The market clocked the biggest ever weekly gains in absolute terms, with the benchmark indices hitting new highs as the bulls, backed by the banking sector, had a free run of the week ended February 5.

A growth-oriented Budget that went big on spending with no new taxes, forward-looking policies of the Reserve Bank of India that stuck to an accommodative stance, strong quarterly earnings, FII buying and positive global cues boosted market sentiment.

The BSE Sensex surpassed the psychologically important 51,000-mark intraday, rising 4,445.86 points, or 9.61 percent, to end the week at 50,731.63. The Nifty50 finally touched 15,000, gaining 1,289.65 points or 9.46, percent at 14,924.25. The market has doubled from the lows of March 2020.

Given the spectacular run and major events out of the way, experts foresse some consolidation and stock-specific action due to quarterly earnings in the coming week.

"Next week, markets could take a pause to reflect upon the current exuberance and assimilate the upcoming corporate numbers. Markets being forward-looking have already discounted a major chunk of growth expectations, however, small-time corrections will be a part of this bull favoured journey," Nirali Shah, Head of Equity Research at Samco Securities told Moneycontrol.

In the absence of a major economic event, the market is expected to be stock-specific based on the forthcoming quarterly results, Vinod Nair, Head of Research at Geojit Financial Services said.

The broader markets also joined the bulls' party as the Nifty midcap 100 index gained 7.25 percent and smallcap 100 index rallied 6.4 percent.

Here are 10 key factors that will keep the traders busy in the coming week:

As we enter the last week of December quarter earnings season, more than 2,400 companies will release their scorecards, including BPCL, Tata Steel, Aurobindo Pharma, Eicher Motors, GAIL India, Hindalco Industries, Titan Company, ACC, Coal India, ITC, Power Grid Corporation, Grasim Industries and ONGC.

Astrazeneca Pharma, Balkrishna Industries, Bombay Dyeing, Godrej Consumer Products, NMDC, Sun Pharma Advanced Research, Sun TV Network, Torrent Pharmaceuticals, Aster DM Healthcare, Berger Paints India, Burger King India, Central Bank of India, Dhanlaxmi Bank, Endurance Technologies, Future Retail, HeidelbergCement India, Indian Overseas Bank, Jammu & Kashmir Bank, Mahanagar Gas, Muthoot Finance, Spandana Sphoorty Financial, Torrent Power, ABB India, Bank of India, BEML, Gujarat State Petronet, Happiest Minds Technologies, Indraprastha Gas, Metropolis Healthcare, RITES, Shalimar Paints, SpiceJet, Ujjivan Financial Services, Ashok Leyland, Bosch, CRISIL, General Insurance Corporation of India, HUDCO, Infibeam Avenues, Natco Pharma, MRF, NCC, NHPC, Oil India, Petronet LNG, Power Finance Corporation, Prestige Estates Projects, Puravankara, Apollo Hospitals Enterprises, Bharat Dynamics, Bharat Forge, Dilip Buildcon, Glenmark Pharmaceuticals, Hindustan Aeronautics, Home First Finance Company, Indiabulls Housing Finance, Mazagon Dock Shipbuilders, MOIL, NALCO, Peninsula Land, PTC India, Siemens, Sobha, Voltas, Amara Raja Batteries, IDFC, IRCON International, Indian Railway Finance Corporation and Kalpataru Power Transmission are the other companies who will be sharing their numbers.

ITC

Index heavyweight ITC rallied 15 percent last week, especially after the Budget didn't propose in tax for cigarettes, which contribute 40-45 percent to the company's revenue.

The company will declare its December quarter earnings on February 11, along with an interim dividend for the current financial year. Brokerages expect a decline in Q3FY21 profit (around 8-9 percent) and tepid sales performance as cigarette volumes could fall 6-8 percent and EBIT may decline 7-10 percent compared to the corresponding period.

However, other FMCG segments may continue their strong growth trend, with revenue growth at around 10-15 percent and more than 100 percent increase in EBIT and over 300 bps margin expansion compared to the year-ago period, brokerages said. "We estimate other divisions to record flat sales and EBIT decline of 24 percent," Emkay Global said.

Economic data points

Key economic data to watch out will be the industrial production for December and CPI inflation for January that will be released on February 12.

The industrial production contracted 1.9 percent in November against 3.6 percent growth in October, while CPI inflation in December eased to 4.59 percent compared to 6.93 percent in the previous month and 7.35 percent in December 2019.

Bank loan and deposit growth data for the fortnight ended January 29 and foreign exchange reserves for the week ended February 5 will also be released on the same day.

India's forex reserves jumped by $4.85 billion to a record high of $590.18 billion in the week ended January 29, driven by an increase in foreign currency assets.

FII flow

Foreign investors pumped in Rs 13,595 crore in the week gone by, thanks to the Budget 2021. FII has turned cautious in the run-up to the Budget, investing Rs 12,096 crore in the previous week.

It will be interesting to see if the money flow will continue or ebb with major events out of the way.

On the other side, domestic institutional investors seem to have taken the opportunity of book profits, as they net sold Rs 4,713 crore worth of shares in the week gone by against net buying of Rs 3,789 crore in the previous week.

Bank Nifty

The Bank Nifty (up 16.65 percent) was the biggest gainer last week, with PSU Bank (up 25.57 percent) rallying the most after the Budget.

