‘I lost everything’: laid-off workers battle Florida’s chaotic benefit system

A 12 months because the first coronavirus case was reported within the US, tens of millions of Americans have discovered themselves out of labor for practically all that point because the pandemic triggered an financial disaster on a scale unseen because the Depression of the Thirties.

Florida has been hit more durable by the pandemic than practically another state and the disaster has wreaked havoc on numerous lives, households and communities from the Florida Keys to the Panhandle – and in every single place in between.

The state skilled the second most unemployment claims within the US because the begin of the pandemic, with an unemployment improve of 1,683% in contrast with January final 12 months, in response to data compiled by WalletHub.

Florida has recorded over 1.6m circumstances and greater than 25,000 deaths because the begin of the pandemic, the third highest case depend amongst states within the US and fourth in complete deaths, though its inhabitants, at practically 22m, is the third largest.

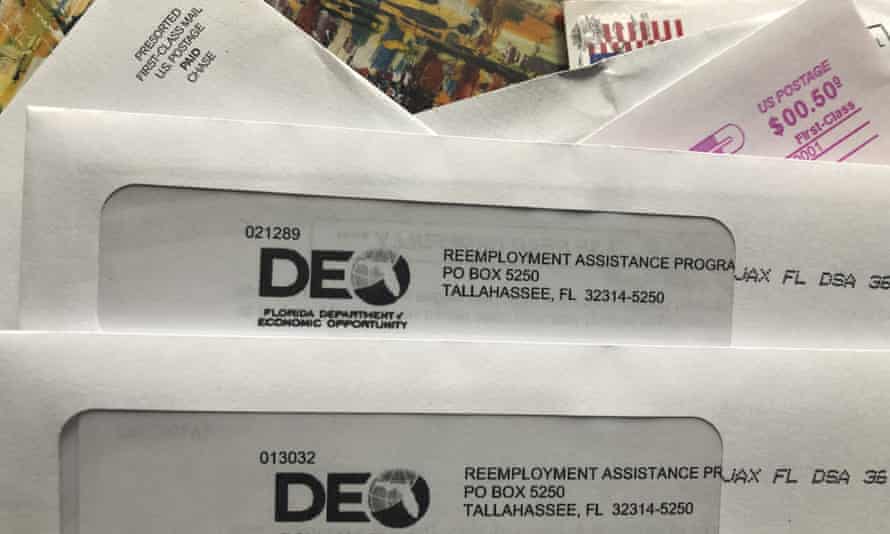

Workers who’ve lost their jobs have been pressured to depend on a damaged state unemployment system that has experienced lengthy delays, backlogs, system crashes and small funds because the state’s most payout of $275 covers solely a portion of the lost revenue for hundreds of workers within the state.

Through 2020, Florida was the second worst state within the US at paying unemployment advantages on time. Internal audits had uncovered varied points with the state’s unemployment system for years earlier than the pandemic hit, and elected officers are nonetheless conducting reviews on learn how to repair the state’s ongoing unemployment failures.

The Guardian spoke to workers in Florida who’ve struggled to outlive whereas counting on the state’s damaged unemployment system.

Here are a few of their tales.

Ann Largent

Former lodge worker at Disney World in Orlando for 2 years

Right earlier than coronavirus shut down Orlando’s tourism business, Largent was separated from her job of two years at a Walt Disney World lodge, the place she labored late-night shifts conducting upkeep and housekeeping duties.

Orlando, one of many most visited tourist destinations within the US earlier than the pandemic, has taken among the hardest hits in job losses as its theme parks, Disney World, SeaWorld, Universal Studios and others have completely laid off hundreds of workers.

The surrounding space has maintained the highest unemployment rates within the state, with an estimated 125,000 jobs lost over 2020.

Largent was one in all hundreds of Floridians who skilled lengthy delays in receiving unemployment advantages by way of the state. During that point, Largent and her daughter needed to depart the home they rented as a result of they may not afford it. They moved right into a cellular trailer park the place they at the moment reside as a result of lease is just too excessive wherever elsenearby.

“During that time frame, I lost everything,” mentioned Largent. “Covid-19 has destroyed my life.”

Her automotive was rear-ended by a truck whereas she awaited unemployment, and since the driving force had no automotive insurance coverage, she hasn’t been capable of restore the harm. Her personal automotive insurance coverage expired final month as a result of she will be able to not afford the funds. That places her driver’s license in danger, which she wants not solely in hopes of discovering a job, however for taking her 12-year-old daughter, who’s at the moment in remission from most cancers, to physician’s appointments.

Shortly after she lastly began to obtain unemployment advantages, her Snap meals help advantages have been reduce from $355 a month to $16 a month. Then the federal prolonged advantages of $600 every week expired on 26 July, leaving Largent and her daughter to outlive on simply $247 every week, Florida’s most unemployment payout after taxes are deducted.

