The market staged stellar performance with the benchmark indices gaining 5 percent as the Union Budget 2021 boosted investors and traders' sentiment. The government increased capital expenditure by 35 percent to Rs 5.54 lakh crore and focussed on several key sectors such as infrastructure and healthcare in FY22 to increase jobs, along with a divestment target of Rs 1.75 lakh crore. Finance Minister Nirmala Sitharamn announced strategic divestment in public sector companies and financial institutions, including two PSU banks and one insurance company, in the next fiscal year.

The BSE Sensex rallied 2,314.84 points or 5 percent to 48,600.61 after weakness seen in the previous six consecutive sessions, while the Nifty50 climbed 646.60 points or 4.74 percent to 14,281.20 and formed a big bullish candle which resembles a Long White Day kind of candle on the daily charts.

"This pattern could be considered as a strong comeback of bulls, after six sessions of weakness. Hence, the recent swing low of 13,596 could be considered as a new higher bottom of the sequence. This one large bull candle has changed the short-term sentiment of the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The sharp upside momentum of the market on the Union Budget day seems to have changed the sentiment of the market. The Union Budget has turned out to be an event for the market so far now. The next important hurdles to be watched are 14,600 and 14,753. At the lower side, the area of 14,000 could be a crucial support for the market," he said.

The overall market breadth has turned positive and the broader market indices like Nifty Midcap 100 and Smallcap 100 have closed higher by 3.30 percent and 2.01 percent respectively. But the sharp upside was seen in the sectors such as banking, financial and realty with the gains of more than 6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,849.9, followed by 13,418.6. If the index moves up, the key resistance levels to watch out for are 14,524.4 and 14,767.6.

Nifty Bank

The Nifty Bank surged 2,523.55 points or 8.26 percent to end at 33,089.05 on February 2. The important pivot level, which will act as crucial support for the index, is placed at 31,561.9, followed by 30,034.7. On the upside, key resistance levels are placed at 33,960.8 and 34,832.5.

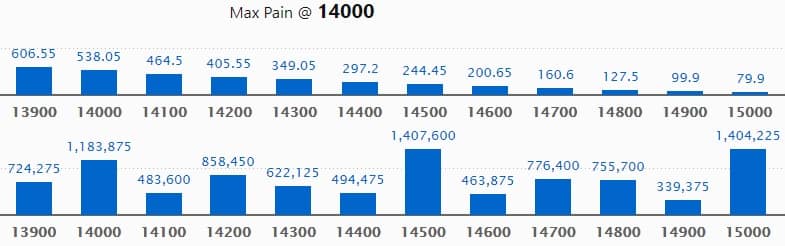

Call option data

Maximum Call open interest of 14.07 lakh contracts was seen at 14,500 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,000 strike, which holds 14.04 lakh contracts, and 14,000 strike, which has accumulated 11.83 lakh contracts.

Call writing was seen at 14,200 strike, which added 1.44 lakh contracts, followed by 13,500 strike which added 1.43 lakh contracts and 14,100 strike which added 88,800 contracts.

Call unwinding was seen at 13,800 strike, which shed 1.08 lakh contracts, followed by 14,000 strike which shed 1.03 lakh contracts.

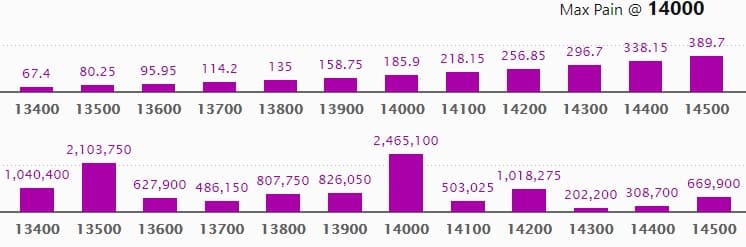

Put option data

Maximum Put open interest of 24.65 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the February series.

This is followed by 13,500 strike, which holds 21.03 lakh contracts, and 13,400 strike, which has accumulated 10.4 lakh contracts.

Put writing was seen at 14,200 strike, which added 4.09 lakh contracts, followed by 13,500 strike, which added 3.21 lakh contracts and 14,100 strike which added 2.51 lakh contracts.

Put unwinding was seen at 14,600 strike, which shed 23,550 contracts, followed by 14,900 strike, which shed 2,700 contracts.

