:quality(80)/images.vogel.de/vogelonline/bdb/1794500/1794521/original.jpg)

Market Scenario Surge of Bio/Pharma Special Purpose M&A Should Be Viewed with Skepticism: Global Data

Global Data, the leading data and analytics company has stated that despite the recent increase in bio/pharma special purpose acquisition companies (SPAC) deals by companies, the long-term success of these organizations in generating revenue remains to be seen.

Related Companies

UK – There has been a boom in bio/pharma special purpose acquisition companies (SPAC) deals in recent years. Last year seems to be no different as SPAC deals continue to provide an alternative way for companies to go public without needing a traditional initial public offering (IPO). However, the long-term success of SPAC acquisition targets in generating revenue remains to be seen, says Global Data, a leading data and analytics company.

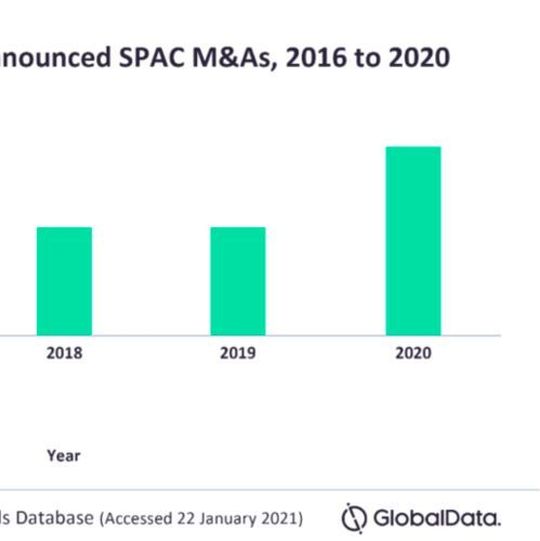

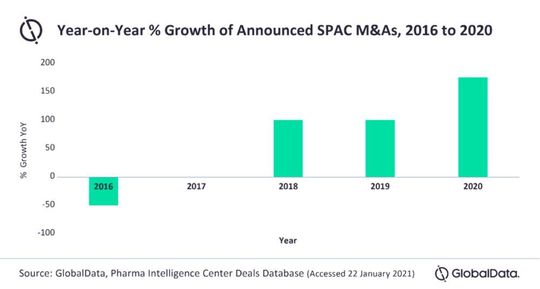

Global Data’s research reveals that the number of announced mergers and acquisitions (M&As) rose by 1,000 % between 2016 and 2020, and the popularity of bio/pharma SPAC M&As has surged, with a 175 % increase in the announced SPAC M&As between 2019 and 2020.

Madeleine Roche, MSc, Pharma Analyst at Global Data, comments: “The rapid rise in SPAC M&As may create significant issues by flooding the market with too many SPACs. Additionally, the lock-up period before shareholders can sell their shares for a SPAC is typically longer than that of an IPO, which can lead to increased volatility and loss of market value of the company’s shares.”

Despite the initial success, companies that go public through a SPAC M&A may perform worse on the public market in the long-term. Some experts have also expressed skepticism over the surge of SPAC deals, as there may not be enough companies out there capable of delivering good returns.

Roche concludes: “Despite the current trend for SPAC M&As to be used as an easy way to avoid going public, the long-term success of these companies remains to be seen.”

(ID:47132683)

:quality(80)/images.vogel.de/vogelonline/bdb/1796000/1796064/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1794800/1794843/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1794200/1794278/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1796600/1796663/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1796600/1796639/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1796600/1796611/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1796000/1796012/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1797000/1797083/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1795400/1795494/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1793300/1793348/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1797000/1797068/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1796500/1796588/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1794100/1794194/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1793200/1793267/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1793300/1793360/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1790500/1790551/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1781300/1781356/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1779700/1779733/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1797000/1797079/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1797000/1797072/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1797000/1797066/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1788100/1788142/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1769000/1769071/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1750700/1750774/original.jpg)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/113800/113818/65.jpg)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/34300/34309/65.jpg)

:fill(fff,0)/p7i.vogel.de/companies/5f/98/5f98fbb2e7bf2/05-trm-filter-logo-with-slogan-en-alt.png)

:quality(80)/images.vogel.de/vogelonline/bdb/1682900/1682997/original.jpg)

:quality(80)/images.vogel.de/vogelonline/bdb/1726900/1726937/original.jpg)