The year 2021 has begun on a high note on the news of COVID-19 vaccine rollout. The event holds great importance as it is expected to bring the sagging economy back on the growth track. As a result, the equity market has soared to all-time highs.

However, with looming challenges of COVID-19 and the economic uncertainty, correction from the current levels cannot be ruled out, because valuation-wise markets have run much ahead of fundamentals.

If you are planning to invest in equity mutual funds buoyed by the recent rally, ensure that you set realistic post-tax return expectations from your investment portfolio. More importantly, stick to your personalized asset allocation plan.

Large and Mid Cap Funds can help you maintain portfolio stability with significant exposure to largecaps, while keeping a focus on wealth creation with a sizable exposure to midcaps, as well as small allocation to small caps.

Mirae Asset Emerging Bluechip Fund (MAEBF) is one such large and mid cap fund, that has been clearly distinct from its peers and has rewarded investors well, without taking unnecessary risk.

--- Advertisement ---

These 3 Stocks are the Dark Horses of the Stock Market

The mainstream media mostly ignores them.

Mutual funds and hedge funds can't buy them in bulk.

Stock brokers rarely cover them.

These stocks are the dark horses of the stock market.

They only come in limelight after they have rallied by hundreads of even thousands of percent.

Our head of smallcap research, Richa Agarwal, has a knack for identifying such stocks before they begin their rally.

Over the years, she has spotted such stocks which have gone on to offer triple and even quadruple digit gains for investors.

(* Past performance is no guarantee of future results)

Today, when the markets are near all-time high... and some investors are thinking of booking profits... Richa has spotted 3 such stocks which are set for a massive rally.

She will reveal the details of these 3 stocks on 28th January at her free online summit.

Click here to sign-up instantly. It's free.

------------------------------

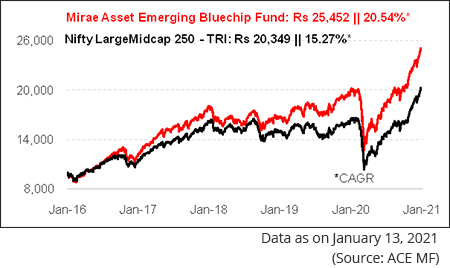

MAEBF is a top performing fund in the large and midcap space that has witnessed a massive growth in its asset size. In order to put a check on capacity, the fund house suspended lump sum investments in the scheme and restricted fresh investments via SIP. The fund has built a superior track record in a short span of time and has been successful in delivering superior returns across market cycles. The superior investment process and stock picking ability has driven the performance of the fund. An investment of Rs 10,000 in the fund five years ago would now have appreciated to Rs 25,452, thus generating an alpha of around 5 percentage point compound annual growth rate (CAGR) over the benchmark. In the recent corrective phase, it has been among the top performers. The well-constructed portfolio has ensured that risk is kept well within limits, without compromising on long-term wealth creation.

BREAKING: Full Details of the #1 Investment of the Decade...

| Scheme Name | Corpus (Cr.) | 1 Year (%) | 2 Year (%) | 3 Year (%) | 5 Year (%) | 7 Year (%) | Std Dev | Sharpe |

|---|---|---|---|---|---|---|---|---|

| Mirae Asset Emerging Bluechip | 12,921 | 28.16 | 23.44 | 12.24 | 20.52 | 26.71 | 23.13 | 0.104 |

| Edelweiss Large & Mid Cap Fund | 564 | 23.37 | 18.38 | 10.51 | 15.20 | 16.78 | 20.93 | 0.088 |

| Invesco India Growth Opp Fund | 3,207 | 18.95 | 16.80 | 10.40 | 16.44 | 17.69 | 20.91 | 0.081 |

| Kotak Equity Opp Fund | 4,186 | 20.87 | 19.01 | 10.27 | 16.54 | 18.33 | 21.91 | 0.083 |

| Canara Rob Emerg Equities Fund | 6,616 | 28.83 | 20.09 | 9.41 | 17.32 | 25.15 | 22.50 | 0.071 |

| Tata Large & Mid Cap Fund | 1,785 | 17.40 | 17.44 | 9.26 | 13.71 | 16.72 | 21.64 | 0.073 |

| Quant Large & Mid Cap Fund | 6 | 34.88 | 18.25 | 8.66 | 15.67 | 21.11 | 21.55 | 0.046 |

| LIC MF Large & Midcap Fund | 842 | 18.26 | 17.33 | 8.51 | 17.01 | 0.00 | 21.14 | 0.065 |

| Sundaram Large and Mid Cap Fund | 1,320 | 13.06 | 13.36 | 8.41 | 14.57 | 17.24 | 23.22 | 0.063 |

| DSP Equity Opportunities Fund | 5,212 | 20.38 | 17.82 | 7.82 | 15.77 | 17.68 | 22.98 | 0.046 |

| Nifty LargeMidcap 250 Index - TRI | 24.76 | 16.5 | 7.89 | 15.25 | 17.3 | 23.7 | 0.059 |

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

MAEBF has constantly made it to the list of top quartile performers. Its outperformance and the ability to generate alpha is clearly visible across time periods considered. The fund has managed to outperform the benchmark as well as most of its peers by a significant margin of around 5-7 percentage points CAGR. MAEBF has not only managed to deliver massive returns in the bull phases, but has considerably restricted losses in the bear phases.

