What is Equity Index Fund and how to choose the right one

Jatin Visaria

Equity supplies alternative to take part in the long-term India development story. Investment in Index fund is the easiest method to spend money on equities and will be core a part of fairness allocation due to simplicity of funding and low value.

There are over 400 actively managed fairness funds in India, and it is very tough to determine which funds are most applicable. Within fairness additionally there are numerous classes like Largecap, Multicap, Midcap, Small cap, thematic and sector funds and many others., which can confuse traders whereas choosing the appropriate funds. Further, it can’t be predicted prematurely, which lively fund will carry out nicely going ahead. Hence, it makes immense sense to first get publicity of equities by an Index fund to obtain market returns.

Index Funds are managed by merely monitoring or replicating a inventory market index. For instance, you will need to have heard about indices like Nifty 50, Nifty Next 50, S&P BSE Sensex and many others. Index funds strive to replicate the returns of one of such indices by investing into the shares that are forming a part of this index and that too nearly in similar proportion. These indices are rebalanced at a selected frequency, the place portfolio is reviewed based mostly on pre-decided standards. During such rebalancing interval if any inventory fail to fulfill the standards, such shares are changed by new shares. Thus, this is an automatic mechanism the place winners change into a part of an index and losers are eliminated with none main human intervention. This additionally helps in conserving the portfolio freed from particular person biases and subjectivity of opinions.

Broadly, Tracking Error, Cost and measurement are three vital parameters whereas selecting Index Fund.

The funding mandate of an fairness index fund is to monitor its underlying fairness index. Any deviation or error in such monitoring is referred to as monitoring error. It displays how carefully & persistently the scheme is replicating its underlying complete return index. Due to prices like complete expense ratio (TER) and transaction costs accounted in the scheme, there could also be distinction between underlying portfolio and scheme portfolio. This distinction is referred to as monitoring error. In case of Index Funds, fund supervisor’s mandate is to decrease such distinction and replicate/monitor the underlying index as carefully as doable. Near to zero or low monitoring error exhibits the effectivity of managing the scheme.

Second vital side is the value i.e. Total Expense Ratio or TER of the scheme. As everyone knows, rupee saved is rupee earned. I.e. low TER translate in to value saving & could assist in enhancing the earnings or returns of the scheme. Apart from TER one also needs to contemplate different transaction value related to the funding by different options. In case of Index Funds, broadly all prices are mirrored in the Net Asset Value i.e. NAV of the scheme (besides stamp obligation). And Investor could not pay one other further value like buying and selling brokerage, bid/ask unfold, liquidity provision value, demat account costs and many others., which is paid over and above NAV of the scheme.

Lastly Asset Under Management or AUM i.e. measurement of the scheme is additionally one of the vital parameters. Relatively giant measurement helps in effectively managing the scheme.

Index Fund having low monitoring error, giant AUM and cheap value could also be the prudent alternative for funding.

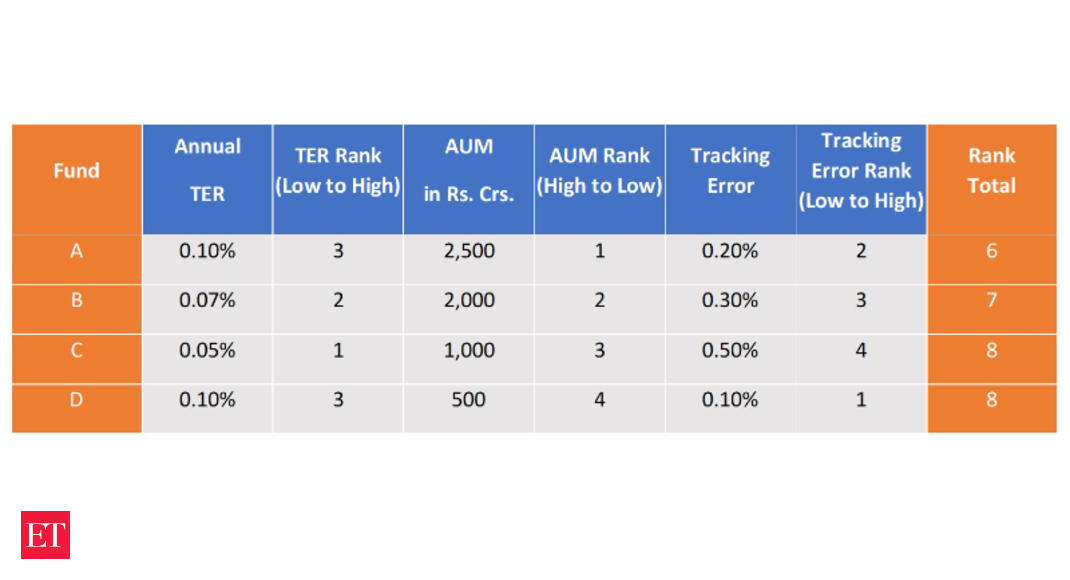

Let us perceive this with an instance. As talked about under, suppose there are 4 index funds. We can rank these funds based mostly on their respective TER, AUM and Tracking Error and merely sum up the ‘ranking number’. The fund having lowest sum of rating numbers could also be the prudent possibility. In this instance, Fund A is having 0.10% of annual TER which is third lowest, Rs. 2,500 Crs of AUM which is the largest amongst accessible selections and 0.20% of monitoring error which is second lowest. The complete of those rating quantity is 6. Thus, on this instance ‘Fund A’ could also be the applicable alternative. This is one of the manner of selecting the index fund for beginning the choice course of.

To summarize, Index Fund are easy, low value and one of the environment friendly choices for taking publicity to fairness as an asset class. Index Fund having low monitoring error, giant AUM and cheap value could also be the prudent alternative of investing.

An Investor Education Initiative by UTI Mutual Fund

Mutual Fund investments are topic to market dangers, learn all scheme associated paperwork rigorously.

To find out about the KYC documentary necessities and process for change of tackle, telephone quantity, financial institution particulars, and many others. please go to http://www.utimf.com/servicerequest/kyc. Please take care of solely registered Mutual funds, particulars of which will be verified on the SEBI web site below “Intermediaries/market Infrastructure Institutions”. All complaints concerning UTI Mutual Fund will be directed in direction of http://[email protected] and/or go to http://www.scores.gov.in (SEBI SCORES portal). This materials is a part of Investor Education and consciousness initiative of UTI Mutual Fund.

Disclaimer: Content Produced by UTI Mutual Fund