Is Tesla Close to a Top or Ready to Clear $1,000?

Tesla (TSLA) - Get Report seems to have no quit, currently up more than 7.5% on Friday, while sporting a new all-time high of $884.49.

The rally has taken shares above an $830 billion market cap. Just days ago it hit $700 billion.

The rally here is simply stunning. Nio’s (NIO) - Get Report gains are impressive in the EV space, but no stock tops my view of Tesla given the fact that it’s not all that far from a $1 trillion valuation.

However, the obvious concern here is that the stock has gone far too high, far too fast.

As enjoyable as it has been to watch this one run, I agree with those observations. The higher it goes in the short term, the riskier it becomes when it corrects.

That doesn’t mean, however, that the run in Tesla is about to end. For all we know, a move above $1,000 a share could be brewing. Let’s have a look at the charts.

Trading Tesla

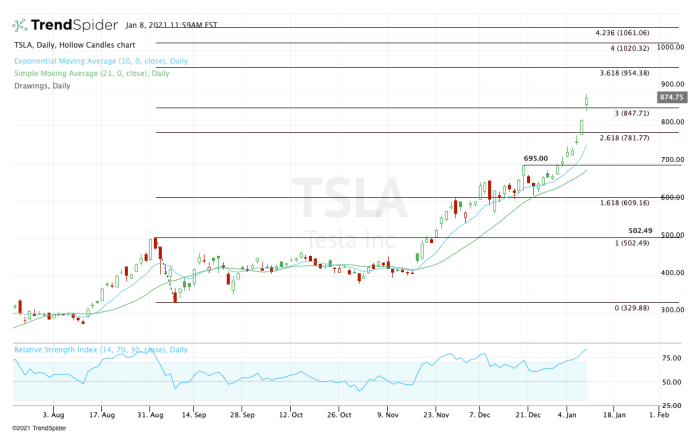

The move is bordering on parabolic. While the stock had a similar move in August, the rally came to an abrupt end and shares consolidated for several months.

That led to a very healthy breakout and a series of smaller dips and breakouts have followed.

At least until Tesla cleared $700 on Dec. 31 — what a fitting way to end the year.

From that session’s close to today’s high, shares are up more than 25%. Tesla has rallied every day so far this year.

The RSI reading at the bottom of the chart measures how overbought or oversold a stock is. That reading is now hitting its high levels since the July and August highs. That alone isn’t reason enough to be bearish, though.

Stocks can rally much further than investors think at the time. Clearing the three-times range now, Tesla stock stock is sniffing for $900.

While on the one hand I consider this move extreme, on the other hand I could see the rally continuing. If that’s the case, simply follow the extensions.

The 361.8% extension comes into play near $955. Above that puts $1,000 in play, followed by the four-times range extension and 423.6% extension near $1,020 and $1,061, respectively.

I would consider that the high end of the range. At least in the short-term.

For what it’s worth, near $1,050 to $1,060, Tesla would be at a market cap of roughly $1 trillion.

On the downside, look how far away the 10-day moving average is, all the way down at $750. Nine sessions have passed since a test of this mark as Tesla works on its 11th straight daily rally.

On a dip, look for Tesla to lose the prior session’s high. That could set up a larger correction to the 10-day moving average, and possibly the 21-day moving average.