Table of Contents

- How to pay PCMC property tax?

- PCMC property tax e-receipt

- How to view PCMC property tax property bill?

- How to calculate PCMC property tax?

- How to change the name in property tax records?

- Rebate on PCMC property tax

- Properties exempted from property tax

- PCMC property tax news

- How to register complaint on PCMC Suvidha?

- PCMC contact details

- FAQs

The Pimpri-Chinchwad Municipal Corporation (PCMC) is counted as one of the richest civic bodies, owing to a large number of multi-national manufacturing units that are functional in the area. The area has also gained prominence as a real estate neighborhood, as the workforce employed in these manufacturing units started buying houses in the region. As a result, a number of housing societies and townships came up in the area, for which the infrastructure is provided by the PCMC. Property owners need to pay half-yearly property tax to the corporation, which can be easily done online. The PCMC was one of the first civic bodies to collect property tax digitally. Follow this step-by-step guide, to understand how to pay the PCMC property tax.

How to pay PCMC property tax?

Step 1: Visit the PCMC India portal and click on ‘Resident’, from the top menu.

Step 2: Select ‘Property Tax’ option, which will take you to an external website.

Step 3: Click on ‘Property Bill’ option after which you will be redirected to a new page.

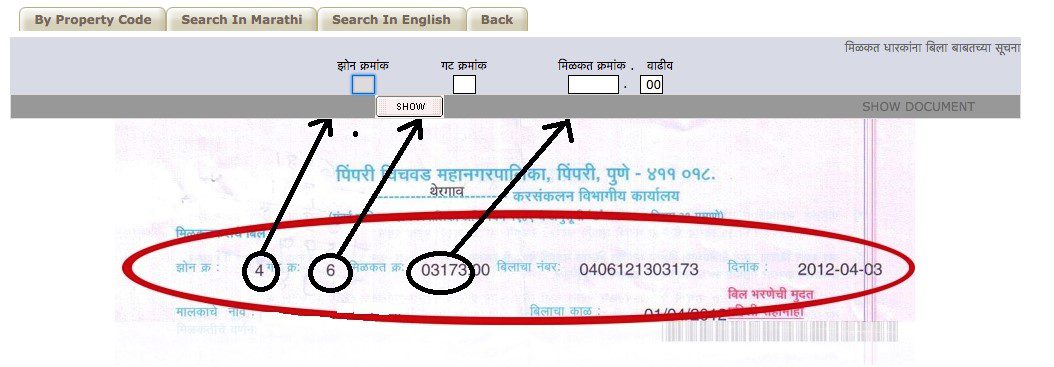

Step 4: You will see four options to search your property details – ‘By Property Code’, ‘Search in Marathi’, ‘Search in English’ and ‘Back to Home page’.

Step 5: Enter the zone number, Gat number, owner name and address, to get your property bill.

Step 6: Click on ‘Show’, once you are prompted to display the property details on the screen.

Step 7: Scroll down to find the ‘Make Payment’ option.

Step 8: Enter your email-id and mobile number, choose the payment option and make the payment.

PCMC property tax e-receipt

Your e-receipt is generated right after you make the payment. If the payment is not completed, or the receipt is not generated due to connectivity or technical problems, users should check the bank account for debit information. If the bank account is debited but the receipt is not generated instantly, you can come back to check again later, in three working days. The receipt will be available below the ‘Make Payment’ option on your property details page.

How to view PCMC property tax property bill?

Step 1: Visit PCMC Property Tax portal and click on ‘Property Bill’.

Step 2: Search your property details by entering the zone number, Gat number and owner’s name.

Step 3: Click on ‘Show’ option, to view your property bill.

Step 4: Search for ‘Total Amount to Pay (Amount with Concession-Fajil Amount)’ in the bill. This is the amount you have to pay as property tax, for the April-September period.

How to calculate PCMC property tax?

It is easy to self-assess the property tax amount for your property in the PCMC area, through a calculator available on the PCMC’s official site. Here is a step-by-step procedure, to calculate your property tax:

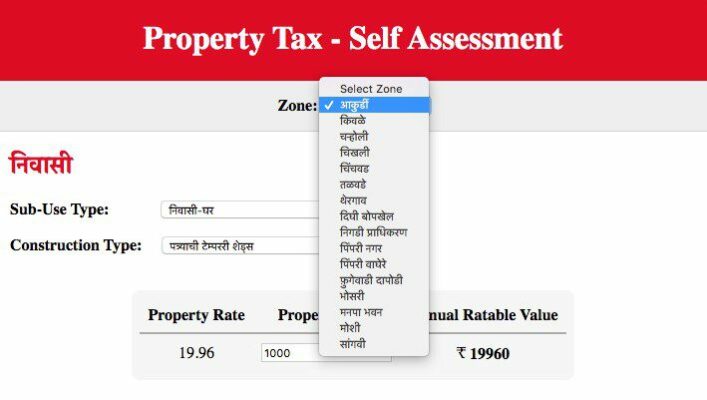

Step 1: Visit the PCMC Property Tax-Self Assessment Portal.

