The pandemic crisis has ignited a big shift in consumer trends as well as the way organizations work. For many of us, cloud computing, remote working, electronic payments, machine learning, over the top (OTT) streaming, among other technological trends, have become an integral part of the 'new normal'. This shift in trend is expected to persist even in the post-pandemic world.

Consequently, shares of Tech companies have been steadily on the rise. The Nasdaq 100 Index --the world's major largecap index--constitutes some of these well-known names in technology that are shaping the future.

To give domestic investors an opportunity to invest and benefit from the growth of these Tech giants, Kotak MF has launched Kotak Nasdaq 100 Fund of Fund. The AMC is of the view that the Nasdaq 100 index has a low correlation with the domestic bellwether indices such as Nifty 50 and Nifty 500; and therefore, investors can benefit from this diversification.

--- Advertisement ---

The Smallcap Revival Summit

Join us on the evening of 28th January to learn,

• Why despite rallying over 100% since March-2020 lows... small-cap stocks are set for a massive rally over the coming months and years

• Details of our top 3 stocks to capture potentially huge gains from this upcoming small-cap rally

• And how to spot opportunities, even in the current market, with potential to generate 200%, 400%, and even 900% long-term gains

Plus there is a lot more that we are going to cover.

The summit is free to attend for Equitymaster readers.

But since there are limited seats, we would recommend you to register at the earliest.

Click here to register in 1-click. It's free.

------------------------------

As a Fund of fund, Kotak Nasdaq 100 Fund of Fund has a mandate to invest a minimum 95% of its assets in units of overseas ETFs and/or Index Fund based on NASDAQ 100 Index. The performance benchmark index of the fund is Nasdaq 100 Total Returns Index.

Kotak Nasdaq 100 Fund of Fund is an open-ended fund of fund that will seek to track the performance of overseas ETFs and/or Index Fund based on NASDAQ 100 Index. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

| Type | An Open ended fund of fund investing in units of overseas ETFs and/or Index Fund based on NASDAQ 100 Index | Category | Fund of Fund (Overseas) |

|---|---|---|---|

| Investment Objective | To generate long-term capital appreciation by investing in units of overseas ETFs and/ or Index Fund based on NASDAQ 100 Index. However, there can be no assurance that the investment objective of the Scheme will be achieved. | ||

| Min. Investment | Rs 5,000 and in multiples of Re 1 thereafter | Face Value | Rs 10/- per unit |

| Plans |

|

Options |

|

| Entry Load | Not Applicable | Exit Load | Nil |

| Fund Manager | - Mr Arjun Khanna - Mr Abhishek Bisen |

Benchmark Index | Nasdaq 100 (Total Returns Index) |

| Issue Opens: | January 11, 2021 | Issue Closes: | January 25, 2021 |

Kotak Nasdaq 100 FoF will invest predominantly in units of overseas ETFs and/or index funds based on Nasdaq 100 Index. The scheme will follow a passive investment strategy, i.e. it will not attempt to apply any economic, financial, or market analysis on the underlying index.

BREAKING: Full Details of the #1 Investment of the Decade...

Here is the indicative list of overseas ETFs and/or Index Fund based on NASDAQ 100 Index:

Or a similar overseas ETF/ and/or Index Fund based on the NASDAQ 100 Index.

Apart from investment in Units of overseas ETFs and/or Index Fund based on NASDAQ 100 Index, the scheme will invest up to 5% of its assets in units of Liquid/ debt schemes, debt, and money market instruments to meet its liquidity requirement.

Under normal circumstances, the fund's asset allocation pattern will be as under:

| Instruments | Indicative Allocation (% of assets) |

Risk Profile High/Medium/Low |

|

|---|---|---|---|

| Minimum | Maximum | ||

| Units of overseas ETF's and/or Index Fund based on NASDAQ 100 Index | 95 | 100 | High |

| Debt schemes, Debt & Money Market Instruments, including Tri Party Repo^, G-Secs, Cash and Cash at call, etc. | 0 | 5 | Low to Medium |

^or similar instruments as may be permitted by RBI/SEBI

--- Advertisement ---

Top 3 Stocks for 2020 and Beyond

We've uncovered 3 high-potential tech stocks after years of research.

These 3 cutting edge tech stocks could potentially create a wave of Indian millionaires.

First one is present in the sector which is expected to GROW over 300 times by 2030.

Second one is one of the leading players in Artificial Intelligence technology.

And the third one is involved in putting up a global safety net to save the world from cyber criminals.

These 3 tech stocks have the potential to offer life-changing gains in the long run.

Click here to get the details...

