Table of Contents

- Stamp duty and registration charges on conveyance/sale deed in West Bengal

- Stamp duty on other property documents and instruments

- How to calculate stamp duty and registration charges in West Bengal?

- How to pay stamp duty and registration charges online in West Bengal?

- How to apply for refund of stamp duty and registration charges in West Bengal?

- Properties exempted from stamp duty in West Bengal

- Can you pay stamp duty in West Bengal using cheque?

- FAQs

For all property related transactions taking place in West Bengal, the executant or the property buyer needs to pay the stamp duty and registration charges to the West Bengal Revenue Department. The state government has made the entire process online, through which the buyer can pay all the property related taxes and charges including stamp duty and registration charges online using West Bengal Registration portal. Here’s a step by step guide about stamp duty West Bengal and the registration charges in the state

Stamp duty and registration charges on conveyance/sale deed in West Bengal

| Location of the property | Stamp duty for property less than Rs 25 lakhs | Stamp duty for property above Rs 40 lakhs | Stamp duty for females | Registration charges |

| Corporation area | 6% | 7% | Same | 1% |

| Notified area/Municipality/Municipal Corporation | 6% | 7% | Same | 1% |

| Areas not included in above categories | 5% | 6% | Same | 1% |

There is no discount in stamp duty and registration charges for female home buyers in West Bengal

Stamp duty on other property documents and instruments

| Instrument | Stamp duty | Registration fee |

| Power of attorney (where the market value of the property does not exceed Rs 30 lakhs) | Rs 5,000 | Nil |

| Power of attorney (where the market value of the property is between Rs 30 lakhs and Rs 60 lakhs) | Rs 7,000 | Nil |

| Power of attorney (where the market value of the property is between Rs 60 lakhs and Rs 1 crore) | Rs 10,000 | Nil |

| Power of attorney (where the market value of the property is between Rs 1 crore and Ra 1.5 crores) | Rs 20,000 | Nil |

| Power of attorney (where the market value of the property is between Rs 1.5 crores and Rs 3 crores) | Rs 40,000 | Nil |

| Power of attorney (where the market value of the property exceeds Rs 3 crores) | Rs 75,000 | Nil |

| Partnership deed (up to Rs 500) | Rs 20 | Rs 7 |

| Partnership deed (up to Rs 10,000) | Rs 50 | Rs 7 |

| Partnership deed (up to Rs 50,000) | Rs 100 | Rs 7 |

| Partnership deed (exceeding Rs 50,000) | Rs 150 | Rs 7 |

| Transfer of lease (government land in favour of family members) | 0.5% of the market value of the property | Same as conveyance deed |

| Transfer of lease (in all other cases) | Same as conveyance on the market value of the property. | Same as conveyance deed |

| Gift deed (to family members) | 0.5% | Same as conveyance deed |

| Gift deed (apart from family members) | Same as conveyance deed on the market value of the property | Same as conveyance deed |

| Sale agreement (where the market value of the property does not exceed Rs 30 lakhs) | Rs 5,000 | Rs 7 |

| Sale agreement (where the market value of the property is between Rs 30 lakhs and Rs 60 lakhs) | Rs 7,000 | Rs 7 |

| Sale agreement (where the market value of the property is between Rs 60 lakhs and Rs 1 crore) | Rs 10,000 | Rs 7 |

| Sale agreement (where the market value of the property is between Rs 1 crore and Rs 1.5 crores) | Rs 20,000 | Rs 7 |

| Sale agreement (where the market value of the property is between Rs 1.5 crores and Rs 3 crores) | Rs 40,000 | Rs 7 |

| Sale agreement (where the market value of the property exceeds Rs 3 crores) | Rs 75,000 | Rs 7 |

How to calculate stamp duty and registration charges in West Bengal?

Follow this step by step procedure to use the stamp duty calculator for transactions happening in West Bengal:

Step 1: Visit the WB Registration Portal and click ‘Stamp Duty and Registration Fee’ from the left menu.

Step 2: Choose the type of transaction from the drop-down menu.

Step 3: Choose the local body where the transaction took place.

Step 4: Mention the market value

Step 5: Enter the captcha and the details will be displayed on the screen.

How to pay stamp duty and registration charges online in West Bengal?

