Representative image

The market witnessed volatility throughout the session and continued to see flat closing for second consecutive day on February 10 as it is looking for triggers for further directional move. The selling in banks weighed on sentiment, while auto, select IT and pharma stocks aided the market.

The S&P BSE Sensex was down 19.69 points at 51,309.39, while the Nifty50 fell 2.80 points to 15,106.50 and formed Doji kind of indecisive pattern on the daily charts.

"Another high wave-type candle was formed with minor upper and long lower shadow. Technically, this pattern again signals confusion among participants at the highs, which is now leading to volatility. But the formation of long lower shadow could signal the emergence of sharp buying on dips," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

As long as Nifty shows similar consolidation for the next 1-2 sessions, the odds of sharp upside bounce can't be ruled out, he feels.

He believes the underlying trend of Nifty is volatile with positive bias. "The market action like lack of sustainable selling from the highs and emergence of sharp buying from the lows could eventually result in a strong comeback of bulls in the next few sessions. This expectation could alive, as long as the support of 15,000-14,950 holds firmly," he said.

The broader markets outperformed frontliners with the Nifty Midcap and Smallcap indices rising more than 0.7 percent each, but the market breadth was negative.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,999.73, followed by 14,892.97. If the index moves up, the key resistance levels to watch out for are 15,190.73 and 15,274.97.

Nifty Bank

The Nifty Bank fell 273.40 points to 35,783.10 on February 10. The important pivot level, which will act as crucial support for the index, is placed at 35,398.4, followed by 35,013.7. On the upside, key resistance levels are placed at 36,197.5 and 36,611.9.

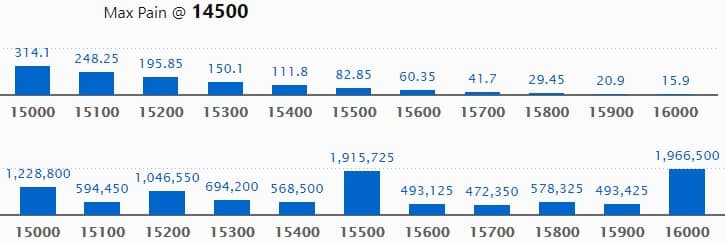

Call option data

Maximum Call open interest of 19.66 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,500 strike, which holds 19.15 lakh contracts, and 15,000 strike, which has accumulated 12.28 lakh contracts.

Call writing was seen at 15,200 strike, which added 1.74 lakh contracts, followed by 15,900 strike which added 1.32 lakh contracts and 16,000 strike which added 1.22 lakh contracts.

Call unwinding was seen at 15,100 strike, which shed 1.05 lakh contracts, followed by 15,600 strike which shed 50,625 contracts and 15,400 strike which shed 38,550 contracts.

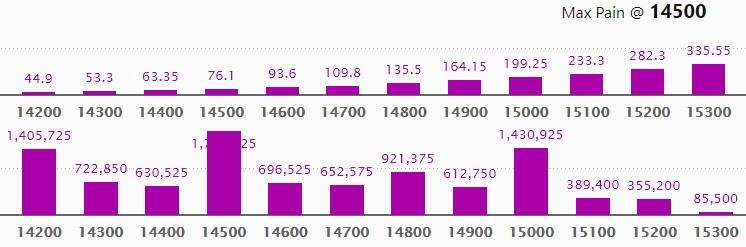

Put option data

Maximum Put open interest of 17.90 lakh contracts was seen at 14,500 strike, which will act as crucial support level in the February series.

This is followed by 15,000 strike, which holds 14.30 lakh contracts, and 14,200 strike, which has accumulated 14.05 lakh contracts.

Put writing was seen at 14,300 strike, which added 64,425 contracts, followed by 14,500 strike, which added 47,250 contracts and 15,000 strike which added 43,275 contracts.