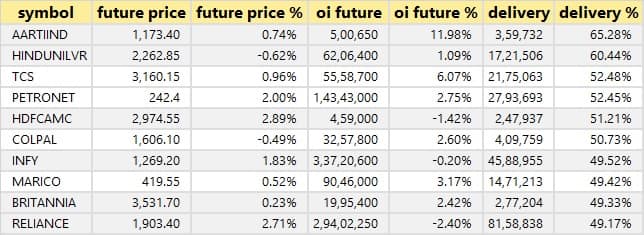

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

79 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

Three stocks saw long unwinding

Based on the open interest future percentage, here are the three stocks in which long unwinding was seen.

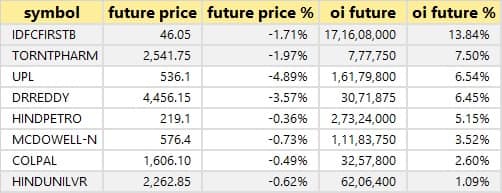

Eight stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the eight stocks in which a short build-up was seen.

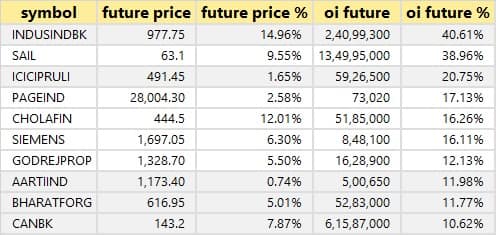

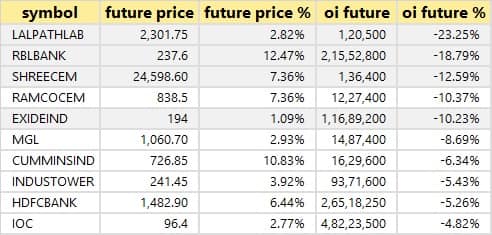

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

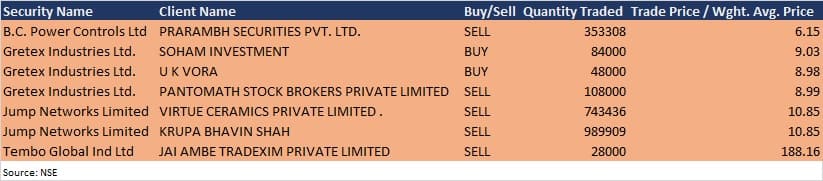

(For more bulk deals, click here)

HDFC, Ajanta Pharma, Balrampur Chini Mills, Carborundum Universal, Dhampur Sugar Mills, Dixon Technologies, Escorts, IIFL Wealth Management, Intellect Design Arena, Neuland Laboratories, NOCIL, PI Industries, Tata Consumer Products, Vinati Organics and Wonderla Holidays were among 69 companies to announce their quarterly earnings onFebruary 2.

Stocks in the news

PVR: The company set the issue price for QIP at Rs 1,440 per share and raised Rs 800 crore.

Castrol India: The company reported higher profit at Rs 582.9 crore in Q3FY21 against Rs 187.7 crore in Q3FY20; revenue increased to Rs 2,997 crore from Rs 935.2 crore YoY.

Coal India: Coal production in January 2021 was at 60.5 million tonnes against 63.1 million tonnes in January 2020; offtake fell to 53.3 million tonnes from 55.9 million tonnes in the same period.

VST Tillers & Tractors: The company sold 2,258 units of power tillers in January 2021 against 1,971 units in January 2020. Tractor sales increased to 647 from 516 units in the same period.

Eicher Motors: The company sold 68,887 units of Royal Enfield in January 2021 against 63,520 units in January 2020.

NMDC: The company announced production of 3.86 million tonnes in January 2021 against 3.31 million tonnes in January 2020, and sales at 3.74 million tonnes against 2.96 million tonnes in the same period.

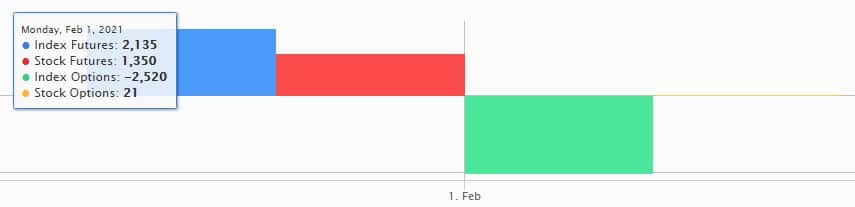

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,494.23 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 90.46 crore in the Indian equity market on February 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for February 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.