise, bond prices fall and vice versa. The effect of rising rates is sharper in longer duration bonds and gentler in lower duration bonds. This has been playing out of late.

The graphs below show the movement of shorter-term and longer-term government bonds. Note how yields have started to climb up from late last year. Given this background, a fall in bond prices and fund returns is inevitable. The rise in yields has been sharper from January 2021.

Debt fund YTMs increasing

But here’s another point to note: funds eventually adjust to the new yields by acquiring bonds with higher coupon. Therefore, while price volatility cannot be wished away, returns will even out if you hold the fund for the minimum time required. For funds that follow an accrual strategy, a higher rate scenario will help them see better portfolio yields; this will eventually show up in returns, mitigating volatility.

The portfolio yield-to-maturity for some categories appear to be moving higher, going by latest portfolio data. For example, the jump is clearest in liquid funds, where January 2021 YTMs stood at 3.45 percent, the highest since August last year. Ultra-short duration and money market funds have also seen good increase in portfolio YTMs.

The bottomline

Apart from changing debt markets and RBI action to keep rates at desired levels, regulatory moves by SEBI regarding debt funds have also contributed to volatility. So keep the following points in mind:

-If yields move up, your funds will fall in value. Essentially, your fund is reflecting market realities. Volatility in debt fund returns is here to stay.

-In a rising rate scenario, funds that follow accrual strategies will adjust to the higher rates, resulting in higher coupon (interest) generated. This adjustment will happen as and when they add new securities. Shorter-maturity funds will reflect this scenario faster than those with longer maturities.

-If rates remain range-bound or low, you may still face volatility from FPI or RBI moves.

Here’s what you need to do:

-Accept that debt fund returns can fall and will not be steady. Shorter-term funds will see gentler reactions to rate changes, but will not entirely escape it. Longer-term funds will see sharper falls, but can also see bigger gains.

-If you cannot handle volatility in returns, stick to shorter-term funds and avoid categories such as dynamic bond or gilt funds. There are very short and short-term funds for this purpose.

-Know the minimum time-frame you need to have for your debt fund. This is a factor of both the average maturity of the fund and the strategy it follows. Don’t use aggressive strategies or longer-maturity funds for short-term needs. You can hold a fund for any length of time beyond the minimum required.

-Stick to this time-frame and your planned goal duration. Don’t be worried by lower returns in a shorter period such as one week or one month. Holding for the minimum timeframe mitigates the effect of volatility in returns.

-Don’t constantly try to change your funds or debt strategy based on fund returns or the rate cycle. Keep it simple, especially where these funds are simply the debt component in your long-term equity-heavy portfolio.