The stock market, after rangebound movement with a weak bias, tried to recover losses in the afternoon session on January 18, but failed in the attempt and corrected sharply in the last hour of trade. All sectoral indices were caught in the bear trap.

The benchmark indices fell for a second consecutive session with the BSE Sensex declining 470.40 points or 0.96 percent to 48,564.27, while the Nifty50 dipped 152.40 points or 1.06 percent to 14,281.30 and formed a bearish candle on the daily charts.

"This follow-through weakness pattern has been formed for first time on Monday, nearly after two months (as per daily chart). Hence, one needs to be cautious about crucial trend reversal in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The sharp back-to-back declines (Friday and Monday) seems to have changed the sentiment of the market. A move below 14,125 could confirm the reversal pattern and that is likely to trigger more weakness in the short term," he said.

"Any attempt of upside bounce towards 14,400-14,450 could run into resistance in the short term. Confirmation of reversal could open immediate downside target of 13,700 for the coming weeks," he added.

The broader markets also corrected sharply for the second day in a row, with the Nifty Midcap index falling 2.12 percent and Smallcap down 1.77 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,183, followed by 14,084.7. If the index moves up, the key resistance levels to watch out for are 14,419.4 and 14,557.5.

Nifty Bank

The Nifty Bank dropped 435 points or 1.35 percent to close at 31,811.80 on January 18. The important pivot level, which will act as crucial support for the index is placed at 31,494.64, followed by 31,177.47. On the upside, key resistance levels are placed at 32,285.24 and 32,758.67.

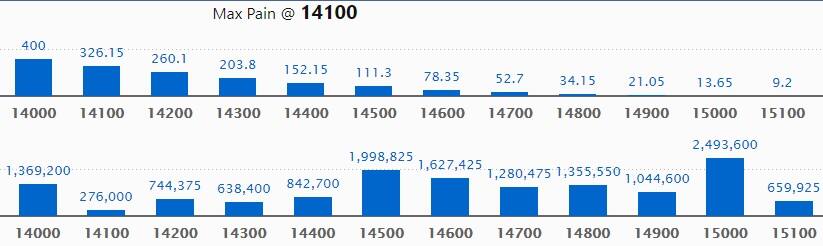

Call option data

Maximum Call open interest of 24.93 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,500 strike, which holds 19.98 lakh contracts, and 14,600 strike, which has accumulated 16.27 lakh contracts.

Call writing was seen at 14,500 strike, which added 3.17 lakh contracts, followed by 14,400 strike which added 2.05 lakh contracts and 14,300 strike which added 1.79 lakh contracts.

Call unwinding was seen at 13,900 strike, which shed 27,075 contracts, followed by 14,100 strike which shed 13,200 contracts and 13,500 strike which shed 10,725 contracts.

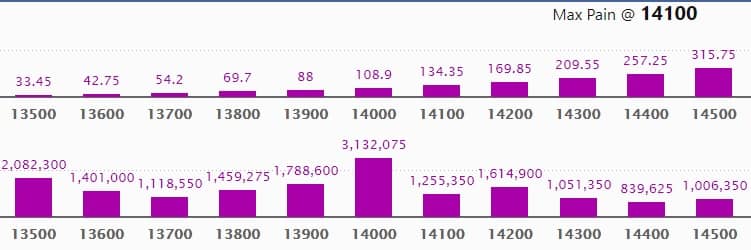

Put option data

Maximum Put open interest of 31.32 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 20.82 lakh contracts, and 13,900 strike, which has accumulated 17.88 lakh contracts.

Put writing was seen at 14,100 strike, which added 2.9 lakh contracts, followed by 13,600 strike, which added 1.48 lakh contracts and 13,800 strike which added 1.47 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 2.44 lakh contracts, followed by 15,000 strike, which shed 1.04 lakh contracts and 14,400 strike which shed 1.01 lakh contracts.