After submitting a whole lot of job purposes, she lastly obtained a proposal to start out work as a affected person care technician at a nursing house, however after working sooner or later was by no means offered a full schedule.

Her unemployment advantages have been stopped on account of a maintain positioned on her account for working sooner or later. It took a month for Florida’s division of financial alternative to take away the maintain after weeks of Largent calling for assist, spending hours on maintain making an attempt to talk with service representatives. While her advantages have been on maintain, she fell behind on lease.

Largent additionally skilled her personal well being points whereas making an attempt to outlive on unemployment.

“I lost my health insurance because Medicaid said I was making too much money on unemployment. I only get $247 a week. How am I making too much in unemployment? All that pays is my rent,” she mentioned.

The medical insurance difficulties occurred whereas Largent required medical consideration after she was bitten by a black widow spider on her ankle, and virtually lost her foot because of this.

Her daughter has struggled by way of the pandemic, in transitioning to a brand new, smaller house, battling digital studying and worrying about catching the coronavirus as a most cancers survivor with a compromised immune system.

Largent defined her daughter’s character had modified because of the lockdown, from very outgoing and talkative to quiet, reserved and shy.

Delaun Stokes

Former server at Macaroni Grill in Orlando for 2 years

Stokes labored as a server at Macaroni Grill at Orlando worldwide airport for 2 years earlier than the coronavirus hit the US and he lost his job.

In March, Stokes defined every part began to alter instantly. First tables have been reduce and unfold out to socially distance prospects. The subsequent week, Stokes and his colleagues have been knowledgeable the restaurant was going to be shut down, and he can be furloughed till issues returned to regular.

By August, his restaurant was nonetheless shut and he obtained a letter informing him that his furlough can be a everlasting layoff by 15 October.

He obtained unemployment advantages immediately not like hundreds in Florida however issues obtained far more tough when the additional $600 every week of federal prolonged advantages expired on 26 July.

“It went from keeping myself afloat, paying bills, to wondering where I’m going to get my next meal, if I’m going to have enough to pay rent or use what little I had to get food that week, trying to juggle things around got hard,” Stokes mentioned. “The coronavirus relief hasn’t been enough, so we need something more. For the elected officials who are fighting for it, I thank them from the bottom of my heart. For the ones who oppose it all I have to say is we’ll see you guys next election day.”

His mom and stepfather moved out of the world through the pandemic to comply with work in audio engineering, so he’s spent the period of the pandemic with out the assist system of a household close by.

Stokes and a number of other of his colleagues at Orlando airport have held protests to push native elected officers to move laws to make sure workers who lost their jobs through the pandemic are offered recall rights to return to their jobs when their workplaces reopen.

“We need assurances to make sure we can go back to our jobs. It’s only fair and it stops us from having to worry about what’s going to happen next,” Stokes added.

Maria E Gonzalez

Former cashier at Sbarro’s in Orlando for 4 years

On 26 March, Gonzalez’s supervisor at Sbarro’s pizza assured her the furloughs can be non permanent solely to obtain a letter 5 months later asserting her layoff can be everlasting by 15 October.

She’s had a number of issues with Florida’s unemployment system since she first utilized for advantages.

When Gonzalez first utilized, her utility was delayed as a result of she was required to offer her start certificates after the Florida division of financial alternative requested additional documentation to confirm her identification.

In August, Gonzalez labored a short lived job organizing in assist of the Biden marketing campaign in Florida, however her job was discontinued after two days as a result of the group was experiencing technical points.

“I reported this to unemployment and they’ve kept me on hold for months, and I’m still on hold five months later,” mentioned Gonzalez. “I call unemployment every single day for the benefits. I’m told they don’t know when I’m going to receive them again, they don’t have a time frame, just that they’re fixing it. They said they owe me a lot of money, but they still haven’t given it to me, so I’m having to depend on friends and family to help me with bills because I’ve been behind.”

On a each day foundation, Gonzalez is harassed by calls from collectors demanding cost, however due to her ongoing maintain with unemployment, she’s been unable to pay her payments. Even when she manages to work one thing out with a service agent for a creditor to defer pay for a month or two, she nonetheless receives calls demanding cost whereas late charges and curiosity are piling up.

“I’m frustrated. I’m depressed,” mentioned Gonzalez. “I don’t know what’s going to happen in my future, even in the next month. I don’t know what to do.”

Williams Alvarez

Cargo employee at Miami worldwide airport for 10 years

For 10 years, Alvarez, an immigrant from Cuba, labored as a cargo worker for the contractor Eulen America at Miami worldwide airport.

When coronavirus started spreading across the US in March, Williams famous there was immense stress at work, as private protecting tools shortages have been widespread, and there have been ongoing rumors workers can be laid off.

