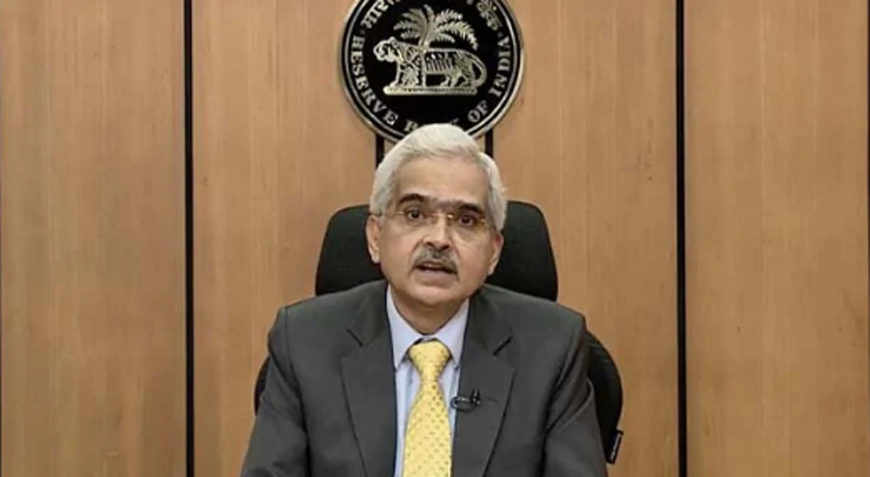

An Expert Committee (EC) will be constituted to provide a medium-term road map for strengthening the Primary (Urban) Co-operative Banks leveraging on the legislative amendments. This was stated by the RBI Governor on the occasion of announcement of Monetary Policy on Friday.

The Constitution of the Expert Committee (EC) and its terms of reference will be announced shortly, added the RBI Governor saying the Primary (Urban) Co-operative Banks are an important segment of the credit structure.

In his statement, the RBI Governor said “The Reserve Bank has undertaken several measures in the recent past to strengthen the Urban Co-operative Banking sector and deepen financial inclusion. The recent amendments to the Banking Regulation Act, 1949 have brought near parity in regulatory and supervisory powers between Primary (Urban) Co-operative Banks and commercial banks, including those related to governance, audit and resolution.”

It bears recall that the Monetary Policy Committee (MPC) met on 3rd, 4th and 5th February, 2021 and deliberated on current and evolving macroeconomic and financial developments, both domestic and global. The MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent.

It also unanimously decided to continue with the accommodative stance of monetary policy as long as necessary – at least through the current financial year and into the next year – to revive growth on a durable basis and mitigate the impact of COVID-19, while ensuring that inflation remains within the target going forward.

The Marginal Standing Facility (MSF) rate and the Bank rate remain unchanged at 4.25 per cent. The reverse repo rate stands unchanged at 3.35 per cent.

In the statement the RBI Governor set out the broad contours of the MPC’s decision making process and its underlying motivation. Inflation outturns in the last two months have turned out to be better than what was expected at the time of the December meeting.

“For the first time during the COVID-19 period, inflation has eased below the upper tolerance level of 6 per cent. Going ahead, factors that could shape the food inflation trajectory in coming months, including the likely bumper kharif harvest arrivals in markets, rising prospects of a good rabi crop, larger winter supplies of key vegetables and softer poultry demand on fears of avian flu are all indicative of a stable near-term outlook”, said the Governor.

The preliminary estimate of GDP for 2020-21 released by the National Statistical Office (NSO) on January 7, 2021 has turned out to be very close to the MPC’s December projection, it said.

The outlook on growth has improved significantly, with positive growth impulses becoming more broad-based, and the rollout of the vaccination programme in the country auguring well for the end of the pandemic. Given that inflation has returned within the tolerance band, the MPC judged that the need of the hour is to continue to support growth, assuage the impact of COVID-19 and return the economy to a higher growth trajectory.