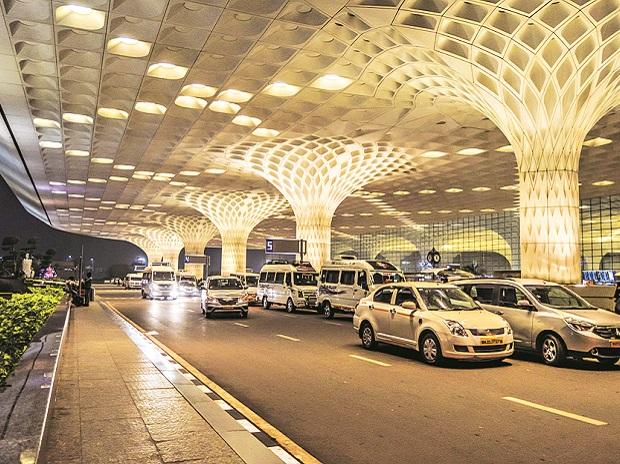

Adani Group has completed the purchase of 23.5 per cent stake in Mumbai International Airport (MIAL) from two South African entities, marking the first step towards acquiring a majority control in the country’s second-busiest airport.

In a stock exchange notification on Saturday, Adani Enterprises said that its airports division had acquired 13.5 per cent stake of Bidvest and 10 per cent stake of Airport Company of South Africa, for a consideration of Rs 1,685 crore.

The deal marks a culmination of Adani Group’s two-year quest to acquire a stake and gain control of the Mumbai airport. It also marks the exit of foreign investors from the airport.

The group has already taken over six Airport Authority of India (AAI) airports under the privatisation exercise.

Last August, it had signed an agreement with GVK Group to acquire its 50.5 per cent stake in Mumbai airport. The deal also included acquisition of 23.5 per cent stake held by the two South African companies.

As a part of the deal, Adani Group will take over Rs 2,500 crore of debt owed by GVK Airport Developers, the holding company of MIAL. Adani will get controlling stake in MIAL upon conversion of the debt into equity.

Last month, the AAI had granted its nod to Adani Group for acquiring GVK Group’s 50.5 per cent stake in MIAL. A few other government approvals are pending.

In March 2019, Bidvest had signed an agreement to sell its stake to Adani Group for Rs 1,248 crore. GVK Group exercised the ‘right of first refusal’ but was unable to conclude the deal.

The acquisition battle then moved to courts, as GVK Group tried to block Adani Group’s entry.

In October 2019, GVK had announced the sale of 79 per cent stake in its airport’s holding company to a clutch of foreign investors for Rs 7,614 crore, but the deal fell through. The group had hoped to use the proceeds to retire debt and buy out South African investors in MIAL.

Finally, under pressure from lenders, GVK agreed to sell its stake in MIAL to the Adani Group. A money laundering probe by the CBI against GVK Group had made fundraising even more difficult.

“We see our airport portfolio as a critical level to help converge tier-I cities with tier-II and tier-III ones, in a hub and spoke model,” Adani Group Chairman Gautam Adani had said last year after signing of the agreement.

“The addition of MIAL and Navi Mumbai to our existing portfolio of six airports provides us a transformational platform that will help shape and create strategic adjacencies for our other B2B businesses,” Adani had said.

The six airports under include Ahmedabad, Lucknow, Mangaluru, Jaipur, Thiruvananthapuram, and Guwahati.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU