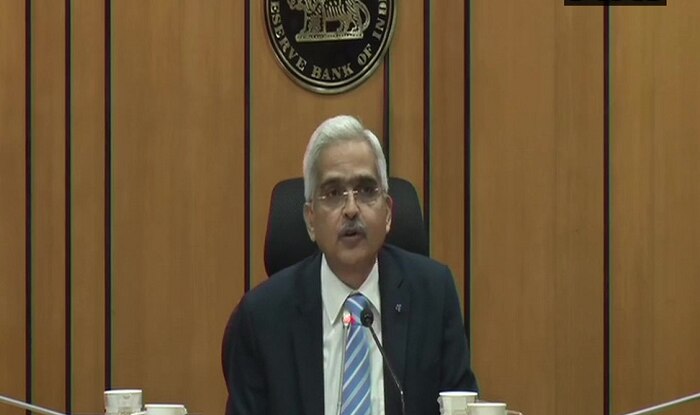

New Delhi: The Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday said the COVID-19 pandemic can result in balance sheet impairments, capital shortfalls, as regulatory reliefs are rolled back.

Maintaining banking sector’s health remains a policy priority, the RBI governor said in his foreword to the bi-annual Financial Stability Report.

Adding that available accounting numbers obscure true recognition of stress at banks, Das said lenders should raise capital, alter business models.

Expansion in government’s market borrowing programme following COVID-19 has imposed additional pressures on banks, he said.

Stretched valuations of financial assets pose risks to financial stability; banks, financial intermediaries need to be cognisant of it, he added.

“We’ve been scarred by the pandemic, the task ahead is to restore economic growth and livelihood,” Das said while expressing concern.

The RBI Financial Stability Report shows that Gross NPA of banks may rise to 13.5 per cent by September 2021 from 7.5 per cent a year ago.

(With inputs from PTI)