The market started off on a strong note, extending the previous two-day rally to hit a fresh record high amid positive global cues, but lost all gains in the last hour of trade due to profit booking and closed in the red on January 21.

The BSE Sensex crossed the psychological 50,000 mark for the first time on January 21 but closed the session 167.36 points lower at 49,624.76, while the Nifty50 ended at 14,590.40, down 54.30 points after hitting a life high of 14,753.55 and formed a bearish candle which resembles a Dark Cloud Cover kind of pattern on the daily charts.

Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities, is of the view that the bulls are still in total control but intraday chart shows a temporary pause near 14,750 levels. Hence traders may prefer to take a cautious stance near the resistance level, he said.

Technically, "the index still maintains higher high and higher low series. Below 14,750 levels, the correction is likely to continue up to 14,550-14,500. On the other side, 14,750 would be the immediate hurdle for the bulls, and above the same, the index could rally till 14,850," he said.

The broader markets also caught in a bear trap with the Nifty Midcap 100 index falling 1.22 percent and Smallcap 100 index down 0.64 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,487.17, followed by 14,384.03. If the index moves up, the key resistance levels to watch out for are 14,723.47 and 14,856.63.

Nifty Bank

The Nifty Bank corrected 356.80 points or 1.10 percent to 32,186.90 on January 21. The important pivot level, which will act as crucial support for the index, is placed at 31,834.23, followed by 31,481.56. On the upside, key resistance levels are placed at 32,690.93 and 33,194.97.

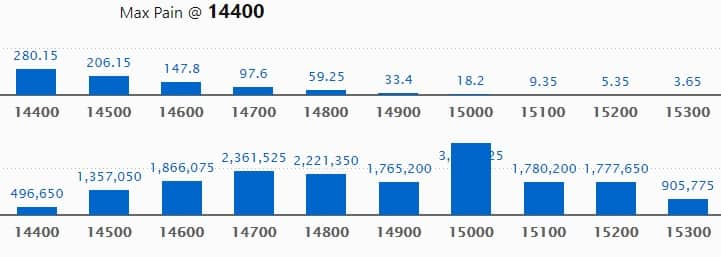

Call option data

Maximum Call open interest of 38.63 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,700 strike, which holds 23.61 lakh contracts, and 14,800 strike, which has accumulated 22.21 lakh contracts.

Call writing was seen at 15,200 strike, which added 8.53 lakh contracts, followed by 14,700 strike which added 7.97 lakh contracts and 15,100 strike which added 7.28 lakh contracts.

Call unwinding was seen at 14,400 strike, which shed 1.2 lakh contracts, followed by 14,000 strike which shed 1.17 lakh contracts and 14,300 strike which shed 37,050 contracts.

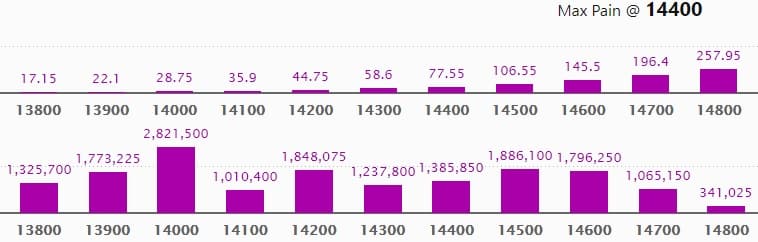

Put option data

Maximum Put open interest of 28.21 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 14,500 strike, which holds 18.86 lakh contracts, and 14,200 strike, which has accumulated 18.48 lakh contracts.

Put writing was seen at 14,600 strike, which added 8.7 lakh contracts, followed by 14,700 strike, which added 7.4 lakh contracts and 14,500 strike which added 2.45 lakh contracts.

Put unwinding was seen at 14,300 strike, which shed 2.35 lakh contracts, followed by 13,800 strike, which shed 66,150 contracts and 14,100 strike which shed 44,025 contracts.