Along with infrastructure, the Budget also focussed on banking and financials by proposing a 'bad bank, privatisation of PSU banks, recapitalisation of PSU banks and creation of a Development Financial Institution for infrastructure financing. The Reserve Bank of India also left the repo rate unchanged with an accommodative stance in its bi-monthly policy review.

It remains to be seen if the Bank Nifty can sustain the rally. Most analysts feel there could be some profit-booking and consolidation, given the massive rally that pushed the index to record highs.

Nirali Shah said the banking sector seemed to be a worthy candidate to book short-term profits as it witnessed a bout of optimism due to the Budget.

Coronavirus and vaccination

The vaccination drive started on January 16 has been going to plan, with healthcare workers being inoculated first. More than 54 lakh healthcare workers have been vaccinated so far, making India the fastest country to reach the number in a short period of time.

The health ministry has said the second vaccine dose will be administered from February 13. So far, 12 states achieved 60 percent or more vaccination coverage of healthcare workers.

This comes as active cases continued to decline for the 30th consecutive day and daily deaths slipped below 100.

The recovery rate remained strong, improving to 97.19 percent with the mortality rate at 1.43 percent. In absolute terms, India reported more than 1.08 crore confirmed cases with over 1.55 lakh deaths but the total active cases dropped to 1.48 lakh with recoveries now over 1.05 crore.

Technical View

The Nifty50 gained 28.60 points on February 5 and rallied 9.5 percent for the week, forming Doji candle on the daily charts and a robust bullish candle on the weekly charts.

The weekly bull candle has negated the bearish reversal pattern seen last week. Experts say initially there could be some consolidation, but overall the momentum will favour the bulls.

"In the past, a similar negation of weekly reversal pattern has occurred in the early part of October and November 2020 and the Nifty witnessed two weeks of sharp upside bounce during those negations. Hence, there is a possibility of further upside by next week," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The next upside levels to be watched at 15,475, which is 1.618 percent Fibonacci extension. Immediate support is placed around 14,800-14,750 levels," he said.

F& O cues

The options data indicated that the Nifty50 could see a wider trading range of 14,500 to 15,200 levels in the coming days. Maximum Call open interest was seen at 15,500 strike, followed by 15,000 and 14,500 strikes, while the maximum Put open interest was seen at 14,000, 14,200 and 14,500 strikes,

Call writing was seen at 15,500, 14,900 and 15,000 strikes with unwinding at 14,700 strike, while Put writing was seen at 14,500, 15,000 and 14,800 strikes with Put unwinding at 14,000 and 14,700 strikes.

"Significant Call option concentration was at ATM 15,000 strike for both weekly and monthly settlement. Further closure of positions can take the index above these levels. On downsides, incremental Put writing was seen at 14,700 strike, which remains immediate support for the index," ICICI Direct said. The Nifty started the new series with relatively low open interest and despite the recent upmove, no major open interest accumulation was seen, suggesting low leverage, it said.

Despite the sharp up move, the volatility index has remained elevated and did not move below 23. India VIX was down by 7.62 percent from 25.34 to 23.41 levels during the week. "While closure among Call writers can be attributed to elevated volatility, we believe volatility levels will decline from here onwards. Sustainability at current levels may be considered a sign of caution after recent sharp upsides," said the brokerage.

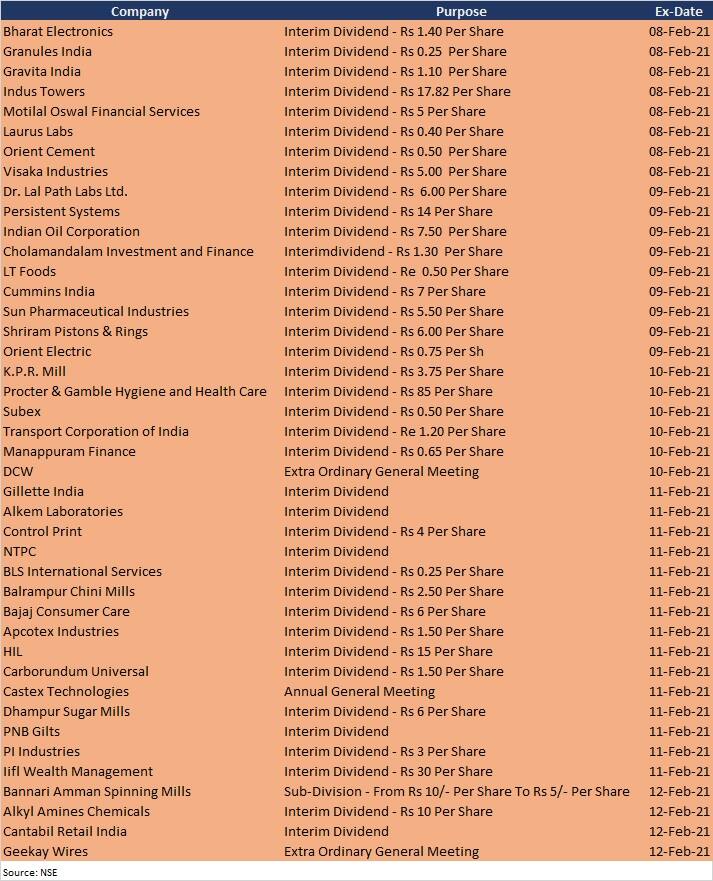

Corporate Action

Here are key corporate actions expected in the coming week:

Global Cues

Here are key global data points to watch out: