Kantar. The company bills itself as "the world’s leading data, insights and consulting company", today revealed its smartphone OS data for the fourth quarter of 2020. Data reveals that iOS accounts for 26.2% of all smartphone sales across the five major European markets (EU5), with share also up in Australia and flat in the USA."

Jennifer Chan, Insight Director at Kantar, Worldpanel Division said: “In Q4 2020 Android grew YoY in Japan (+3.3% pts) and China (+4.7% pts.). A closer look at China shows local brands driving sales growth in the latest quarter; Huawei took 46.5% share (+2.3% pts.) and Xiaomi 11.7% share (+1.5% pts.).

“Chinese brands continue to expand their global footprint with Xiaomi making up almost 1 in 5 sales across the EU5, with an impressive growth of 5% pts. YoY, largely driven by Italy and Spain. Oppo, although still relatively small, also grew in all reported markets. Global brands that track smaller sales share experienced some successes relative to their market size; Motorola was up by more than 1.5 share points YoY in each Germany and the USA. Google grew in Japan by +2.1% pts. YoY."

“Samsung, meanwhile, have held their fort across all reported markets in Q4’20 with sales share up by 2.3% pts. YoY across the EU5, driven by France and Germany.”

More detailed Australian data is towards the end of this article.

Chan continued: “While still in the early stages of launch, iPhone 12 models are tracking well. The iPhone 12 model proves popular and is already the 2nd most sold smartphone in Q4’20 in the USA, China and Australia. iPhone 11 continues to attract buyers and is the number one model sold across the EU5, USA and Australia. In Japan, smaller form factors are most desired with iPhone SE (2nd generation) topping the sales list, making up almost 1 in 5 devices sold and was followed by iPhone 12 Mini in 2nd place.

“Interestingly, when comparing the specific features driving sales of each iPhone 12 model, the iPhone 12 Pro Max skews heaviest among consumers looking for “quality of the camera” across the EU5 and USA. Prior to purchasing, they attained their main source of information direct from Apple.com and across the EU5 skew higher to have ‘watched new product launch event’. Other specific features to also rank in the top 3 for buyers of iPhone 12 models were “Reliability and durability” across EU5 and China, and “size of the screen” across EU5, Japan and Australia.

“With much noise around 5G, iPhone 12 certainly stands out for driving sales through this capability. In all reported markets, at least 25% of iPhone 12 models were bought for ‘5G capability’, the most being 51% of buyers in the USA. Compared to average smartphones sold, iPhone 12 models indexed by at least 117, the highest index being 367across EU5.

“In Q4’20, the share of smartphone owners connected to a 5G network was higher YoY in Great Britain, Italy, Spain, Urban China and Australia. Across all reported markets, at least 50% of smartphone owners intending to buy in the next 6 months, intend to buy a 5G enabled smartphone; and compared to intenders of last year, this is up in all markets except in France and Japan.”

Chan added: “Over half of smartphones were sold online in the latest quarter, across all report markets. Online smartphone sales were up in EU5 (+8.7% pts), USA (+7.3% pts) and AU (+11.0% pts.) where the top source of information prior to buying was through websites; highlighting the continued need to develop and deploy digital marketing strategies to respond to the aggressive channel growth of the category.

“Also, not to be underestimated is the power of influence through friends and family. This touchpoint finds itself in the Top 5 purchase touchpoints across all reported markets and is number one in China, with 20% of smartphone buyers going to their friends and family as the main source of information prior to purchasing.”

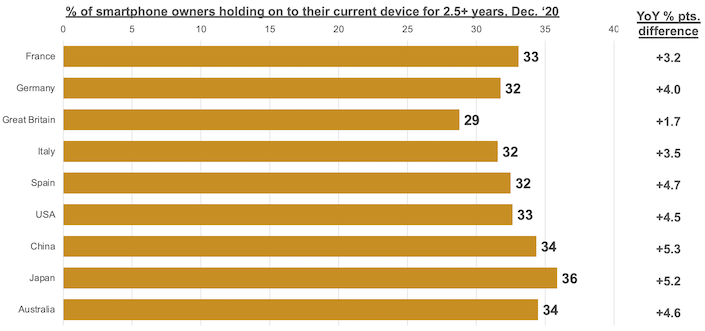

Chan noted: “Some final thoughts…It’s not new news that smartphone sales slowed through 2020, as a result of the pandemic, with many consumers delaying their smartphone purchases and some even cancelling their plans completely; this will certainly push out replacement cycles further. Almost 1/3rd of smartphone owners have held their current device for 2.5+ years and these figures have increased YoY. With many consumers being repressed by current environmental and economic challenges, this year is set to be extremely interesting as we monitor and anticipate returning consumers to market.”

Australian data

For more Australian data, we turn to Tamsin Timpson, the Strategic Insight Director, ComTech Asia in the Worldpanel Division, who added: “In the 3m/e Dec 2020, the Australia smartphone market saw a welcome increase in sales of +6% vs the same period a year ago, the only quarter of 2020 to show any uplift. Mirroring the trend reported in EU5, iOS enjoyed a considerable increase in share, up from 43.7% in 3 m/e Dec 2019 to 46.7% in 3 m/e Dec 2020.

“The iPhone 11 continues to be the top selling model, however, share has dropped to 8.6% of all smartphone sales as the iPhone 12 captures 6.7% of the market, followed by the iPhone 12 Pro Max and Pro which account for 5.4% and 5.1% respectively. Almost 90% of all iPhone 12 buyers have upgraded from another iPhone.

“Apple’s success in the latest quarter has undoubtedly accelerated the adoption of 5G handsets and has changed the brand composition quite considerably. With 32% of smartphones purchased in the Q4 20 period being 5G enabled devices, the number of 5G owners has rocketed to 950k and, whilst Samsung still leads with a share of 49% of all 5G owners, with its real strength in the super premium price tier, Apple has carved out a share of 40%, with share highest in the premium tier.

“Other key players in the 5G space are OPPO with 4.9% share and Google with 2.5%. Over the next 6 months, a further 750k smartphone owners intend to buy a 5G phone, 60% of whom currently own an iPhone and 26% a Samsung device.

“In the same period, Android share dropped from 55.9% in Dec 2019 to 53.3% in Dec 2020. Samsung managed to maintain share YoY at 30.9%, bolstered by the competitively-priced Galaxy S20 FE 5G device which was its top selling phone for the Q4 20 period, with 31% of buyers switching from another brand (compared with 19% for the whole of the Galaxy S20 series).

“OPPO share increased YoY to 6.2%, with its higher end Find X2 series gaining momentum, although growth for the brand slowed compared with an exceptionally high share in the Q3 20 period due to high sales volumes of its A series devices. Other brands to enjoy share growth YoY are Alcatel, Motorola and relative newcomer Realme, whilst the new Pixel 4a and Pixel 5 devices allow Google to grow share QoQ to 2.4%.”

Here are two Kantar charts: