Apollo Hospitals Enterprise | The company reported consolidated profit at Rs 134.16 crore in Q3FY21 against Rs 89.95 crore in Q3FY20, revenue fell to Rs 2,759.84 crore from Rs 2,911.74 crore YoY.

Apollo Hospitals Enterprises share price jumped over 8 percent intraday on February 15 after the company declared ist Q3 results.

Apollo Hospitals on February 12 reported 49.14 percent rise in consolidated net profit at Rs 134.16 crore for the quarter ended December 31, 2020 mainly on account of reduction in expenses.

The company had logged a net profit of Rs 89.95 crore in the year-ago period, Apollo Hospitals Enterprise said in a regulatory filing. Revenue from operations stood at Rs 2,759.84 crore in the quarter under review. It was Rs 2,911.74 crore for the same period a year ago, it added.

Total expenses were Rs 2,595.54 crore as against Rs 2,776.46 crore in the year-ago period, it added. "The third quarter of the year saw robust growth as we increased focus on non-COVID-19 patients, especially non communicable diseases (NCDs), which pose a substantial risk to the health of the people. "

The stock was trading at Rs 2,974.20, up Rs 226.85, or 8.26 percent at 11:42 hours. It has touched a 52-week high of Rs 3,002.30. It has touched an intraday high of Rs 3,002.30 and an intraday low of Rs 2,761.05.

The scrip also witnessed spurt in volume by more than 2.09 times and was trading with volumes of 55,434 shares, compared to its five day average of 25,511 shares, an increase of 117.29 percent.

Global research firm Credit Suisse has maintained outperform rating on the stock and has raised target to Rs 3,160 per share. It is of the view that large Q3 beat was due to strong margin in hospitals adding that Q3 beat lifts FY21 EPS estimate to Rs 6.10 from Rs 1.90 and FY22/FY23 by 15 percent/11 percent.

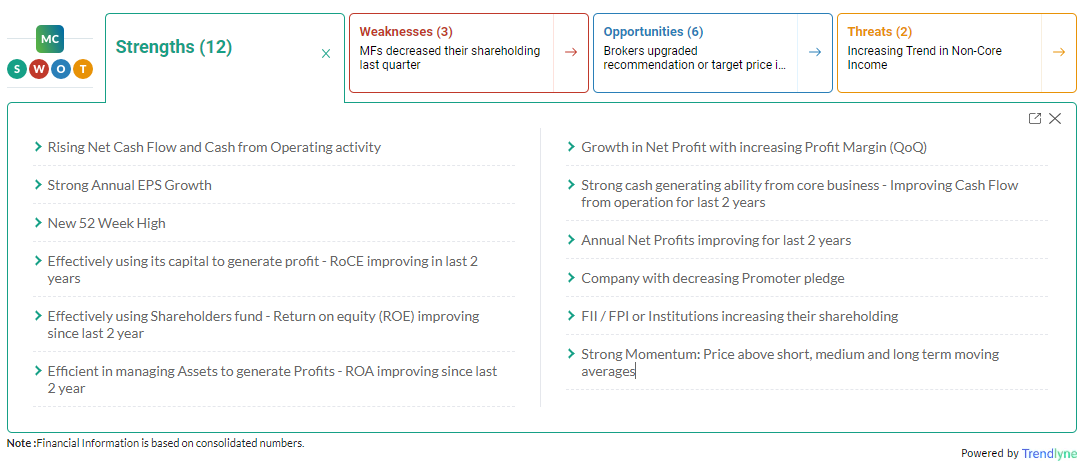

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum: price above short, medium and long term moving averages. The company has decreasing promoter pledge with FII / FPI or institutions increasing their shareholding.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.