The market witnessed a sharp slide on January 22 as it corrected 1.5 percent due to selling pressure in banking, financials and metals stocks. Weak global cues also dented investor sentiment.

The S&P BSE Sensex declined 746.22 points to 48,878.54, while the Nifty50 index plunged 218.50 points to 14,371.90 and formed a bearish candle on the daily chart for the second consecutive session. It corrected fourth of a percent for the week and witnessed a Shooting Star kind of formation on the weekly scale.

"The emergence of sharp selling pressure in a very short span of time (without showing reasonable upside bounce or non-consumption of sufficient trading days) hint that the market could be poised for deep correction from here," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Technically, the weekly chart pattern could be considered as a high wave type formation at the highs and this indicates a high volatility/confused state of mind among participants ahead of key economic event of Union Budget 2021. The detailed study of Union Budgets of the last 6-7 years suggest a higher possibility of reversal in the market post the event," he said.

Hence, long positions need to be protected with appropriate stop loss, he advised. "A decisive move below 14,220 could open a larger downward correction in the market and any rise from here is likely to attract selling pressure around 14,460-14,520 levels by next week," he said.

The broader markets also saw selling pressure with the Nifty Midcap 100 index falling 1.2 percent and Smallcap 100 index declining 0.58 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,279.83, followed by 14,187.77. If the index moves up, the key resistance levels to watch out for are 14,541.93 and 14,711.97.

Nifty Bank

The Nifty Bank underperformed the Nifty50, falling 1,019.65 points or 3.17 percent to close at 31,167.25 on January 22. The important pivot level, which will act as crucial support for the index, is placed at 30,814.27, followed by 30,461.33. On the upside, key resistance levels are placed at 31,825.77 and 32,484.33.

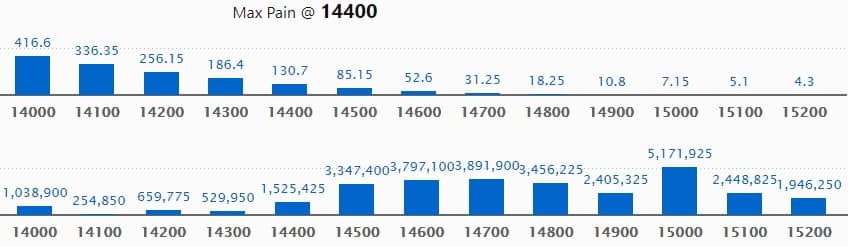

Call option data

Maximum Call open interest of 51.71 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,700 strike, which holds 38.91 lakh contracts, and 14,600 strike, which has accumulated 37.97 lakh contracts.

Call writing was seen at 14,500 strike, which added 19.9 lakh contracts, followed by 14,600 strike, which added 19.31 lakh contracts and 14,700 strike which added 15.3 lakh contracts.

Call unwinding was seen at 14,000 strike, which shed 26,625 contracts, followed by 13,800 strike which shed 14,625 contracts and 13,500 strike which shed 11,775 contracts.

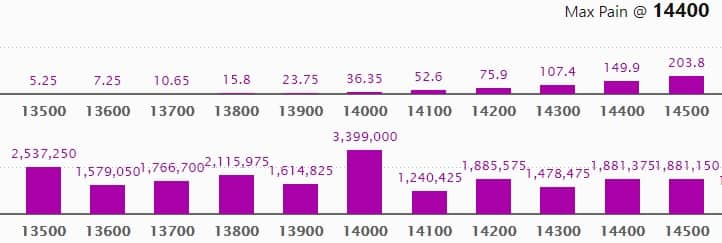

Put option data

Maximum Put open interest of 33.99 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 25.37 lakh contracts, and 13,800 strike, which has accumulated 21.15 lakh contracts.

Put writing was seen at 13,800 strike, which added 7.9 lakh contracts, followed by 13,700 strike, which added 7.18 lakh contracts and 14,000 strike which added 5.77 lakh contracts.

Put unwinding was seen at 14,600 strike, which shed 7.12 lakh contracts, followed by 14,700 strike, which shed 3.23 lakh contracts and 13,900 strike which shed 1.58 lakh contracts.