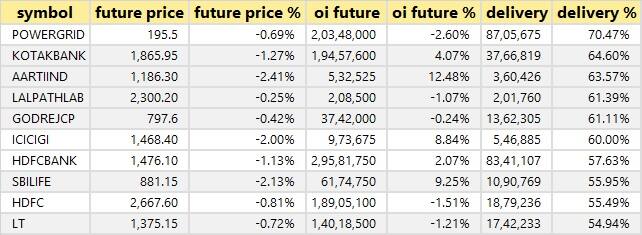

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

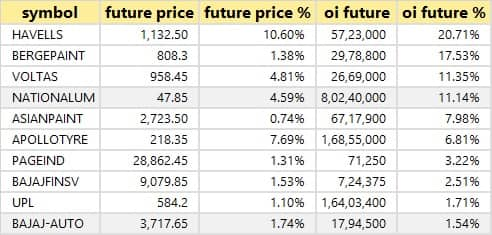

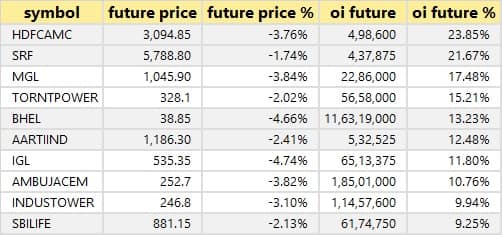

11 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

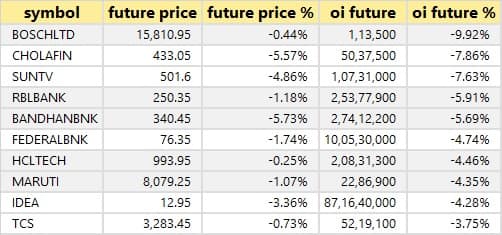

56 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

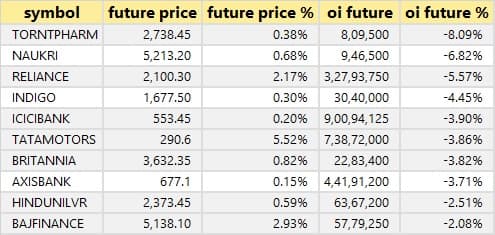

63 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

13 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

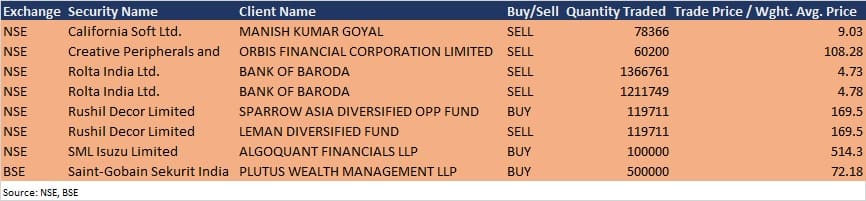

Bulk deals

(For more bulk deals, click here)

Reliance Industries, Yes Bank, Gland Pharma, HDFC Life Insurance Company, SBI Life Insurance Company, ARSS Infrastructure Projects, Century Textiles, Crompton Greaves Consumer Electricals, Fineotex Chemical, Gujarat Ambuja Exports, Indian Bank, India Grid Trust, JSW Steel, Kopran, Mangalam Organics, Oberoi Realty, Reliance Home Finance, Shiva Cement, Simplex Projects, Symphony and V-Mart Retail were among 41 companies to announce their quarterly earnings on January 22.

Stocks in the news

Indian Energy Exchange: The company reported sharply higher consolidated profit at Rs 58.1 crore in Q3FY21 against Rs 41.7 crore in Q3FY20, revenue jumped to Rs 85.2 crore from Rs 59.7 crore YoY.

South Indian Bank: The company reported loss at Rs 91.6 crore in Q3FY21 against profit of Rs 90.4 crore in Q3FY20, net interest income fell to Rs 596.4 crore from Rs 601.8 crore YoY.

JK Tyre: The company reported sharply higher consolidated profit at Rs 230.7 crore in Q3FY21 against Rs 108.9 crore in Q3FY20, revenue rose to Rs 2,769.3 crore from Rs 2,274.8 crore YoY.

HDFC Bank: Sebi imposed Rs 1 crore penalty on HDFC Bank for non-compliance with an interim order.

SRF: The company has reported profit at Rs 324.7 crore in Q3FY21 against Rs 343 crore in Q3FY20; revenue jumped to Rs 2,146.4 crore from Rs 1,850.5 crore YoY.

Cyient: The company has reported a higher profit at Rs 95.4 crore in Q3FY21 against Rs 83.9 crore in Q2FY21; revenue rose to Rs 1,044.3 crore from Rs 1,003.3 crore QoQ.

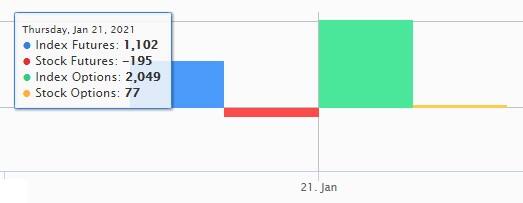

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,614.66 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,039.48 crore in the Indian equity market on January 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Vodafone Idea, SAIL and Sun TV Network - are under the F&O ban for January 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."