The market extended last week's rally and ended at a fresh record closing high on February 15, with the Nifty50 climbing 15,300 mark and the S&P BSE Sensex 52,000 levels for the first time. The rally was led by banking and financials and positive global cues.

The BSE Sensex rose 609.83 points or 1.18 percent to 52,154.13, while the Nifty50 jumped 151.40 points or 1.00 percent to 15,314.70 and formed a small bullish candle on the daily charts.

"Technically, this pattern could indicate an upside breakout of the upper range of around 15,255 levels. This pattern has negated a minor bearish implication created after a Doji or high wave type candle pattern of Friday. This is positive indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"After the sharp upmove of around 1,600 points post the Union Budget-21, the Nifty has failed to show any reasonable downside correction over the last two weeks. The last minor swing low of 14,977, hit on February 10 could be considered as a new higher bottom of the positive sequence, like higher highs and higher lows. From here, one may expect further upside in the market for the short term towards next higher high," he said.

"The next upside levels to be watch out for is around 15,500 in the next few sessions. Immediate support is placed at 15,200," Shetti added.

The Nifty Midcap 100 index gained 1.3 percent and Smallcap 100 index rose 0.4 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,258.67, followed by 15,202.63. If the index moves up, the key resistance levels to watch out for are 15,355.47 and 15,396.23.

Nifty Bank

The Nifty Bank strongly outperformed Nifty50, climbing 1,197.40 points or 3.32 percent to 37,306.30 on February 15. The important pivot level, which will act as crucial support for the index, is placed at 36,657.57, followed by 36,008.94. On the upside, key resistance levels are placed at 37,702.37 and 38,098.53.

Call option data

Maximum Call open interest of 20.68 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,500 strike, which holds 19.09 lakh contracts, and 15,300 strike, which has accumulated 11.47 lakh contracts.

Call writing was seen at 15,300 strike, which added 2.81 lakh contracts, followed by 15,800 strike which added 2.31 lakh contracts and 16,100 strike which added 1.15 lakh contracts.

Call unwinding was seen at 15,100 strike, which shed 4.14 lakh contracts, followed by 15,200 strike which shed 2.9 lakh contracts and 15,500 strike which shed 1.49 lakh contracts.

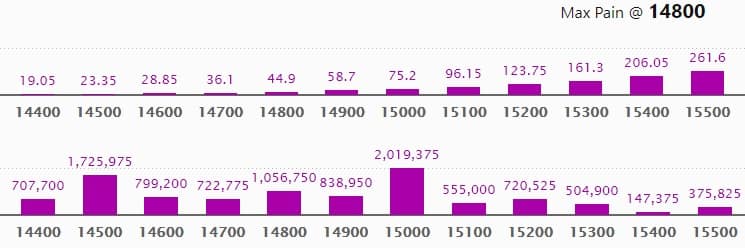

Put option data

Maximum Put open interest of 20.19 lakh contracts was seen at 15,000 strike, which will act as crucial support level in the February series.

This is followed by 14,500 strike, which holds 17.25 lakh contracts, and 14,800 strike, which has accumulated 10.56 lakh contracts.

Put writing was seen at 15,000 strike, which added 3.83 lakh contracts, followed by 15,300 strike, which added 3.69 lakh contracts and 15,200 strike which added 1.98 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 99,675 contracts, followed by 14,700 strike which shed 63,375 contracts.

