Broadly, there is a consensus that infrastructure, healthcare and manufacturing will be the main theme of the Union Budget 2021.

Like every year, there are many expectations from the Budget and the hopes have been bolstered after the Finance Minister announced that the coming Budget will be a remarkable one.

The government is expected to increase funding towards infrastructure development significantly as this would not only boost the economy but generate employment also which has been severely impacted due toCOVID-19.

There are expectations that railways will get higher allocation as the COVID-19 pandemic dealt a severe blow to the sector's revenue in the current financial year.

Brokerage firm YES SECURITIES pointed out that significant funding would be required for railways and with the subdued railway earnings, the dependence on budgetary allocation would be much higher.

While railways require higher funding, roads and highways also need higher allocation as the pandemic thwarted the growth of infra projects.

If the government increases budgetary support to the road and highway sector, it will be positive for companies like L&T, KNR Constructions, Sadbhav Engineering, Ashoka Buildcon, PNC Infratech and JMC Projects.

This will also positive for the cement sector in incremental demand, brokerage firm Sharekhan pointed out. It will be positive for Ultratech Cement, Shree Cement, The Ramco Cements and JK Lakshmi Cement.

Sharekhan highlighted the expectation of dedicated financing of 1 percent of GDP for the infrastructure sector.

"A part of the recent increase in excise duties can be earmarked for infra investments to finance infra investments, in particular for roads and railways," said Sharekhan.

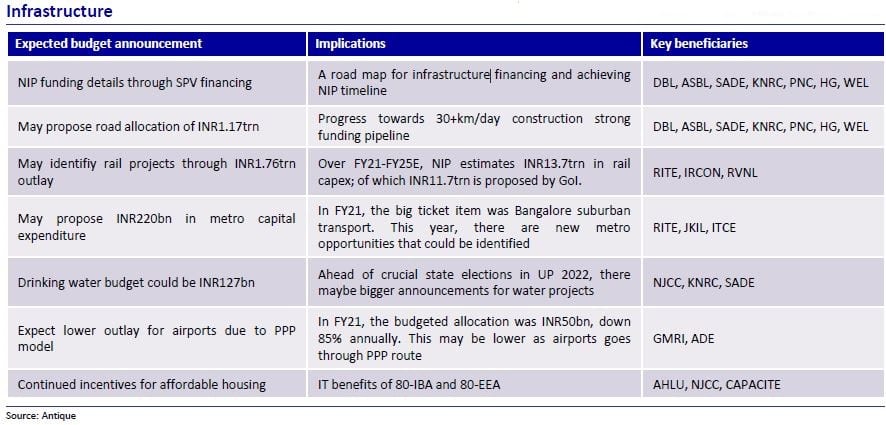

Antique Stock Broking expects infrastructure projects funding details through special purpose vehicle (SPV) financing which will offer a road-map for infrastructure financing and help in achieving the timeline of the National Infrastructure Pipeline (NIP).

The government may also increase the budgetary allocation for drinking water projects and may announce continued incentives for affordable housing. This will be beneficial for stocks such as NCC, Sadbhav Engineering, Ahluwalia Contracts and Capacite Infraprojects.

There are high expectations from the upcoming Union Budget. There are high risks that any disappointment from the Budget will have a strong negative impact on the market.

"Any disappointment in form of higher fiscal consolidation (spending cut), imposing higher long-term capital gain tax (currently at 10 percent) or tax rate on individuals would be construed negatively especially at the time of current elevated valuation," said Antique Stock Broking.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.