The frenzied market action in small-cap stocks like Gamestop

GME,

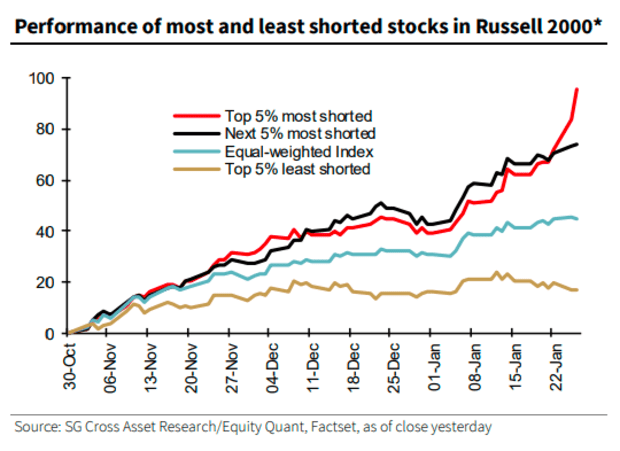

But though some may be tempted to dismiss them as a sideshow, this chart from Société Générale suggests the skyrocketing gains in a smattering of highly shorted shares is a much more broader phenomenon.

Indeed, the most-shorted stocks in the $3 trillion Russell 2000RUT index have reaped immense gains since the end of last year, trouncing the rest of their peers.

The top 5% most-shorted has doubled in value since the end of October, edging out the next 5% most shorted, which, in turn, outpaced the least-shorted shares.

“This top tranche has now broken away from the next one, implying that the level of short interest itself is the target for much of this activity,” said Andrew Lapthorne, head of quantitative equity research at Société Générale, in a Wednesday note.

See: It isn’t just GameStop: Here are some of the other heavily shorted stocks shooting higher

Analysts have suggested retail traders congregating in platforms like Reddit and Discord were actively seeking out stocks with a high percentage of short interest in an effort to generate a short squeeze. The hope was short-sellers faced with punishing losses would cover their shorts and buy the stock back, accelerating gains.

The S&P 500

SPX,

Read: Is the trading in GameStop and AMC a major risk? Analysts weigh in