HIG Europe has joined a pack of private equity bidders vying to buy the UK restructuring arm of KPMG, the big four accountancy firm.

Sky News has learnt that the former owner of the Engine Group advertising and PR agency is one of four parties shortlisted to acquire the business, which was put up for sale last year.

City sources said the other remaining bidders for the KPMG arm included Intermediate Capital Group (ICG), another financial investor.

The auction, which could fetch close to £400m, is entering its latter stages as ministers prepare to consult on long-awaited reforms to the audit profession.

KPMG's UK restructuring division, which advises companies on safeguarding their balance sheets during periods of financial distress, is being hived off amid a desire to eliminate potential conflicts of interest across the big four.

Deloitte is undertaking a similar process and is also in talks with potential bidders.

All of the big four have submitted plans to the Financial Reporting Council (FRC) demonstrating how they intend to 'operationally separate' their audit and consulting arms during the next four years.

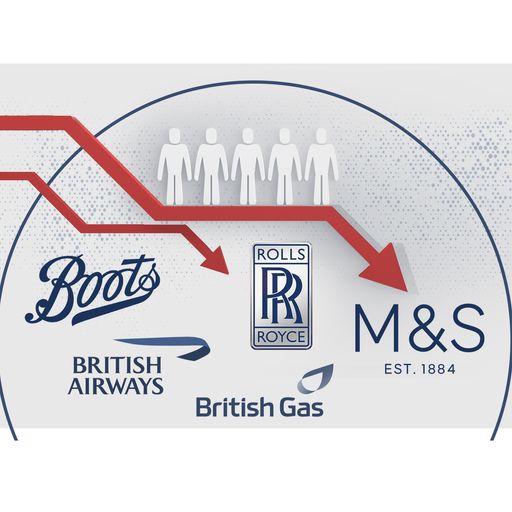

That push has come in the wake of accounting scandals at companies such as BHS and Carillion, which collapsed with the loss of tens of thousands of jobs.

KPMG was Carillion's auditor prior to its demise, and is likely to face a hefty regulatory fine in the coming months as the Financial Reporting Council concludes its investigation.

More stringent restrictions imposed by regulators mean restructuring teams in audit firms are now far more limited in the roles they can assume on corporate restructurings if the company has been audited by them in recent years.

Under plans shared with prospective bidders, three of KPMG's top restructuring partners in the UK - Blair Nimmo, Will Wright and Mark Raddan - would hold senior management roles following a deal.

The firm's restructuring arm has handled a number of prominent insolvency processes during the COVID-19 crisis, including the administration of Intu Properties, the shopping centre-owner.

This week, KPMG disclosed that its partners had taken steep pay cuts for the last year, although they still earned an average of more than £500,000.

Bill Michael, KPMG's UK chairman, has described the pandemic as "an economic disaster".

KPMG has also sold its pensions advisory business to a buyout backed by Exponent Private Equity.

HIG Europe and KPMG declined to comment.