Brookfield India Real Estate Trust is the third Real Estate Investment Trust (REIT) to launch initial public offering after the successful listing of Blackstone Group-backed Mindspace Business Parks REIT in 2020 and Embassy Office Parks REIT in 2019.

This will be the fifth IPO in the current year, after Indian Railway Finance Corporation, Indigo Paints, Home First Finance Company and Stove Kraft.

The units will get listed on the BSE and National Stock Exchange. The global coordinators and book running lead managers to the issue are Morgan Stanley India Company, BofA Securities India, Citigroup Global Markets India, and HSBC Securities and Capital Markets (India).

Ambit, Axis Capital, IIFL Securities, JM Financial, JP Morgan India, Kotak Mahindra Capital Company and SBI Capital Markets are the Indian book running lead managers to the issue.

Here are 10 key things one should know about the issue:

1) IPO Dates

The initial public offering will open for subscription on February 3 and close on February 5, 2021.

2) Price Band

The price band for the issue has been fixed at Rs 274 to Rs 275 per unit.

3) Issue Size

Brookfield REIT is issuing units aggregating up to Rs 3,800 crore. The company already raised Rs 1,710 crore from anchor investors.

4) Bids

Investors, other than anchor investors, can bid for a minimum of 200 units and in multiples of 200 units thereafter. Hence, the minimum application size by retail investors would be Rs 55,000 at higher price band.

5) Objectives of Issue

The company will utilise net proceeds from the issue for partial or full pre-payment or scheduled repayment of the existing indebtedness of asset SPVs; and general corporate purposes.

6) Company Profile

The Brookfield REIT is India's only institutionally managed public commercial real estate vehicle. It is sponsored by an affiliate of Brookfield Asset Management (BAM), one of the world's largest alternative asset managers with approximately $575 billion in assets under management as of September 2020.

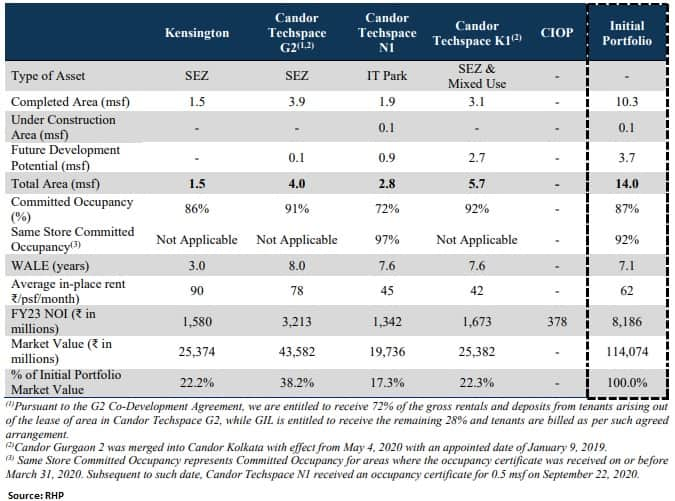

Its initial portfolio comprises 14.0 million square feet (msf), with rights to acquire a further 8.3 msf and rights of first offer on an additional 6.7 msf, both currently owned by members of the Brookfield Group.

The REIT owns an initial portfolio of four large campus-format office parks, which it believes are 'business-critical', located in some of India's key gateway markets - Mumbai, Gurugram, Noida and Kolkata. Its initial portfolio totals 14.0 msf, comprising 10.3 msf of completed area, 0.1 msf of under construction area and 3.7 msf of future development potential.

Initial portfolio's completed area has a same store committed occupancy of 92 percent (and a 87 percent committed occupancy, which includes the recently completed 0.5 msf at Candor Techspace N1) and is leased to marquee tenants with 75 percent of gross contracted rentals contracted with multi-national corporations such as Barclays, Bank of America Continuum, RBS, Accenture, Tata Consultancy Services and Cognizant.

While a 7.1-year weighted average lease expiry (WALE) provides stability to the cash flows of its initial portfolio, the company said it is well positioned to achieve further organic growth through a combination of contractual lease escalations, 36 percent mark-to-market headroom to in-place rents, lease-up of vacant space and near-term completion of under construction area to meet tenants' expansion needs. As of the date, the initial portfolio is significantly de-risked with only 0.1 msf of Under Construction Area, which is expected to be completed by September 2021.

