Did you know that Bajaj Finance, Titan Company, Britannia Industries, among many other large-cap names of today were little-known small-cap stocks until around a decade ago? Small companies that prove their mettle even in the face of adversities have the potential to become big corporations in the future.

In fact, many such companies even today are steadily climbing their way up the leadership ladder and on the way to clock big gains for its investors.

If you are looking to uncover the potential of these multi-baggers of tomorrow while they are still relatively undiscovered, consider investing in small cap funds.

However, be advised that for every high-potential small-cap, there is a long list of stocks that can turn out to be wealth destroyers. Therefore, instead of chasing returns, invest in small-cap fund that focuses on picking high growth-potential quality stocks.

Small-cap funds are equity-oriented mutual funds mandated to invest at least 65% of its assets in equity and equity related instruments of small-cap companies. Small-caps are defined as companies ranking beyond 250 in terms of full market capitalisation.

--- Advertisement ---

The Smallcap Revival Summit

Join us TOMORROW at 5pm to learn,

• Why despite rallying over 100% since March-2020 lows... small-cap stocks are set for a massive rally over the coming months and years

• Details of our top 3 stocks to capture potentially huge gains from this upcoming small-cap rally

• And how to spot opportunities, even in the current market, with potential to generate 200%, 400%, and even 900% long-term gains

Plus there is a lot more that we are going to cover.

The summit is free to attend for Equitymaster readers.

But since there are limited seats, we would recommend you to register at the earliest.

Click here to register. It's free.

------------------------------

Though Small-caps have high return potential, there are various risks associated with them. These companies have smaller operations with limited access to various resources. At times, if there is a constrain on resources, they may face risk to survival in case of economic downturn.

Further, there is liquidity risk associated with them as the limited number of shares makes it difficult for investors to buy and sell as per their wish. That said, a strong business helmed by a well-built management team along with the availability of stock at a reasonable price can make it a very attractive investment.

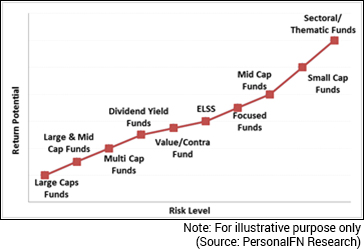

Small-cap funds are placed on the higher end of the risk-return spectrum, just a notch below sector and thematic funds. So, small-cap funds are a very high-risk-high-return investment proposition because the stocks of such companies are highly volatile. When you invest in small-cap funds, make sure you have an investment time horizon of at least 5-7 years, while you endeavour to maximise returns.

If you have a high-risk appetite, with the ability to handle short-term volatility, and a long-term investment horizon, small-cap funds can be included in the satellite part of your equity mutual fund portfolio.

| Scheme Name | Absolute (%) | CAGR (%) | |||

|---|---|---|---|---|---|

| 1 Year | 2 Years | 3 Years | 5 Years | 7 Years | |

| Quant Small Cap Fund | 73.25 | 19.74 | 13.26 | 10.87 | 10.65 |

| Axis Small Cap Fund | 20.11 | 24.42 | 12.40 | 17.67 | 23.25 |

| Kotak Small Cap Fund | 33.38 | 24.69 | 8.17 | 17.58 | 21.79 |

| SBI Small Cap Fund | 30.83 | 23.06 | 5.56 | 19.84 | 28.25 |

| ICICI Pru Smallcap Fund | 21.63 | 21.23 | 3.23 | 13.38 | 14.78 |

| Nippon India Small Cap Fund | 24.77 | 15.68 | 2.64 | 16.68 | 23.91 |

| HDFC Small Cap Fund | 18.33 | 7.45 | 1.52 | 15.43 | 17.08 |

| DSP Small Cap Fund | 26.97 | 18.49 | 0.93 | 13.52 | 22.71 |

| Franklin India Smaller Cos Fund | 18.62 | 9.35 | -0.61 | 11.85 | 19.41 |

| L&T Emerging Businesses Fund | 13.68 | 7.26 | -1.57 | 14.69 | -- |

| Nifty Smallcap 100 - TRI | 18.96 | 9.17 | -6.47 | 9.73 | 12.97 |

| Nifty Smallcap 250 - TRI | 21.32 | 11.38 | -4.36 | 10.33 | 15.49 |

Three years after the small-cap space witnessed a severe correction, small-cap funds are back in the limelight. A predominant number of small-cap schemes outperformed the benchmark S&P BSE Small-Cap Total Return Index (TRI) by a noticeable margin in the last one year. And as a result, their long-term returns have improved.

Based on our analysis and research at PersonalFN, Axis Small Cap Fund and SBI Small Cap Fund are currently the best schemes in the small-cap fund segment. Both the schemes stand out in terms of generating superior risk-adjusted return for its investors by focusing on quality stocks in the small-cap space that are expected to do well in the long run.

BREAKING: Full Details of the #1 Investment of the Decade...

Kotak Small-Cap Fund is another decent performer in the category.

Small-cap funds tend to outperform large-cap funds and mid-cap funds during bull phases, but may suffer heavy losses during bear phases. Therefore, do not invest in small-cap funds based only its performance during market rallies. Instead, determine how the fund performs during a complete market cycle.

