Ambuja Cements share price gained in early trade on February 19, a day after the company announced its December quarter numbers.

The company on Thursday reported a 34.06 percent increase in consolidated net profit to Rs 968.24 crore for December quarter 2020 helped by volume growth.

Ambuja Cements, which follows January-December financial year, had clocked a net profit of Rs 722.26 crore in October-December 2019.

Revenue from operations was up 4.58 percent to Rs 7,452.87 crore during the quarter as compared to Rs 7,126.44 crore in the year-ago period. Total expenses were at Rs 6,434.43 crore, up marginally from Rs 6,372.09 crore in the fourth quarter of 2019.

Morgan Stanley has kept an overweight rating with a target of Rs 300 per share. The revenue surprised positively in Q4, while EBITDA beat the research firm’s estimate by 7 percent and consensus by 5 percent, reported CNBC-TV18.

Motilal Oswal kept a neutral rating on the stock.

Blended EBITDA/t declined 9 percent QoQ (+31 percent YoY) to Rs 1,095 (8 percent below estimates) due to higher cost, said Motilal Oswal.

The board also recommended a final dividend of Re 1 share. The company has already paid an interim dividend of Rs 17 per share in CY20. The greenfield project at Marwar Mundwa is guided to be commissioned later this year, it added.

At 09:24 hrs Ambuja Cements was quoting at Rs 284.50, up Rs 1.70, or 0.60 percent on the BSE.

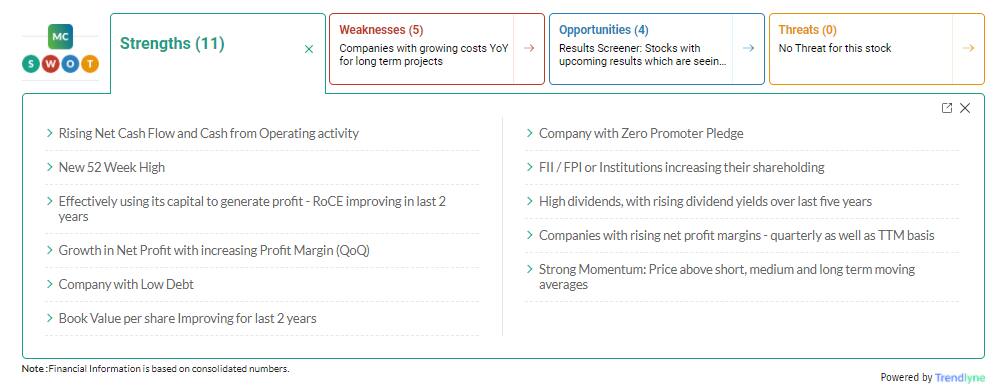

The share touched a 52-week high of Rs 290.70 and a 52-week low of Rs 136.65 on 18 February 2021 and 26 March 2020, respectively.

Currently, it is trading 2.13 percent below its 52-week high and 108.2 percent above its 52-week low.

With inputs from PTI