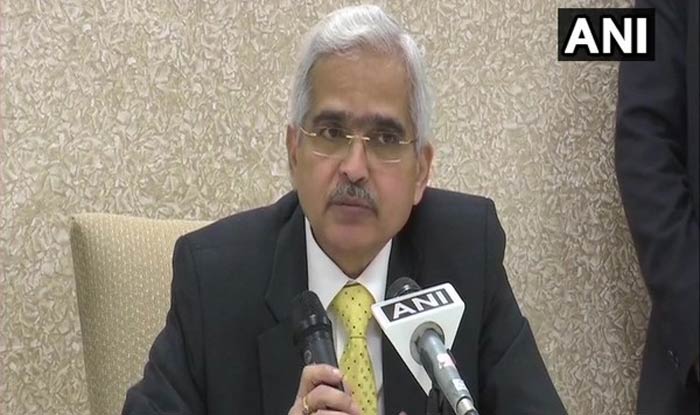

New Delhi: The Reserve Bank of India (RBI) will announce the key decisions of monetary policy committee shortly. This will be the first monetary policy announcement after the presentation of the Union Budget on February 1. The Central bank is expected to hold interest rates and continue with an accommodative policy stance.

Let’s take a look at what to expect from the first monetary policy announcement:

1) Experts are of the view that the RBI will refrain from tinkering with the interest rates and keep the monetary stance accommodative at the policy review though it will take guidance from the budget to be unveiled by Finance Minister Nirmala Sitharaman in the Lok Sabha on February 1.

“We expect the MPC (Monetary Policy Committee) to continue the pause. The fall in inflation rate was mainly due to fall in food prices. The core inflation rate has not come down. Excess liquidity needs to be watched. The vaccine availability is not going to impact macro economy immediately,” opined M Govinda Rao, Chief Economic Advisor, Brickwork Ratings.

2) “We expect an extended pause for the repo rate, with the stance to be changed to neutral in the August 2021 policy review or later, once there is clarity on the durability of the economic recovery,” Aditi Nayar, Principal Economist, ICRA Limited, told PTI.

3) According to another expert Sunil Kumar Sinha, the room available for further policy rate cut is very limited and the RBI would not like to use it when the economy is already reviving.

4) The RBI is also expected to take key targeted measures to make liquidity available to all NBFCs, especially small and unrated ones who operate in this segment.

5) When asked what the MPC may do during its next meeting, Aarti Khanna, founder and CEO, AskCred.Com, said: “The COVID-19 pandemic is more or less behind us now hence the monetary policy must focus on reviving the economy…Look forward to some constructive actions on the SME and MSME sector as a lot more needs to be done to this segment which stands as the backbone in reviving the economy.”

As per the Pre-Budget Economic Survey tabled in Parliament, India’s economy is likely to rebound with a 11 per cent growth in the next financial year as it makes a “V-shaped” recovery after witnessing a pandemic-led carnage. The Gross Domestic Product (GDP) is projected to contract by a record 7.7 per cent in the current fiscal ending March 31, 2021.

(With agency inputs)