Put unwinding was seen at 14,600 strike, which shed 1.53 lakh contracts, followed by 15,200 strike which shed 1.33 lakh contracts and 14,200 strike which shed 1.07 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

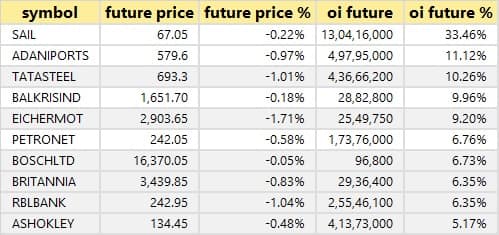

40 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

30 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

22 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

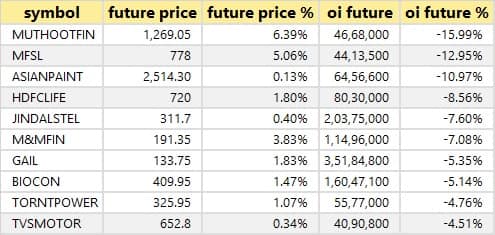

49 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

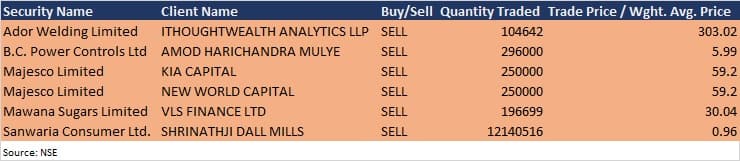

Bulk deals

(For more bulk deals, click here)

ITC, Coal India, Power Grid Corporation, ACC, Ashok Leyland, Ashapura Minechem, Atul Auto, Bajaj Hindusthan Sugar, Bayer Cropscience, Bosch, Capacite Infraprojects, CRISIL, General Insurance Corporation of India, Gujarat Pipavav Port, Graphite India, HUDCO, Infibeam Avenues, ITDC, ITD Cementation, Jaypee Infratech, KNR Constructions, MRF, Natco Pharma, NCC, NHPC, Oil India, Petronet LNG, Power Finance Corporation, Prestige Estates Projects, Spencers Retail, VA Tech Wabag and Zee Media Corporation are among 442 companies to announce their quarterly earnings on February 11.

Stocks in the news

Aurobindo Pharma: The company reported a sharp rise in profit at Rs 2,946.3 crore in Q3FY21 against Rs 705.3 crore in Q3FY20, revenue rose to Rs 6,364.9 crore from Rs 5,895 crore YoY.

Bata India: The company reported lower profit at Rs 26.4 crore in Q3FY21 against Rs 118.2 crore in Q3FY20, revenue fell to Rs 615.6 crore from Rs 830.8 crore YoY.

Indraprastha Gas: The company reported a higher profit at Rs 381.8 crore in Q3FY21 against Rs 297.4 crore in Q3FY20, revenue declined to Rs 1,446.2 crore from Rs 1,664.2 crore YoY.

Bank of India: The Competition Commission of India approved acquisition of BOI AXA Invst Managers & BOI AXA Trustee Services by Bank of India.

Titan Company: The company reported lower standalone profit at Rs 419 crore in Q3FY21 against Rs 470 crore in Q3FY20, revenue rose to Rs 7,287 crore from Rs 6,206.2 crore YoY.

Magma Fincorp: Rising Sun Holdings, a company controlled by Mr. Adar Poonawalla, to acquire a controlling stake in Magma Fincorp, through a preferential allotment and open offer route.

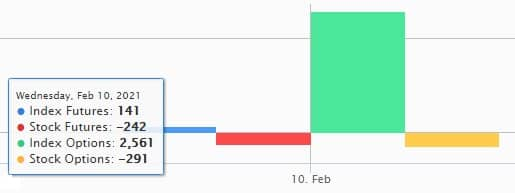

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,786.97 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,075.68 crore in the Indian equity market on February 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - BHEL, SAIL and Sun TV Network - are under the F&O ban for February 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.