On 23 March, Williams obtained his layoff discover and has tried to outlive on unemployment ever since.

Like hundreds of Americans who have been instantly laid off or furloughed, Williams spent every single day for weeks making an attempt to name and go surfing to unemployment to course of his utility, however the cellphone traces have been at all times busy and the web site stored crashing.

After six weeks, he began receiving advantages, however continued making an attempt to assist co-workers safe theirs. During the wait, his payments started piling up, and he’s been behind ever since.

“My car broke down, but I’ve only been able to afford to get part of it fixed,” mentioned Williams. “I broke my tooth and had other dental issues, including an infection as a result of dental problems. My uncle passed away, and afterwards responsibilities of caring for my aunt and my mom fell on to me and that’s made it really difficult for me to try to get ahead.”

When the federal unemployment advantages of $600 every week expired on 26 July, Williams began falling additional behind. He managed to work out a cost plan for his automotive and mortgage to defer funds for six months, however this February he’s anticipated to restart funds.

With the brand new presidential administration coming in, Williams has some hope issues will enhance and future coronavirus aid packages will concentrate on serving to the working class and frontline workers.

“This whole pandemic has physically and mentally impacted me. I’m frustrated. I want things to change, but things aren’t changing. It’s already been almost a year and I constantly feel like I’m drowning, raising my hand for help, but being ignored,” he concluded.

Jilma Guevara

Cargo safety officer at American Airlines subcontractor in Miami for seven years

Guevara was shocked when she obtained a layoff discover on 23 March. For weeks in March there was a whole lot of insecurity and nervousness about coronavirus, however she had essentially the most seniority in her division, a spotless document, was a backup supervisor, however was the primary individual laid off in cargo.

“I felt like the roof fell in on my head. I’m diabetic, we were already living through this feeling of anxiety because no one was telling us at work what was going to happen with the pandemic, and then I asked myself, what was I going to do without any money?” Guevara mentioned. “I felt humiliated and betrayed. My co-workers and I gave the best of ourselves so we could make American Airlines and other airlines look good, so to me it was a betrayal, a stab in the back.”

In October, a congressional subcommittee launched a report on varied airline contractors who misused coronavirus aid funds, as delays within the disbursement of funds allowed contractors to conduct mass layoffs, then subsequently hold payroll aid funds for pre-pandemic jobs.

It took practically three months earlier than Guevara began receiving unemployment advantages. She relied on former co-workers and pals to assist pay for her diabetes treatment, meals and different payments. She utilized for Snap advantages and commenced making use of for different jobs, though her well being points make her notably weak to a coronavirus an infection.

Shortly after she began receiving unemployment advantages, the additional $600 every week of federal prolonged advantages expired, leaving her with simply $1,000 a month in revenue to cowl her lease of $1,575, her medicines which value $400 a month even with diminished prices by way of a clinic, and for meals and different payments.

“The politicians don’t have any idea what’s happening, their salaries keep coming. Meanwhile, the average worker, we earn every dollar through our sweat. And either way, life is invaluable. That money helped us stay home and protect ourselves from the pandemic,” Guevara added.

Ramona Vera

Airplane cabin cleaner for 10 years at Orlando worldwide airport

Ramona, 65, and her husband have relied on meals banks all through the pandemic. Their food plan has primarily consisted of rice and beans, or no matter meals they may afford.

“We haven’t been able to eat like we used to eat before. We can’t go out to eat. We can’t buy meat because it’s so expensive,” she mentioned.

When she first lost her job in March, it took about two months to start out receiving unemployment advantages after struggling to course of her utility, and she or he by no means obtained again pay for the weeks of advantages she missed.

She receives $500 a month in social safety advantages, most of which matches towards her medical insurance. While ready on unemployment, she fell behind on mortgage funds for her cellular house, however managed to get an extension till May 2021, however has no thought how she pays the again funds she owes.

“I haven’t been able to pay the mortgage. I’m behind on my credit card bills and my utility bills. I don’t know what I’m going to do right now because it’s been extremely difficult finding work. I’ve been looking everywhere, applying for jobs,” Ramona mentioned.

It’s been much more tough looking for a brand new job at her age, and she or he’s often tried to get a job at close by Walmart shops regardless of the continued dangers of coronavirus. Her hopes heading into 2021 are to discover a new job so she will be able to afford to outlive and to finally repay the $106,000 mortgage on her house, which she was paying for 3 years earlier than the coronavirus hit.

“Being without work, and little money coming in, there are a lot of bills and it’s frustrating because there’s no help coming from anywhere. The money we do get immediately goes right back out to pay off bills,” she added. “I’m hoping the mortgage lender gives me some kind of payment plan because right now I can’t pay back the money I owe. They told me I have to pay $7,000 when the extension ends. No way I can pay that.”

This reporting was supported by a grant from the Sidney Hillman Foundation