The market has carried its good form into the new year, hitting record highs on strong FII flows, better-than-expected corporate earnings, a growth-focussed Budget, supportive policies by the Reserve Bank of India, sliding coronavirus infections and a smooth vaccination programme.

The BSE Sensex and Nifty50 surged 25 percent each since last Valentine's Day to close at 51,544.30 and 15,163.30 on February 12. They have more than doubled from the lows of March 24 2020 , backed by rotational buying in all sectors.

The broader markets also joined the party and outperformed benchmark indices. The Nifty midcap index is up 27.5 percent and the smallcap index 28.75 percent from last Valentine's Day.

Though there could be intermittent corrections after the stupendous rally, the bull run is expected to continue on hopes of strong economic and earnings growth, experts say.

"For long, corporate earnings, as a part of the GDP, have been suppressed. With the normalisation in earnings, we expect corporate profit to GDP to rise beyond 4 percent, which is currently around 2.8 percent," Vineeta Sharma, Head of Research at Narnolia Financial Advisors said.

They were optimistic about the GDP growth on the back of reduced imports from China, production linked incentive (PLI) schemes for sectors such as electronic manufacturing and auto components, boost in Infra and evolution of Digital India . "All these should keep the market buoyant," she said."We believe the rise of another bull market is in place, though intermittent corrections cannot be negated," she added.

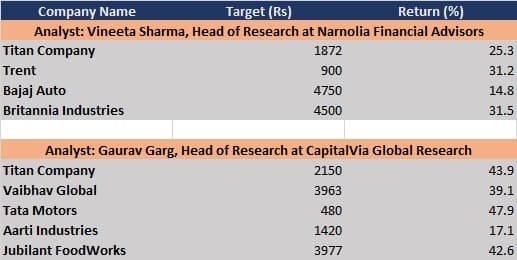

Analysts have picked these 8 stocks for 15-48 percent gains by next Valentine's Day:

Analyst: Vineeta Sharma, Head of Research at Narnolia Financial Advisors

Titan Company: Buy | Target: Rs 1,872 | Return: 25.3 percent

Consumer spending is likely to grow from $1.5 trillion at present to $6 trillion by 2030, making it the third-largest consumer market in the world after the US and China. Upper middle-class and high-income segments are expected to grow from being one-in-four to one-in-two households by 2030.

About 68 percent of the jewellery business comes from the unorganised sector. Hallmarking and the introduction of GST in the jewellery segment have been important changes in the sector. Titan Company has an asset-light distribution model, enriched jewellery portfolio and has invested in brand building, which is enabling the company to record better than industry growth.

Trent: Buy | Target: Rs 900 | Return: 31.2 percent

Trent's strong balance sheet, strong business positioning and stores expansion plan make it attractive for long-term investment. Despite the challenging environment, Westside has been delivering better than industry growth. Post COVID-19, the trajectory of revenues has continued to improve month-on-month with encouraging trends. As per management, in January 2021 (end of season sale month), traction for full-price merchandise was consistent with the levels witnessed in the previous year in both quantity and value terms.

The company's working capital is well managed. The inventory turnover is the best in the industry.

Bajaj Auto: Buy | Target: Rs 4,750 | Return: 14.8 percent

The company gained around 300 bps market share in the 125cc segment led by strong Pulsar 125 sales. The company reported strong volumes in the majority of export markets in both two-wheeler and commercial vehicles. African, South Asia and Latin America markets have seen strong recovery as these markets are operating at above 80 percent of the previous year levels. Despite gross margin decline, EBITDA margin saw an expansion of 171 bps QoQ to 19.4 percent on the back of higher operating leverage and a better product mix.

Britannia Industries: Buy | Target: Rs 4,500 | Return: 31.5 percent

Britannia has shown overall growth, mainly led by distribution expansion, and better traction from international business. Benign raw material prices with cost optimisation are expected to help the company maintain its margin. Recovery in dairy and cake portfolio and distribution expansion in rural areas drives growth for the company.

The company has been able to expand its biscuit portfolio by adding adjacent products like croissants, cookies and cakes, which are growing at a higher rate than the traditional biscuit Sales. Better dividend policy along with net profit expansion helps ROE improvement going forward.

Analyst: Gaurav Garg, Head of Research at CapitalVia Global Research

Titan Company: Buy | Target: Rs 2,150 | Return: 43.9 percent

Robust performance in challenging times reaffirms the long-term potential for the company. Overall, 12 percent sales growth in Q3FY21 is ahead of the management's target of achieving normalcy by Q4FY21, which is why Titan is among few discretionary companies to have reverted back to healthy sales growth post-COVID-19.

Vaibhav Global: Buy | Target: Rs 3,963 | Return: 39.1 percent

The company has reported robust sales growth of 23.4 percent with one of its highest ever EBITDA margins at 16 percent. The strong performance was led by robust growth in the retail business, which grew by 29 percent YoY. The stock has outperformed the broader indices backed by its strong and consistent financial performance.

Tata Motors: Buy | Target: Rs 480 | Return: 47.9 percent

In Q3FY21, overall EBITDA margin rose to 15.4 percent and as a result, the company was able to generate positive free cash flows for the second consecutive quarter. With a robust order pipeline, a desirable product mix coupled with strong executional capabilities, Tata Motors is well-placed among peers, and is expected to outperform the industry in terms of growth with demand on the rise.

Aarti Industries: Buy | Target: Rs 1,420 | Return: 17.1 percent

The demand from end-user industries has picked up after lockdown. Q3FY21 revenue grew by 10 percent YoY, as revenue from specialty chemicals grew by 3 percent and pharma business grew by 32 percent YoY. The pharma segment continues to demonstrate strong momentum, as supply disruptions have eased, while overall revenue growth was aided by better volumes from the regulated market.

Jubilant FoodWorks: Buy | Target: Rs 3,977 | Return: 42.6 percent

The growth prospects that the Indian QSR industry offers to the organised players are on the positive note. We also believe that the company maintains its dominant position in this space, with its strong brand equity, robust balance sheet and initiatives like investment in data science & innovation.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.