Apollo Tyres | Total income at Rs 5,217.42 crore against Rs 4,417.53 crore YoY. Profit at Rs 443.81 crore against Rs 173.86 crore YoY.

Apollo Tyres share price spiked over 11 percent intraday on February 4 after the company reported two-fold rise in Q3 profit.

Apollo Tyres on February 3 posted over two-fold increase in its consolidated net profit at Rs 444 crore for the third quarter ended December on the back of robust sales across domestic and international markets.

It had reported a net profit of Rs 174 crore in the October-December period of the last financial year.

Sales during the period under review grew by 14 percent to Rs 4,965 crore, as against 4,347 crore in the year-ago period, Apollo Tyres said in a statement.

"Our performance across geographies have been robust in the past quarter, and we continue to be extremely positive on the demand environment," Apollo Tyres Chairman Onkar Kanwar said.

Given the company's planned investments in capacity, R&D, brand and distribution, along with cost optimisation programme, it is extremely well placed to leverage demand recovery across segments and geographies, he added.

The stock was trading at Rs 253.10, up Rs 25.80, or 11.35 percent. It has touched a 52-week high of Rs 253.70. It has touched an intraday high of Rs 253.70 and an intraday low of Rs 232.25.

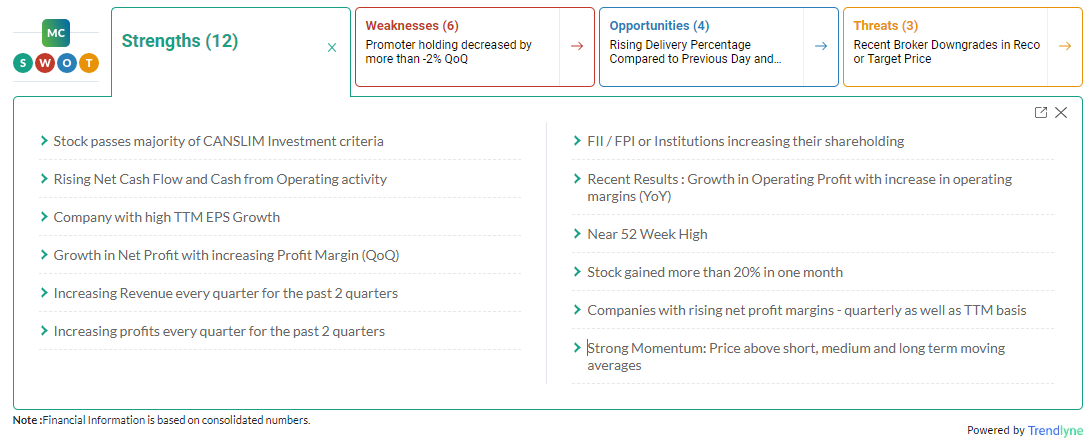

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum: price above short, medium and long-term moving averages. It has rising net cash flow and cash from operating activity. FII/FPI or institutions are increasing their shareholding.

Moneycontrol technical rating is very bullish, with moving averages and technical indicators being strong.

Disclaimer: Moneycontrol.com advises users to check with certified experts before taking any investment decisions.