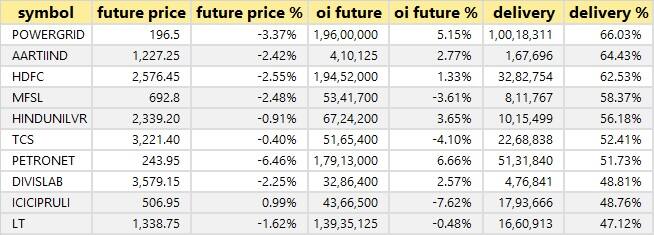

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

6 stocks saw long build-up

Based on the open interest future percentage, here are the 6 stocks in which a long build-up was seen.

71 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

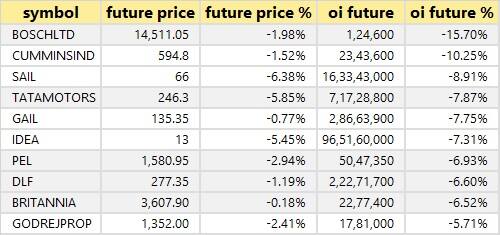

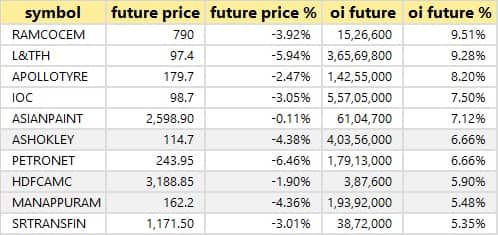

58 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

7 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 7 stocks in which short-covering was seen.

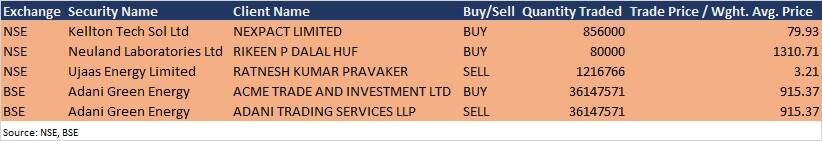

Bulk deals

(For more bulk deals, click here)

ICICI Lombard General Insurance Company, Alembic Pharmaceuticals, Ceat, CSB Bank, DCM Shriram, L&T Infotech, Skipper, Tata Communications, Tata Metaliks, Tata Steel Bsl, Gateway Distriparks, Hatsun Agro Product, HT Media, JSW Ispat Special Products, Bank of Maharashtra, Mold-Tek Packaging, Network18 Media & Investments, Roselabs Finance, TV18 Broadcast, Vardhman Special Steels, Raghav Productivity Enhancers, Shree Ganesh Biotech, Wardwizard Innovations & Mobility, Add-Shop ERetail, AVI Polymers and Bigbloc Construction will announce their quarterly earnings on January 19.

Stocks in the news

Mindtree: The company has reported a sharply higher profit at Rs 326.5 crore in Q3FY21 against Rs 253.7 crore, while revenue rose to Rs 2,023.7 crore from Rs 1,926 crore QoQ.

Maruti Suzuki: The company increased prices by up to Rs 34,000 ex showroom in Delhi, effective from January 18.

Cholamandalam Investment: Arun Alagappan tendered his resignation as MD and Director of the company.

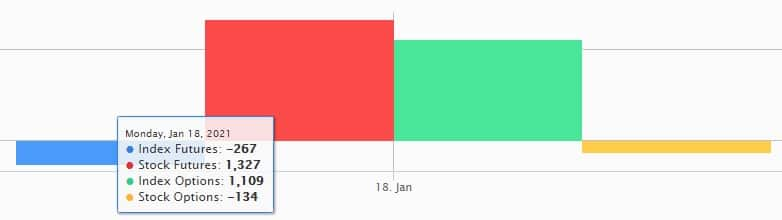

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 650.6 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 42.51 crore in the Indian equity market on January 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - BHEL, Vodafone Idea and SAIL - are under the F&O ban for January 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.