------------------------------

The Nasdaq-100 is one of the world's pre-eminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Nasdaq 100 is home to some of the most well-known names in technology, including Apple, Microsoft, Alphabet, Intel, Amazon, and Facebook. The index also includes category-defining companies on the forefront of innovation in other key industries such as Moderna, Starbucks, and Tesla.

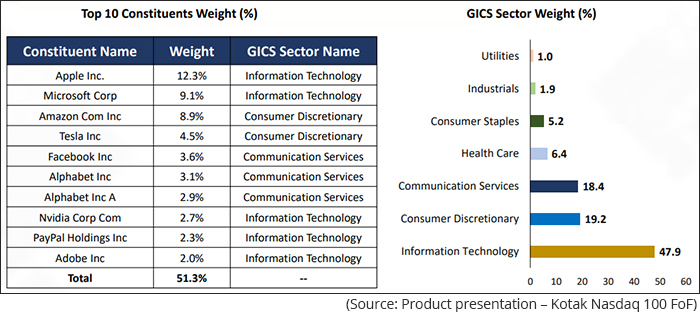

The composition of the index as on December 31, 2020 is as follows:

Mr Arjun Khanna will be the dedicated fund manager for Kotak Nasdaq 100 FoF; Mr Abhishek Bisen will be fund manager for debt securities of the scheme.

Mr Arjun Khanna is the dedicated fund manager for investments in foreign securities in various schemes at Kotak AMC. He has over 13 years of experience, out of which 12 years has been with Mutual Funds in Equity Research. Prior to joining Kotak Mahindra Mutual Fund, he was associated with Principal Mutual Funds. He has also worked at Citibank N.A. in an earlier stint. His qualifications include CFA, FRM, MMS (Finance), and B.E (Electronics).

He currently manages Kotak Global Emerging Market Fund, Kotak Asset Allocator Fund, Kotak Pioneer Fund, and Kotak International REIT FoF.

Mr Abhishek Bisen is Senior Vice President - Debt at Kotak AMC. He has been associated with the company since October 2006 and his key responsibilities include fund management of debt schemes. Prior to joining Kotak AMC, he worked with Securities Trading Corporation of India Ltd where he was tasked with Sales & Trading of Fixed Income Products apart from doing Portfolio Advisory. His earlier assignments also include 2 years of merchant banking experience with a leading merchant banking firm.

He currently manages Kotak Bond Fund, Kotak Gilt Investment (Regular & PF-Trust), Kotak Balanced Advantage Fund, Kotak Equity Savings Fund, Kotak Equity Hybrid Fund, Kotak Debt Hybrid Fund, Kotak Gold Fund and Kotak Gold ETF.

Even as India is striving to regain normalization, some of the changes we have adopted amid the pandemic could continue as the norm going forward. This includes increasing use of digital payments, cloud storage, online movie streaming, etc.

The companies at the forefront of such growth and innovation can create significant value for its investors. But since these companies are not listed in India, investing in International funds allows investors to tap opportunities abroad and diversify the portfolio geographically.

Kotak Nasdaq 100 FoF is one such fund that provides investors the opportunity to potentially benefit from the growth. The fund's performance will depend on the performance of overseas ETFs and/or Index Fund that invest in NASDAQ 100 Index.

Keep in mind that while there are advantages to investing in International Funds, the fortune of the scheme would be closely linked to how the underlying companies in those economies fare, the overall economic scenario, political scenario, and will be subject to exchange rate fluctuation risk.

Therefore, before you decide to invest in Kotak Nasdaq 100 FoF, ensure that your portfolio has a well-diversified exposure to domestic equities. Besides this, consider its suitability after assessing your risk appetite, investment horizon, and financial goals.

PS: PersonalFN has completed 20 years of unbiased research service and we want to celebrate it with our loyal readers and subscribers like yourself. Get PersonalFN's premium mutual fund research service 'FundSelect Plus' in this exclusive anniversary offer. As a FundSelect Plus subscriber, you will get access to 7 ready-to-invest premium mutual fund solutions with high performance potential. Subscribe now!

Author: Divya Grover

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

Here's why I believe there is a lot more steam is left in the smallcap rally.

In this video, I'll cover a new development that could affect our short sell trade in natural gas.

PersonalFN explains the outlook for midcap funds and the best midcap funds that can be considered for investment in 2021.

The pandemic failed to thwart Richa's investing success formula for 2020.

The budget is just a few weeks away. Which stocks can you expect to move? Find out in this video.

More Views on NewsMy view on the one sector I'm bullish on in 2021.

This stock has a very high chance of rerating once the temporary clouds of uncertainty disperse.

My new guide will show you the huge potential in future proof businesses.

The charts are telling the bulls to be cautious.

Ajit Dayal on the investing strategy for 2021 and beyond.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!