Ashok Leyland share price was down 5 percent in the morning session on February 12, a day after the commercial vehicle manufacturer reported a quarterly net loss at Rs 19.38 crore in December 2020, down 169.84 percent from Rs. 27.75 crore profit in the year-ago period.

Net sales were at Rs 4,813.51 crore in December 2020, up 19.87 percent from Rs. 4,015.65 crore in December 2019. The company's EBITDA was at Rs 287.85 crore, up 16.31 percent from Rs 247.48 crore in the year-ago quarter.

At 0936 hours, the stock was trading at Rs 128.40, down Rs 6.60, or 4.89 percent. It has touched an intraday high of Rs 130.55 and an intraday low of Rs 124.10.

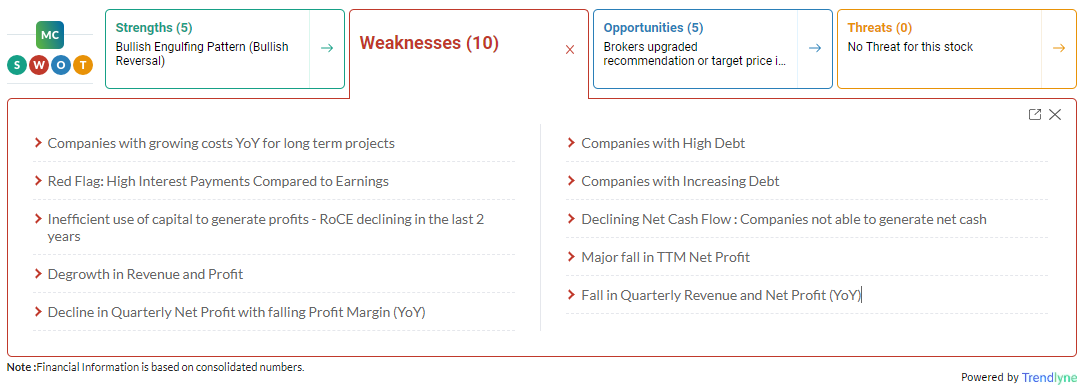

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company has been inefficient in the use of capital to generate profits, with RoCE declining in the last two years. It has a high debt with high interest payments compared to earnings.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Disclaimer: Moneycontrol.com advises users to check with certified experts before taking any investment decisions.