Quantitative Parameters:

Analyse if the fund has shown consistency in performance across various market periods (bull and bear market phases) compared to the benchmark and category peers. While all funds may perform well during the bull phase, an important parameter while selecting a small-cap fund is to determine its ability to manage the downside risk during tough market conditions.

The next step is to determine whether the fund has rewarded its investors well for the risk they have taken using the risk-reward ratios like Sharpe Ratio, Sortino Ratio, and Standard Deviation over a 3-year period.

Give preference to those funds that stand strong on risk-reward parameters when you are short-listing funds for your portfolio.

Qualitative Parameters

Qualitative parameters are often overlooked though they are a vital aspect in the selection process. It involves determining the quality of the portfolio and the efficiency of fund manager/house.

The fund house should have a significant performance record and must follow robust investment processes with adequate risk management systems in place.

And because the fund's performance is directly dependent on the ability of its fund manager, check the qualification and experience of the fund manager. In addition to this, check the track record of the other schemes they manage.

--- Advertisement ---

MEGA WEBINAR "2021, Boom or Bust?... An Asset Class Outlook"

Date: Jan 29th | Time: 6pm | Venue: Your Computer

• What Does 2021 Hold For You From A Macro-Economic View?

• Which Way Are The Markets & The Mutual Funds Industry Headed?

• How Will The Year Be For All Asset Classes?

Get answers to such burning questions that will put your mind at ease.

You definitely need all the information you could get, to make informed decisions.

And that is exactly what this webinar will address.

Ensure you don't miss this mega event!

Join Ajit and Chirag as they dive deep into the macroeconomic view for 2021 & all asset class perspective.

Register FREE for this MEGA Webinar

[No Payments | No Credit Card | Absolutely FREE] [Yes! I want to attend this Webinar]

Yes, also send me your financial planning newsletter, Quantum Direct, free of charge.

------------------------------

Look at the fund's portfolio for how well diversified it is across stocks/sectors. Remember that a concentrated portfolio can expose you, the investor/s, to higher risk. Ensure that the scheme includes highly liquid, quality names of organisations in the small-cap space to help it sail through adverse market conditions.

Moreover, keep a tab on the churning rate of the securities in the portfolio because a high churning rate can make the portfolio prone to volatility and negatively impact the overall returns of the scheme. Analyse the portfolio's turnover ratio and expense ratio to assess how efficiently the fund controls the churning and limits the expenses.

Yes, we know that the above list is a lot for an average investor to look at. It involves number crunching and much of the data is not easily available in one place. But if you do need to narrow down on the top funds, these factors are of utmost importance.

Watch this short video on selecting mutual fund schemes:

At PersonalFN, we select and recommend mutual funds based on quantitative and qualitative parameters using our S.M.A.R.T Score Matrix:

Despite the pandemic crisis, small-cap funds have generated significant gains in 2020, with the majority of schemes outpacing the index by a significant margin. Funds having a considerable exposure to speciality Chemicals, Pharmaceuticals, Information Technology (IT), and Banking &Financial service managed to trump their respective benchmark indices and the broader markets.

Notably, the pandemic-related uncertainties have reduced and most economic activities are back to pre-COVID levels. Going forward, the gradual return to normalcy from the COVID-19 pandemic may benefit small-cap companies, especially those with quality management team, healthy financial track record, and competitive advantage.

In the recent past, the government has initiated various steps to nurture the growth of small companies. Moreover, liquidity infusion from RBI and increased participation from retail investors has made the small-cap segment attractive.

However, keep in mind that after a sharp ~110% rise in the small-cap index since the March 2020 low, valuations now are flying high; they look rather expensive. Besides, a lot hinges on the Union Budget 2021-22 announcements. Any potential correction could weigh on the performance of small-cap funds.

Therefore, it would be imprudent to invest in small-cap funds with a short-term view. Even if the market rally continues in the near term, do not increase your weightage in the small-cap category without evaluating your portfolio and financial needs. Stick with your personalised asset allocation plan based on your financial goals, risk appetite, and investment horizon and avoid taking undue risk.

Lastly, when you invest in small-cap funds, prefer the SIP route to mitigate the impact of volatility.

PS: PersonalFN has completed 20 years of unbiased research service and we want to celebrate it with our loyal readers and subscribers like yourself. Get PersonalFN's premium mutual fund research service 'FundSelect Plus' in this exclusive anniversary offer. As a FundSelect Plus subscriber, you will get access to 7 ready-to-invest premium mutual fund solutions with high performance potential. Subscribe now!

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

In this video I'll show you the way to trade the volatile market before and after the budget.

The downside risk from a stock trading at 130x earnings.

Here's how to not miss 10 best days for your portfolio returns.

In today's video, I'll show you why it's not a good idea to blindly support the bullish consensus prevalent in the market these days.

Is the valuation for this 5-bagger running ahead of its fundamentals?

More Views on NewsIn this video, I'll show you why it might be the right time to take money of the table in pharma stocks.

The pandemic failed to thwart Richa's investing success formula for 2020.

In this video, I'll show you a crucial chart that you need to check before you decide to sell any stock or index.

Our ace stock picker is ready to capitalise on a big growth opportunity.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!