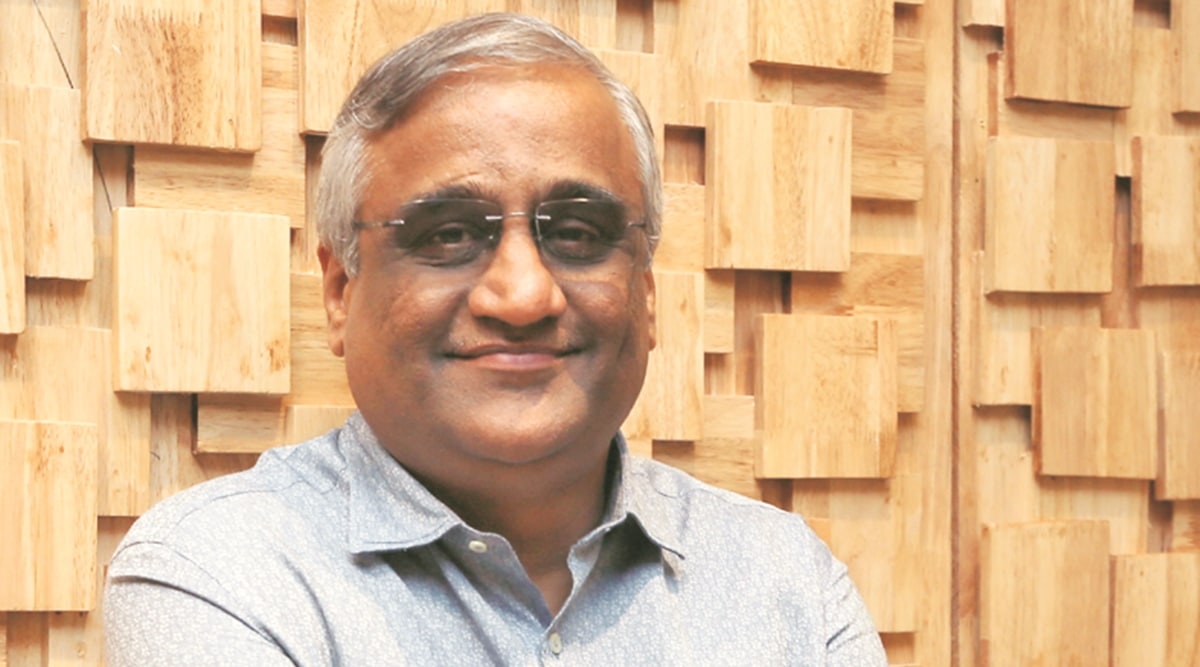

Kishore Biyani, CEO of Future Group.

Kishore Biyani, CEO of Future Group. The Securities and Exchange Board of India (SEBI) has barred Kishore Biyani, CEO of Future Group, his brother Anil Biyani and a few entities from accessing the securities market for a year for alleged insider trading between March and April 2017.

Sebi’s case against the Biyanis, Future Corporate Resources Pvt Ltd, a Future group company and other related entities, pertains to insider trading in the shares of Future Retail based on unpublished price sensitive information in 2017 when a few companies of the Future group were being restructured.

Sebi has barred Kishore Biyani from buying, selling or dealing in securities of Future Retail for two years. The order comes when Biyani’s Future Group has locked horns with Amazon as it bids to sell its retail assets to Reliance Industries Ltd (RIL).

Amazon has alleged that Future Group has breached a contract with the US-based e-commerce giant by striking the asset sale deal with RIL.

A Future group representative claimed the Sebi order wouldn’t affect the Rs 24,713- crore Future-RIL deal which “will progress as planned.” When contacted, RIL officials declined to comment.

The Delhi High Court Monday allowed Amazon to oppose before the regulator Future’s deal to sell assets to Reliance Retail. But the court said that Amazon’s attempt to control Future Retail is violative of FEMA and FDI rules.

Sebi wholetime member Anant Barua, in a 77-page order, has asked Biyani and other entities to disgorge unlawful gains of Rs 17.78 crore. Apart from this, SEBI has also imposed a penalty of Rs 3.7 crore on Biyani and a few others.

The regulator said it found that Future Retail made a public announcement of a scheme of arrangement involving several group companies on April 20, 2017, which resulted in a demerger of a particular business of the company.

Sebi alleged that the announcement had a positive impact on the shares of Future Retail. A probe by Sebi found that this arrangement had come into existence on March 10, 2017, and Kishore Biyani and others traded in the shares of Future Retail between March 10 and April 20, when they had knowledge of the demerger.

The probe found that the Biyanis had opened a trading account for Future Corporate Resources, which traded in the shares of Future Retail during this period.

The Biyanis, in their response to Sebi, said that information about the transaction had been widely reported across numerous media platforms much before the dates on which the trades were undertaken. And that it does not constitute unpublished price-sensitive information.