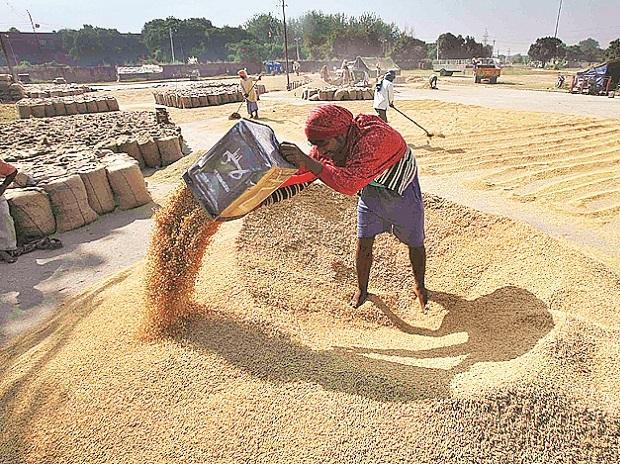

Global rating agency Standard & Poor's (S&P) said India is on track for an economic recovery in the fiscal year ending March 2022 with consistently good performance in agriculture, a flattening of the Covid-19 infection curve, and a pick-up in government spending are all supporting the economy.

However, the economy still faces major risks as it transitions from stabilisation to recovery. India faces a permanent loss of output versus its pre-pandemic path, suggesting a long-term production deficit equivalent to about 10 per cent of Gross Domestic Product (GDP).

India needs many things to be right for its recovery to continue. Most significantly, the country needs to quickly and thoroughly vaccinate most of its 1.4 billion people, S&P, in a report titled, "Cross-Sector Outlook: India's Escape From Covid," said.

The emergence of yet more contagious Covid-19 variants with the potential to evade vaccine-derived immunity present a major risk to this recovery. As does the possibility of early withdrawal of global fiscal stimulus, it said.

Near-term prospects are positive. With a sustained decline in national confirmed Covid-19 cases allowing for a gradual relaxation of formerly stringent epidemic control measures, high frequency economic indicators continue to show improvement.

The government's recently released Budget will also support the recovery, with higher than previously expected expenditures for fiscals 2021 and 2022. India's improving growth prospects are critical to its ability to sustain the higher deficits associated with its more aggressive fiscal stance, S&P added.

Localised containment measures in India are replacing nationwide lockdowns. This has rejuvenated demand, removed supply bottlenecks and labour shortages, supporting a sharp recovery in infrastructure use. The pace of recovery varies widely. Airports are still struggling with most flights grounded.

Utilities are faring better, bolstered by regulated, contracted or availability-based returns that protect their operating cash flows despite an earlier fall in unit demand. The counterparty credit risks and receivable delays pose the biggest risk for utilities (including renewables) while benign funding conditions assuage liquidity risk, agency said.

Likewise, a faster-than-expected earnings recovery has lowered downside risk for rated corporates. An increase in commodity prices and a revival of domestic demand after lockdowns were eased have driven upside earnings surprises. Changes in consumer choices, for example a preference for personal transport for health-safety reasons, have helped sectors such as automobiles, it added.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor