As the adage goes, "Patience is a virtue"; after waiting months, investors in the Franklin Templeton Mutual Fund's (FTMF) six debt schemes that were wound up last year finally have reason to be optimistic.

As stipulated by the courts, FTMF recently conducted a three-day voting process between December 26 and December 29 to seek investors consent to wind up these schemes. Consent by simple majority was necessary to allow the mutual fund house to proceed with the winding up process of the schemes in an orderly manner.

The result of the e-voting process, made public yesterday by the Supreme Court, revealed that an overwhelming majority of more than 90% unitholders in each of the six schemes voted in favour of winding up. This can be seen as a positive sign. It will now pave the way for the mutual fund house to initiate the steps to monetise the assets.

Notably, it was feared that if the fund house did not receive the consent, the schemes would have to be reopened, which could have resulted in a high volume of redemption requests. The fund house had forewarned unitholders that it may have to undertake distressed sale of assets to meet the redemptions request, which would result in a reduction in the net asset value (NAV) of the schemes and substantial losses for the unitholders.

--- Advertisement ---

These 3 Stocks are the Dark Horses of the Stock Market

The mainstream media mostly ignores them.

Mutual funds and hedge funds can't buy them in bulk.

Stock brokers rarely cover them.

These stocks are the dark horses of the stock market.

They only come in limelight after they have rallied by hundreads of even thousands of percent.

Our head of smallcap research, Richa Agarwal, has a knack for identifying such stocks before they begin their rally.

Over the years, she has spotted such stocks which have gone on to offer triple and even quadruple digit gains for investors.

(* Past performance is no guarantee of future results)

Today, when the markets are near all-time high... and some investors are thinking of booking profits... Richa has spotted 3 such stocks which are set for a massive rally.

She will reveal the details of these 3 stocks on 28th January at her free online summit.

Click here to sign-up instantly. It's free.

------------------------------

It could have also resulted in a disproportionate distribution of any cash generated to unitholders depending on the time of redemption. Furthermore, there could have been a longer delay in the recovery timeline for unitholders.

Now that the distressed sale of assets can be ruled out, FTMF will start the winding up process for these six schemes in an orderly manner and repay unitholders.

The next Supreme Court hearing is scheduled for January 25 where the court will decide on how the funds should be repaid.

FTMF in a press release said, "We are thankful to our unitholders for voting overwhelmingly in favour of the orderly winding up in all six schemes. We hope to commence distribution of investment proceeds at the earliest, subject to the directions of the Supreme Court in the next hearing."

It is expected that there will another round of voting to appoint a liquidator. After this, the liquidator will start the monetisation of assets to fetch the best value for the underlying securities of respective schemes which can then be returned to the unitholders. The process of appointment and initiation of asset monetisation could take a couple of weeks.

BREAKING: Full Details of the #1 Investment of the Decade...

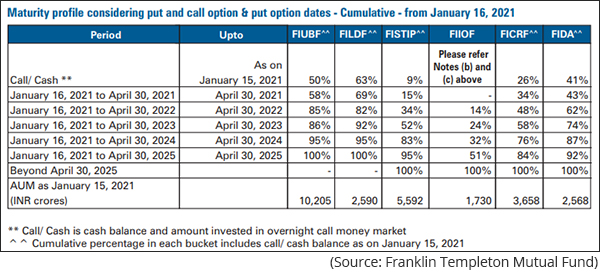

As per the latest update from FTMF, the six wound-up schemes have received Rs 13,789 crore so far (till January 15, 2021) from maturities, pre-payments, and coupons.

Five out of the six schemes have now turned positive, these are Franklin India Ultra Short Bond Fund (FIUBF), Franklin India Dynamic Accrual Fund (FIDA), Franklin India Low Duration Fund (FILDF), Franklin India Credit Risk Fund (FICRF), and Franklin India Short Term Income Plan (FISTIP). Moreover, the borrowing level in Franklin India Income Opportunities Fund (FIIOF) has reduced.

FTMF has stated that close to Rs 9,190 crore is available for distribution to unitholders. The expected timeline of the pay-out from these six schemes is as follows:

Since the debt market conditions have improved substantially after facing illiquidity amid the pandemic, it will be possible for the fund house to derive maximum value from the underlying securities of the schemes. Fortunately, unitholders are likely to receive most of their money back.

--- Advertisement ---

Top 3 Stocks for 2020 and Beyond

We've uncovered 3 high-potential tech stocks after years of research.

These 3 cutting edge tech stocks could potentially create a wave of Indian millionaires.

First one is present in the sector which is expected to GROW over 300 times by 2030.

Second one is one of the leading players in Artificial Intelligence technology.

And the third one is involved in putting up a global safety net to save the world from cyber criminals.

These 3 tech stocks have the potential to offer life-changing gains in the long run.

Click here to get the details...

------------------------------

Editor's note: If you are looking for ready-to-invest debt mutual fund strategies, I suggest subscribing to PersonalFN's FundSelect Plus --a premium mutual fund research service that has a proven track record of 13 years to its credit.

As a FundSelect Plus subscriber, you will get access to 7 ready-to-invest premium mutual fund solutions with high-performance potential that caters to both equity and debt investors.

FundSelect Plus is a perfectly suitable unbiased research service for all mutual fund investors who can't spare time to do thorough research required to shortlist schemes or don't have the expertise to understand the nitty-gritty of mutual fund research. Subscribe now!

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

The BSE Sensex is trading at its all-time high of 49,793 (up 0.8%). Among the top gainers in the BSE Sensex today are TECH MAHINDRA. In the meantime, the NSE Nifty is trading at 14,644 (up 0.8%).

Turning Rs 1 lakh into Rs 14 lakh is not impossible.

In this video, I'll tell you if we are in a correction or not and update you on our latest trade recommendation.

The masses expect the government to do a lot more as regards healthcare and education infrastructure, plus place more income in their hands by way of tax reforms and reliefs.

Has the Indian stock market moved to a permanently high price to earnings ratio?

More Views on NewsThe smallcap rally has enough steam left in it. If you haven't joined yet, it is still not too late.

The charts are telling the bulls to be cautious.

Were you shocked that bullion prices hit lower circuits on Friday on the MCX? Find out why it happened...

Jan 11, 2021Our ace stock picker is ready to capitalise on a big growth opportunity.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!