The uptrend in the equity market continued for the fifth consecutive session on February 5, supported by positive global cues and consistent FII inflow.

The BSE Sensex gained 117.34 points to end at record closing high of 50,731.63, while the Nifty50 crossed 15,000 mark for the first time, rising 28.60 points to see record closing high of 14,924.30 and formed Doji kind of pattern on the daily charts. The index gained 9.5 percent during the week and formed a robust bullish candle on the weekly charts.

"A small negative candle was formed on the daily chart with upper and lower shadow at the new all-time high of 15,014. Technically, this could signal a formation of high wave-type candle pattern at the highs. Normally, a formation of high wave could indicate indecision among participants. Sometimes, this is also associated with top reversal after the confirmation," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

On the contrary side, "the Nifty has formed a similar type of pattern on February 3 on the daily chart and the market continued its upside momentum after its formation. Presently, the market has sustained above the long term trend line resistance around 14,800 levels (top - top, bottom - bottom) and this consolidation movement could eventually result in an upside breakout of the range movement," he said.

According to Shetti, present volatility and consolidation movement could eventually result in an upside breakout in the next few sessions. "The next upside levels to be watched is 15,475, which is 1.618 percent Fibonacci extension. Immediate support is placed around 14,800-14,750 levels," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,854.43, followed by 14,784.67. If the index moves up, the key resistance levels to watch out for are 15,004.33 and 15,084.47.

Nifty Bank

The Nifty Bank rallied 309.70 points to 35,654.50 on February 5. The important pivot level, which will act as crucial support for the index, is placed at 35,261.27, followed by 34,868.04. On the upside, key resistance levels are placed at 36,331.47 and 37,008.43.

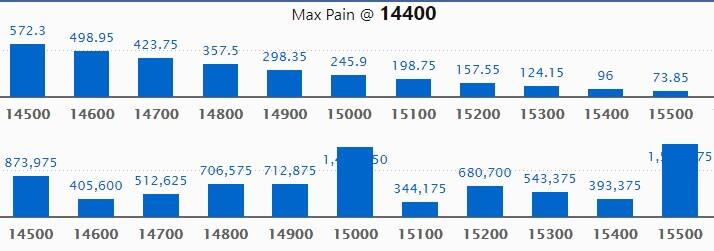

Call option data

Maximum Call open interest of 15.54 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,000 strike, which holds 14.89 lakh contracts, and 14,500 strike, which has accumulated 8.73 lakh contracts.

Call writing was seen at 15,500 strike, which added 1.2 lakh contracts, followed by 14,900 strike which added 86,850 contracts and 15,000 strike which added 67,725 contracts.

Call unwinding was seen at 14,700 strike, which shed 1.87 lakh contracts, followed by 14,800 strike which shed 1.22 lakh contracts and 14,500 strike which shed 57,000 contracts.

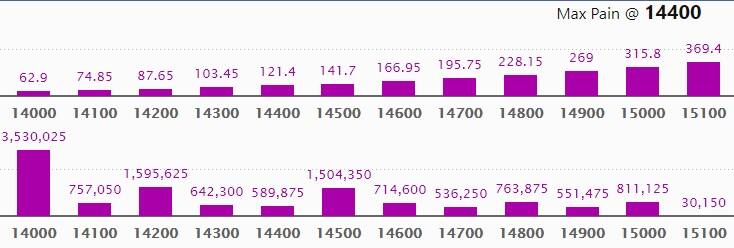

Put option data

Maximum Put open interest of 35.30 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the February series.

This is followed by 14,200 strike, which holds 15.95 lakh contracts, and 14,500 strike, which has accumulated 15.04 lakh contracts.

Put writing was seen at 14,500 strike, which added 2.38 lakh contracts, followed by 15,000 strike, which added 2.34 lakh contracts and 14,800 strike which added 2.31 lakh contracts.

Put unwinding was seen at 14,000 strike, which shed 1.44 lakh contracts, followed by 14,700 strike which shed 1.09 lakh contracts.