Step 2: Choose the zone and scroll down if you want to calculate property tax as a resident or NRI or for commercial property.

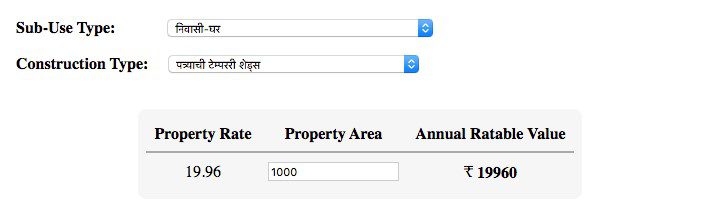

Step 3: Select the sub-use type, construction type and type in the property area.

Step 4: Your property tax amount will be calculated.

How to change the name in property tax records?

The process of getting your name changed in the official property tax record is simple and can be done by the applicant if all the necessary documents are in place. Keep these documents handy:

- Latest property tax receipt.

- Attested copy of the sale deed, which should be in the name of the applicant.

- No-objection Certificate from the housing society.

- Application form, which is available from the property tax office

Fill the application form and submit it with above documents to the Commissioner of Revenue at the PCMC office. The application will be verified and the records will be changed in 15-20 working days.

Rebate on PCMC property tax

If the entire property tax is paid by May 31, the following rebates are available:

| Condition | Rebate |

| For residential properties/ non-residential/open plot specifically registered as residential building | 10% discount on general tax, if the annual rateable value is up to Rs 25,000 or 5% discount, if the annual rateable value is more than Rs 25,000 |

| Residential properties with solar, vermiculture and rain-water harvesting | 5%-10% discount, depending upon the number of projects installed. |

Properties exempted from property tax

There are a few types of properties, which are exempted from property tax. This includes space used for religious worship, public burials or cremation and heritage land. Apart from this, any building that is used for charitable, educational, or agricultural purposes, is also exempted from property tax. In addition to this, the PCMC has also exempted residential structures of less than 500 sq ft from property taxes. This move benefits over 1.5 lakh households in the region.

PCMC property tax news

Update on February 11, 2021

PCMC to mop Rs 150 crores through tax on unauthorised properties

In order to earn additional revenue to fill the deficit, the civic body has begun a survey to assess unauthorised properties in the region, which could be later regularised and taxed. According to an estimate, there are over 50,000 properties, out of which 30,000 have been identified in the survey, while the remaining will be identified soon. The survey has been extended for three more months, to identify such properties. Apart from this, the civic body has identified properties where the owners have pending property taxes of Rs 25 lakhs or more. So far, around 325 properties have been assessed, which could be sealed if the dues are not cleared.

Update on January 29, 2021

No hike in property tax for PCMC residents

The PCMC has decided not to hike property taxes this year, owing to the COVID-19 pandemic and the municipal elections. The decision was made during a meeting of the Standing Committee. There will be no hike in the water tax too.

Recently, the PCMC had reported a drop in revenue by 79% due to the Coronavirus pandemic. Collections reportedly fell from Rs 57 crores to Rs 11 crores, year-on-year. Property owners had been demanding a waiver this year, because of the economic hardships during COVID-19.

The Corporation had earlier proposed a hike in property tax, to increase its revenue. If sanctioned by the standing committee, there would have been an increase of 2.5% in the tax slabs. According to the civic body, there are over 5 lakh properties in the area, which include commercial, residential and vacant plots. There has been no hike in property tax after 2013-14. Any hike in property taxes, if approved, will cover all properties established before 2007.

How to register complaint on PCMC Suvidha?

All citizens can register their complaints related to the Pimpri-Chinchwad Municipal Corporation on the Suvidha platform. Users need to register themselves, to launch a complaint on the platform. The portal can also be used for tracking the status of complaints. All issues related to property tax, water tax, building plan approval, civil works and public establishment systems can be filed on the Suvidha platform.

PCMC contact details

While the PCMC property tax payment process is simple and user-friendly, the payee can reach out to the civic body, in case of problems.

PCMC Sarathi Helpline Number: 8888 00 6666

PCMC Sarathi website: Portal Link

Users can download FAQs, mobile apps, e-book and PDF book in Marathi and English, to resolve their queries.

FAQs

How do I fill my PCMC property tax online?

Visit the PCMC website and follow the above given procedure, to pay your property tax.

How to check PCMC property tax bill online?

You can view the property tax bill on the PCMC property tax website.

Is Ravet under PCMC?

Yes, Ravet falls under the PCMC's jurisdiction.

What is meant by PCMC?

PCMC stands for Pimpri-Chinchwad Municipal Corporation.

Is property tax applicable to vacant land?

Property tax is applicable on all kinds of properties, including the vacant land.

Comments 0