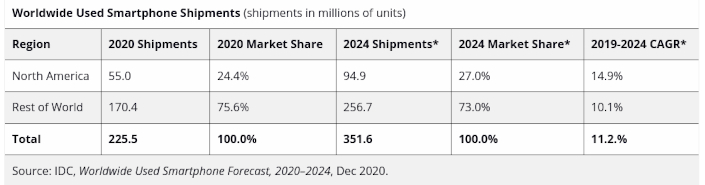

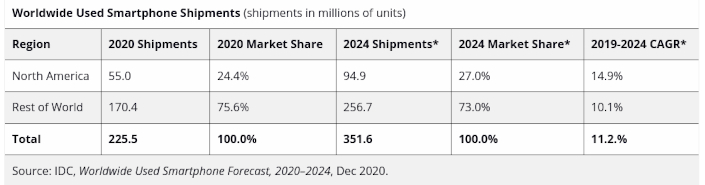

Worldwide shipments of used smartphones — both officially refurbished and used models — are predicted to come in at 225.4 million units for the year that just passed, the technology analyst firm IDC Says, adding that this would be an increase of 9.2% over the 206.5 million units shipped in 2019.

The company forecast that shipments of this category of devices would grow to 351.6 million units in 2024, with a CAGR of 11.2% from 2019 to 2024.

Most of the growth was seen in markets where trade-ins served as a means for users to upgrade, with many premium flagship models being dependent on this kind of transaction.

IDC said vendors like Apple, Samsung and Huawei had their own trade-in offers which were much more aggressive compared to other channels. Telcos were using bundled plans along with trade-ins to convince users to upgrade.

"In contrast to the recent declines in the new smartphone market, as well as the forecast for minimal growth in new shipments over the next few years, the market for used smartphones shows no signs of slowing down across all parts of the globe," said Anthony Scarsella, research manager with IDC's

Worldwide Quarterly Mobile Phone Tracker.

"Refurbished and used devices continue to provide cost-effective alternatives to both consumers and businesses that are looking to save money when purchasing a smartphone.

"Moreover, the ability for vendors to push more affordable refurbished devices in markets where they normally would not have a presence is helping these players grow their brand as well as their ecosystem of apps, services, and accessories."

Will Stofega, IDC's program director for Mobile Phones, said: "Although the COVID-19 pandemic has posed challenges for secondary market participants around able-bodied workers and logistics, most of the industry has been able to satisfy demand for refurbished smartphones.

"Once the pandemic begins to fade, those that were able to invest in technology will be well-poised to prosper during the recovery."

The research firm defines a refurbished smartphone as "a device that has been used and disposed of at a collection point by its owner. Once the device has been examined and classified as suitable for refurbishment, it is sent off to a facility for reconditioning and is eventually sold via a secondary market channel.

"A refurbished smartphone is not a 'hand-me-down' or gained as the result of a person-to-person sale or trade."

INTRODUCING ITWIRE TV

iTWire TV offers a unique value to the Tech Sector by providing a range of video interviews, news, views and reviews, and also provides the opportunity for vendors to promote your company and your marketing messages.

We work with you to develop the message and conduct the interview or product review in a safe and collaborative way. Unlike other Tech YouTube channels, we create a story around your message and post that on the homepage of ITWire, linking to your message.

In addition, your interview post message can be displayed in up to 7 different post displays on our the iTWire.com site to drive traffic and readers to your video content and downloads. This can be a significant Lead Generation opportunity for your business.

We also provide 3 videos in one recording/sitting if you require so that you have a series of videos to promote to your customers. Your sales team can add your emails to sales collateral and to the footer of their sales and marketing emails.

See the latest in Tech News, Views, Interviews, Reviews, Product Promos and Events. Plus funny videos from our readers and customers.

SEE WHAT'S ON ITWIRE TV NOW!