The market rallied to fresh record high levels in the early session on January 13 but slipped into the negative territory in the late morning deals. Later, it recouped losses to settle flat but failed to hold on to early record high levels.

Select banks, auto, and FMCG stocks helped the Nifty50 end flat with a positive bias, but financials, HDFC group, select pharma stocks, and Reliance Industries weighed on the sentiment.

The BSE Sensex was down 24.79 points at 49,492.32, while the Nifty50 rose 1.40 points to 14,564.90 and formed a bearish candle which resembles the Hanging Man kind of pattern on the daily charts.

"A long negative candle was formed with lower shadow on the daily chart. Though this pattern indicates high volatility in the market, still there is no formation of any reversal in Nifty at the highs. Hence, one may expect further upside with range move in the coming sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Upper levels of 14,655 is going to be a short term resistance and on the lower side, 14,450 is expected to be an immediate support for the market," he said.

The overall market breadth has turned negative, with advance-decline ratio closing at 634:1,258 and neutral at 82. The negative market breadth was mainly due to the weakness in the broad market indices. The Nifty Midcap 100 index and Smallcap 100 index fell by around 0.60 percent and 0.18 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,449.23, followed by 14,333.67. If the index moves up, the key resistance levels to watch out for are 14,666.83 and 14,768.87.

Nifty Bank

The Nifty Bank continued to outperform Nifty50 on January 13, rising 235.70 points to 32,574.70. The important pivot level, which will act as crucial support for the index, is placed at 32,254.1, followed by 31,933.5. On the upside, key resistance levels are placed at 32,789.4 and 33,004.1.

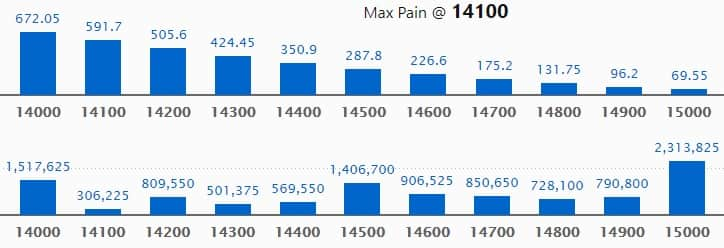

Call option data

Maximum Call open interest of 23.13 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,000 strike, which holds 15.17 lakh contracts, and 14,500 strike, which has accumulated 14.06 lakh contracts.

Call writing was seen at 15,000 strike, which added 2.29 lakh contracts, followed by 14,900 strike which added 1.82 lakh contracts and 14,600 strike which added 1.57 lakh contracts.

Call unwinding was seen at 14,000 strike, which shed 1.16 lakh contracts, followed by 14,400 strike which shed 1.08 lakh contracts and 14,300 strike which shed 92,925 contracts.

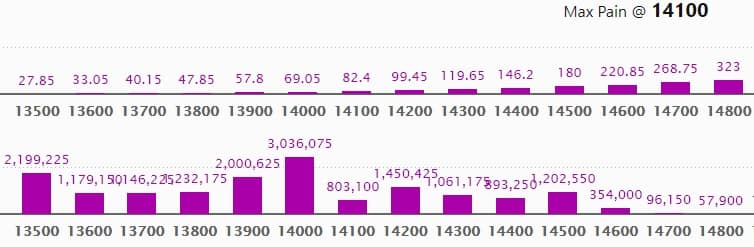

Put option data

Maximum Put open interest of 30.36 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the January series.

This is followed by 13,500 strike, which holds 21.99 lakh contracts, and 13,900 strike, which has accumulated 20 lakh contracts.

Put writing was seen at 14,100 strike, which added 1.52 lakh contracts, followed by 14,600 strike, which added 1.23 lakh contracts and 14,300 strike which added 1.18 lakh contracts.

Put unwinding was seen at 13,600 strike, which shed 2.49 lakh contracts, followed by 14,200 strike, which shed 70,200 contracts.

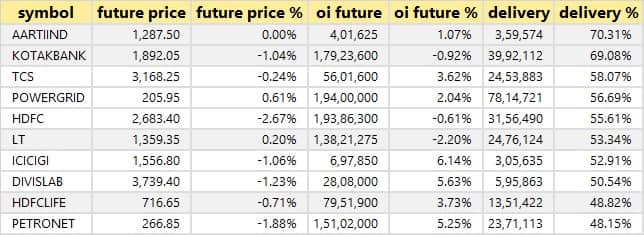

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

25 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

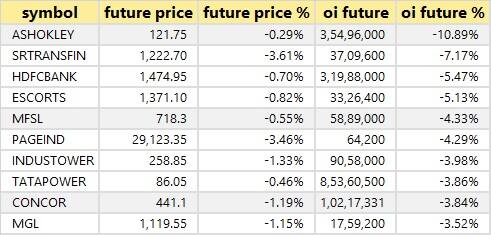

38 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

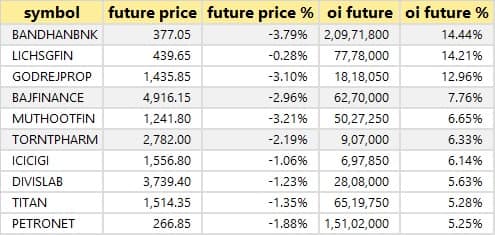

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

31 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Den Networks, HFCL, Reliance Industrial Infrastructure, Tata Steel Long Products, Websol Energy System and Digicontent will announce their quarterly earnings on January 14.

Stocks in the news

Infosys: The company reported a 7.3% rise in profit at Rs 5,197 crore in Q3FY21 against Rs 4,845 crore in Q2FY21, revenue rose 5.5% to Rs 25,927 crore from Rs 24,570 crore QoQ. The company raised FY21 constant currency revenue growth guidance to 4.5-5% from 2-3% earlier and margin guidance to 24-24.5% from 23-24% earlier.

Wipro: IT services dollar revenue rose 3.9% to $2,071 million in Q3FY21 from $1,992.4 million Q2FY21, the growth is the highest in 36 quarters. The company sees Q4 dollar revenue growth at 1.5-3.5% over Q3.

SAIL: The government will sell up to a 10% stake in the company via offer for sale on January 14-15 and the offer price has been fixed at Rs 64 per share.

IndusInd Bank: SEBI has granted bank's promoters extension until February 18 on warrant subscription, according to a CNBC-TV18 report.

Indian Bank: The bank has raised Rs 2,000 crore via bonds at a 6.18% Coupon rate.

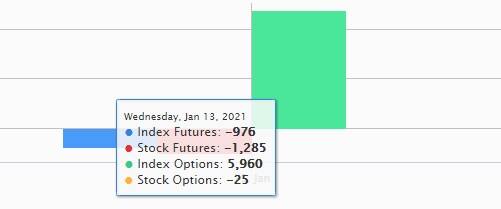

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,879.06 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,370.17 crore in the Indian equity market on January 13, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and SAIL - are under the F&O ban for January 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.