In terms of MAEBF's volatility (standard deviation) is competitive to its peers and the benchmark, but it more than compensates its investors in the form of superior risk-adjusted returns. The Sharpe ratio of the fund is commendable, and is the highest in the category.

--- Advertisement ---

Top 3 Stocks for 2020 and Beyond

We've uncovered 3 high-potential tech stocks after years of research.

These 3 cutting edge tech stocks could potentially create a wave of Indian millionaires.

First one is present in the sector which is expected to GROW over 300 times by 2030.

Second one is one of the leading players in Artificial Intelligence technology.

And the third one is involved in putting up a global safety net to save the world from cyber criminals.

These 3 tech stocks have the potential to offer life-changing gains in the long run.

Click here to get the details...

------------------------------

In the past, MAEBF was a mid-cap biased fund which held significant allocation to large cap stocks. It is now mandated to minimum invest 35% to 65% of its assets each in stocks of midcap companies largecap companies. While under the new mandate MAEBF started with 50:50 allocations to largecaps and midcap stocks, its allocation has gradually inclined more towards large caps (about 55%). The funds flexibility to invest in larger midcap stocks and large caps provides additional stability to the fund, during extreme market conditions.

While picking stocks for the portfolio, MAEBF aims to hold a well-diversified portfolio without having any bias towards any particular theme, sector or style. Following a mix of the top-down and bottom-up approach to investing, the fund management broadly analyses the macro economy and invest in stocks of high-growth companies likely to benefit from macroeconomic, sectoral and industry trends.

The fund manager looks for long-term investment opportunities in stocks of high quality businesses that are available at reasonable prices and follows buy and hold investment strategy until its full potential is derived. Notably, the turnover ratio of the fund has ranged between 65% and 100%.

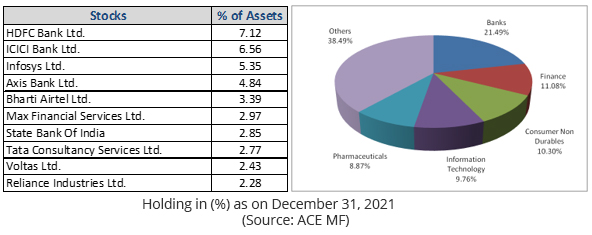

As on December 31, 2020, MAEBF held a well-diversified portfolio of around 60 stocks spread across market capitalization, with some largecap names like HDFC Bank, ICICI Bank, Infosys, Axis Bank, and Bharti Airtel etc. appearing among its top holdings. Some of these stocks have been in the portfolio for well over 2 years now. The top 10 stocks in the portfolio together accounted for around 40.6% of the total assets. The fund's portfolio is not skewed to a set of stocks.

Largecap names like Infosys, Tata Consumer Products, Ipca Laboratories, Reliance Industries, HDFC Bank, TCS contributed majorly to the fund's gain in the last one year, while it also benefitted from midcap names like Mindtree, Balkrishna Industries, Ajanta Pharma, Dr Lal Pathlabs, SRF, Natco Pharma, Voltas, etc.

While MAEBF's portfolio is majorly allocated towards cyclicals, it is fairly spread across defensive and sensitive sectors as well. Banks dominate MAEBF's portfolio with an allocation of 21.5% along with Finance stocks that account for another 11.1% in the portfolio. Consumption, Infotech, Pharma, Petroleum, Auto, Engineering, and Consumer Durables are the other major sectors in the fund's portfolio with an allocation in the range of 4-10%.

MAEBF is a process driven fund that has been agile enough to take advantage of various investment opportunities present in the midcap as well as large cap segment. The fund has a stable fund manager who has been at the helm since the inception of the fund.

MAEBF aims to invest in growth-oriented stocks but at right valuations. The fund adopts well-balanced approach to investing and avoids resorting to aggressive calls. It holds well-balanced allocation across market caps i.e. large-caps and mid-caps along with some allocation to small caps. The flexibility to shift allocation across market caps helps the fund tide over volatile market conditions, and even benefit during broader market rallies.

The aggressive investment mandate along with higher allocation to midcaps makes MAEBF suitable for investors having higher risk appetite and a long term investment horizon.

PS: PersonalFN has completed 20 years of unbiased research service and we want to celebrate it with our loyal readers and subscribers like yourself. Get PersonalFN's premium mutual fund research service 'FundSelect Plus' in this exclusive anniversary offer. As a FundSelect Plus subscriber, you will get access to 7 ready-to-invest premium mutual fund solutions with high performance potential. Subscribe now!

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

The pandemic failed to thwart Richa's investing success formula for 2020.

In this video, I'll tell you my top ETFs for investing in the Nifty, Sensex, and Bank Nifty.

PersonalFN analyses the features of Kotak Nasdaq 100 Fund of Fund and explains the potential this fund has to offer to its investors.

Here's why I believe there is a lot more steam is left in the smallcap rally.

In this video, I'll cover a new development that could affect our short sell trade in natural gas.

More Views on NewsMy new guide will show you the huge potential in future proof businesses.

The smallcap rally has enough steam left in it. If you haven't joined yet, it is still not too late.

The charts are telling the bulls to be cautious.

Were you shocked that bullion prices hit lower circuits on Friday on the MCX? Find out why it happened...

Ajit Dayal on the investing strategy for 2021 and beyond.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!