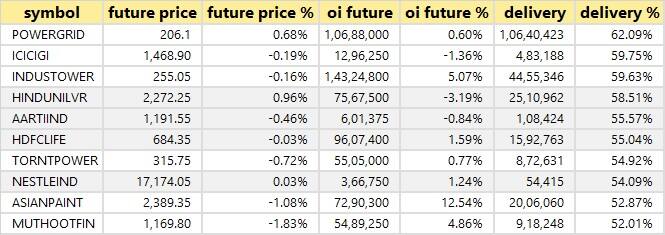

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

24 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

47 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

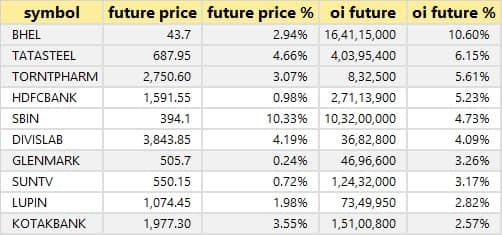

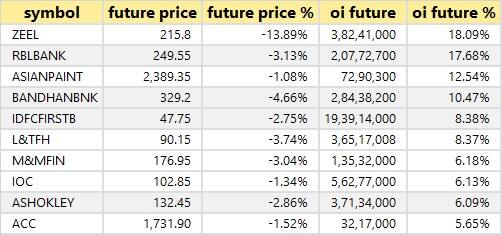

56 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

15 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

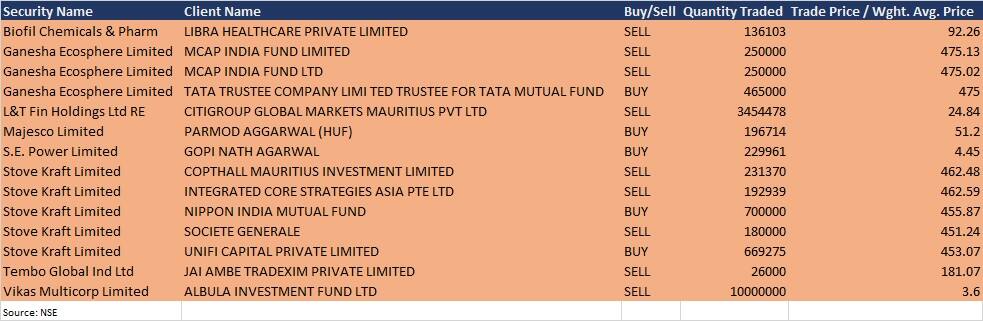

Bulk deals

(For more bulk deals, click here)

BPCL, Aditya Birla Fashion, Astrazeneca Pharma, Balkrishna Industries, Bombay Dyeing, Godrej Consumer Products, NMDC, Redington India, Sun Pharma Advanced Research Company, Sun TV Network, Torrent Pharmaceuticals, Usha Martin and Vakrangee were among 140 companies to announce their quarterly earnings on February 8.

Stocks in the news

Britannia: The company reported a profit of Rs 452.6 crore in Q3 FY21 against Rs 368.9 crore in Q3 FY20. Revenue rose to Rs 3,165.6 crore from Rs 2,982.7 crore YoY.

Punjab National Bank: The bank reported a profit of Rs 506 crore in Q3 FY21 against Rs 621 crore in Q2 FY21. evenue fell to Rs 8,313 crore from Rs 8,444.9 crore QoQ.

Maruti Suzuki: Total production in January 2021 dropped to 1.60 lakh units from 1.79 lakh units in January 2020.

Ashoka Buildcon: The company reported a consolidated profit of Rs 88.4 crore in Q3 FY21 against Rs 32.4 crore in Q 3FY20, while revenue increased to Rs 1,305.5 crore from Rs 1,280.4 crore YoY.

Fortis Healthcare: The company posted a consolidated profit of Rs 53.88 crore in Q3 FY21 against a loss of Rs 69.3 crore in Q3F Y20. Revenue rose to Rs 1,177 crore from Rs 1,169 crore YoY.

Jindal Saw: The company reported a consolidated profit of Rs 88.09 crore in Q3 FY21 against Rs 65.49 crore in Q3 FY20, while revenue fell to Rs 2,864.7 crore from Rs 2,988 crore YoY.

Mrs Bectors Food Specialities: The company reported a profit of Rs 20.67 crore in Q 3FY21 against Rs 11.14 crore in Q3 FY20. Revenue rose to Rs 225.75 crore from Rs 203.8 crore YoY.

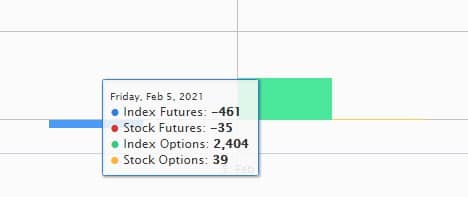

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,461.71 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,418.65 crore in the Indian equity market on February 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - BHEL, Punjab National Bank and SAIL - are under the F&O ban for February 8 as we are in the initial days of February series. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.