Applicants can pay stamp duty and registration fee on their transaction only when the e-deed gets approved. For the e-deed, you need to fill the e-assessment form when submitting the application for property registration in West Bengal. To pay stamp duty and registration fee on property purchase, follow this procedure:

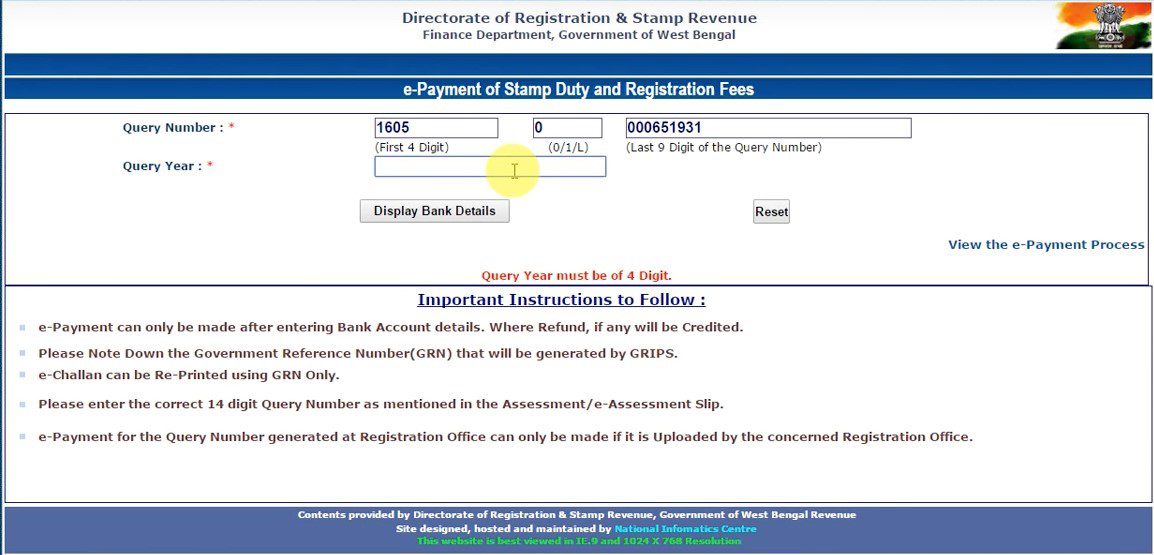

Step 1: Select ‘e-payment of Stamp Duty and registration fees’ from the WB Registration portal.

Step 2: Submit the query number and query year. Enter the bank details of the buyer, in case there is any refund to be credited.

Step 3: You will be redirected to the payment portal. Choose ‘Payment of Taxes and Non-Taxes revenue’.

Step 4: Choose ‘Directorate of Registration and Stamp Revenue’ in department category and select ‘Payment of Stamp Duty’.

Step 5: Fill in all the details such as depositor’s name, query number, etc. Proceed with the amount and payment details. Confirm all the information and make the payment through net banking. Save the government reference number (GRN) for future purposes.

See also: West Bengal’s Banglarbhumi portal for land records: All you need to know

How to apply for refund of stamp duty and registration charges in West Bengal?

The West Bengal government has now allowed the buyers to claim refund of stamp duty and registration charges paid online, only if the document has not been presented to the sub-registrar for registration. To apply for refund of stamp duty and registration charges, follow this procedure:

Step 1: Submit the application form in the format mentioned in Annexure A to the registration office which was selected in e-Assessment form.

Step 2: The refund application can be made only by the depositor and the claim has to be made within three months from the date of making online payment of the stamp duty and registration fee.

Step 3: The following documents will be required to be attached with the form:

- E-challan of deposit (claimant’s copy).

- Copy of valuation report/query.

- Original executed/partly executed document.

- Documentary evidence to prove that the agreement has been cancelled.

- Cancelled blank cheque.

You can download all the above property and payment related documents here.

See also: A guide to paying property tax in Kolkata

Properties exempted from stamp duty in West Bengal

So far, only land purchased by the government departments are exempted from the stamp duty and registration fee and will be remitted by the governor of the state. Apart from this, no other type of transaction is exempted from the government taxes, such as stamp duty and registration charges.

Check out properties for sale in Kolkata.

Can you pay stamp duty in West Bengal using cheque?

Property buyers can pay stamp duty charges through any of these modes:

- Cash

- Cheque

- Demand draft

- Pay order

- RTGS or NEFT

- Account to account transfer.

However, buyers are advised to contact the nearest e-stamping centre, before initiating any kind of fund transfer. Also, buyers will need to bear the additional cost of bank/payment gateway charges.

FAQs

What is the stamp duty for gift deed in West Bengal?

It may vary between 0.5% to 7%, depending upon the receiver and the market value of the property.

How do I calculate my registry charges in West Bengal?

Usually, registry charges are 1% of the property value, depending upon the location of the property.

How can I check ownership of land in West Bengal?

You can check the land ownership in West Bengal using Banglarbhumi.

Comments 0