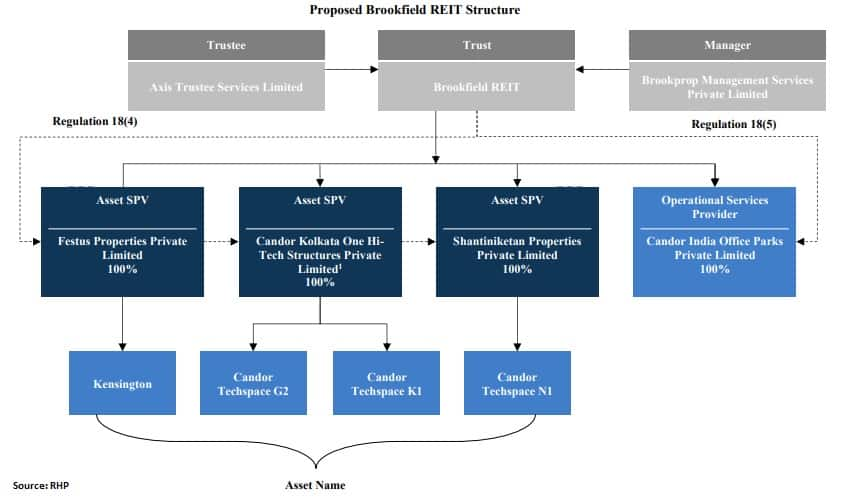

BSREP V is the sponsor of the Brookfield REIT, while Brookprop Management Services has been appointed as the manager to the Brookfield REIT and Axis Trustee Services will act as the trustee to the Brookfield REIT.

Proposed Brookfield REIT structure

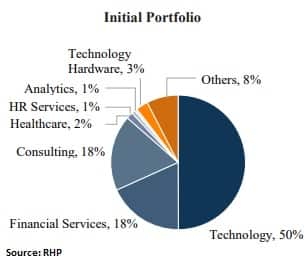

Diversified Tenancy Profile

The initial portfolio houses a diverse base of marquee tenants with 75 percent of gross contracted rentals contracted with multi-national corporations. These marquee tenants represent a broad array of industries, and a majority of these tenants have been occupiers in the portfolio for many years.

7) Key operating metrics for its Initial Portfolio

Operating progress of the office parks under the Manager:

The office parks have made significant operating progress under Brookfield Group’s ownership and our Manager. Its Manager also maintained high levels of Committed Occupancy and a healthy growth in per square foot rents while adding new development.

8) Competitive Strengths

Brookfield REIT believes that the following competitive strengths differentiate it from other public commercial real estate companies and REITs in India.

a>> Global Sponsorship with Local Expertiseb>> Difficult to replicate, dominant and strategically located properties

c>> Placemaking Capabilities in Manager and Sponsor's design, development and operating philosophy

d>> Diversified blue chip tenant roster and cash flow stability

e>> Significant identified internal and external growth opportunities

f>> Experienced, cycle-tested senior management team

g>> Institutional corporate governance framework and strong alignment of interest

9) Business and Growth Strategies

REIT's primary objective is to maximize total returns for unitholders through a combination of growth and value creation at the asset level supported by highly predictable, stable cash flows. The company intends to pursue the following strategies to achieve objective:

a>> Leveraging Brookfield and Manager's operating expertise for proactive asset and property managementb>> Capitalise on initial portfolio’s embedded organic growth and on-campus development potential

c>> Pursue disciplined and accretive acquisition growth opportunities

d>> Prudent and flexible capital structure positioned for growth

10) Management

The corporate governance framework with respect to the Brookfield REIT is implemented by Manager - Brookprop Management Services. The Board of Directors comprises four directors of which two directors are independent. Such Directors are not on the board of directors of the manager of another REIT.

Akila Krishnakumar is an independent director of the Manager. Shee was previously the president - global technology and country head – India for SunGard Solutions (India). She is an experienced professional with a long industry standing, including over 18 years of experience in the field of technology. She is currently on the board of Heidelberg Cement India, Matrimony.com, IndusInd Bank and ABB Power Products and Systems India.

Shailesh Vishnubhai Haribhakti is an independent director of the Manager. He is an experienced professional in the field of finance and accounting. He is the founder and chairman of New Haribhakti Business Services LLP, since 2013. He is also currently the chairman of Blue Star and on the board of directors of L&T Finance Holdings, L&T Mutual Fund Trustee and Ambuja Cements.

Anuj Ranjan is currently a non-executive director of the Manager. Anuj is a part of the senior leadership of BAM and is the managing partner, head of Europe and Asia-Pacific private equity and chief executive officer of South Asia and Middle East for BAM and is responsible for overseeing the investment initiatives and operations of Brookfield in these regions.

Ankur Gupta is currently a non-executive director of the Manager. Ankur is the managing partner, country head – India at the Brookfield Group and is also responsible for overseeing the investments and operations of the Brookfield Property Group in India.