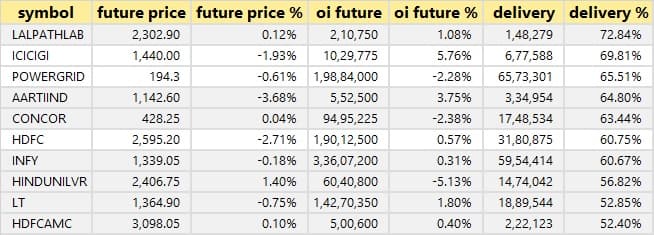

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

12 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

48 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

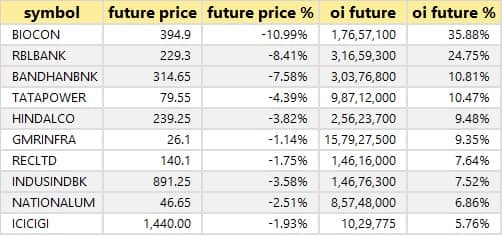

62 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

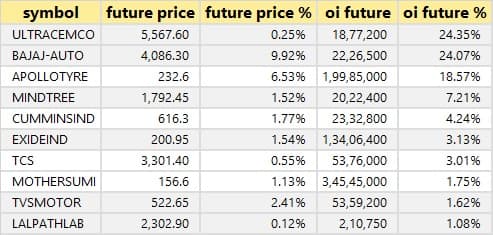

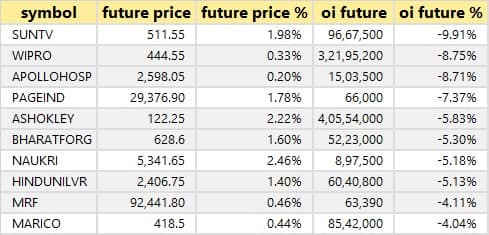

20 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

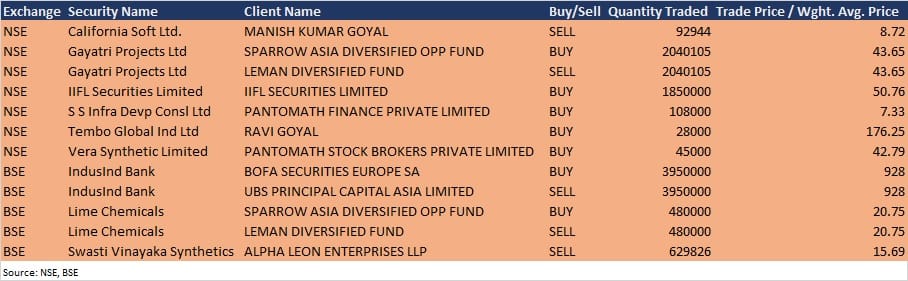

Bulk deals

(For more bulk deals, click here)

Larsen & Toubro, Kotak Mahindra Bank, Aarti Drugs, APL Apollo Tubes, Astec Lifesciences, Can Fin Homes, Chennai Petroleum Corporation, ICICI Securities, Mahindra Holidays & Resorts India, Navin Fluorine International, RPG Life Sciences, Sharda Cropchem and UCO Bank are among 41 companies that are slated to announce their quarterly earnings on January 25.

Stocks in the news

Reliance Industries: The company reported a consolidated profit of Rs 14,894 crore in Q3FY21 against Rs 10,602 crore in Q2FY21; revenue increased to Rs 1,23,997 crore from Rs 1,16,195 crore QoQ.

Birla Corporation: The company reported a sharply higher profit at Rs 148.2 crore in Q3FY21 against Rs 81.5 crore in Q3FY20, while revenue rose to Rs 1,776.6 crore from Rs 1,715 crore YoY.

UltraTech Cement: The company reported a consolidated profit of Rs 1,584 crore in Q3FY21 against Rs 711 crore, and revenue jumped to Rs 12,254.1 crore from Rs 10,439.3 crore YoY.

Piramal Enterprises: DHFL administrator informed company of committee of creditors declaring company as successful resolution applicant.

Grasim Industries: The company said it will enter paints business and invest Rs 5,000 crore over the next three years.

Yes Bank: The bank reported a profit of Rs 150.7 crore in Q3FY21 against a loss of Rs 18,560 crore in Q3FY20. Net interest income jumped to Rs 2,560.4 crore from Rs 1,064.7 crore YoY.

Tata Power: Tata Power Solar Systems received the EPC order worth Rs 1,200 crore from NTPC for setting up of 320MW ground mounted Solar PV project.

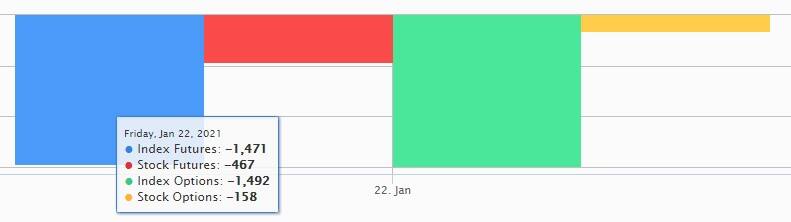

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 635.69 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,290.35 crore in the Indian equity market on January 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - NALCO, PNB and SAIL - are under the F&O ban for January 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."