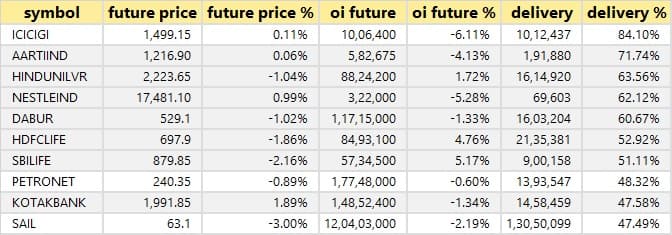

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

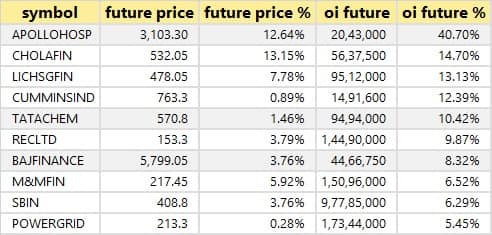

44 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

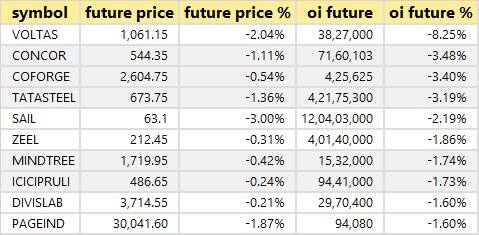

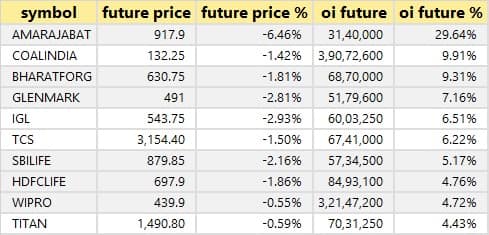

29 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

29 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

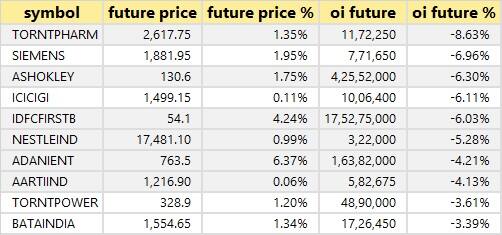

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

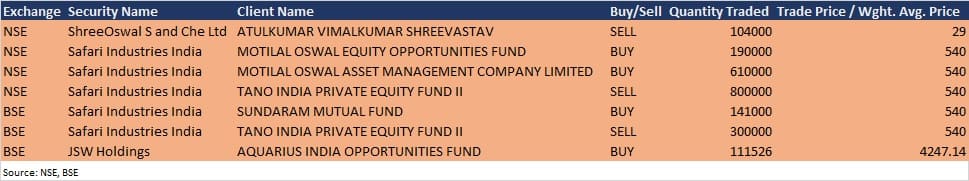

(For more bulk deals, click here)

Nestle India, Varun Beverages, R Systems International, Schaeffler India, Advent Computer Services and GM Polyplast will announce their quarterly earnings on February 16.

Stocks in the news

Titan Company: Subsidiary CataLane incorporated 'StudioC Inc' as a wholly- owned subsidiary. CaratLane acquired 100% stake in StudioC Inc worth $150,000.

Gujarat State Petronet: Mirae Asset Investment Managers (India) increased stake in the company to 5.03% from 4.9998% via open market transaction.

Poly Medicure: The company opened its QIP for subscription on February 15 and fixed the floor price at Rs 550.79 per share.

Siti Networks: Subsidiary Variety Entertainment sold the balance 1,600 equity shares in Voice Snap Services, to Rajalakshmi Communications and Services for Rs 2.4 crore.

Tech Mahindra: The company to support end-to-end IT transformation for Germany-based telecommunications provider Telefonica Germany / O2.

SIS: The company approved the proposal of buyback of upto Rs 99.99 crore worth of equity shares, at a price of Rs 550 per share.

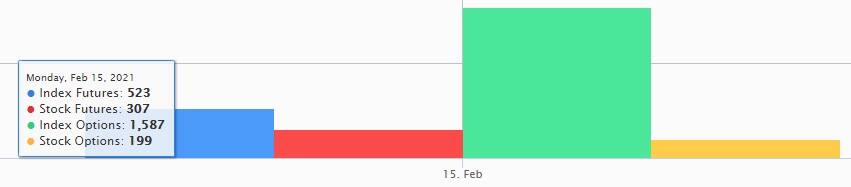

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,234.15 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,048.55 crore in the Indian equity market on February 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and SAIL - are under the F&O ban for February 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.