The market recouped more than half of losses in the last hour of trade and closed around half a percent lower on January 6, dragged by technology, FMCG and index heavyweights Reliance Industries, ITC and HDFC group stocks.

The BSE Sensex fell 263.72 points to 48,174.06, while the Nifty50 slipped 53.20 points to 14,146.30 and formed a bearish candle which resembles the Hanging Man kind of pattern on the daily charts.

"A reasonable negative candle was formed with lower shadow on the daily chart, besides the positive candle of Tuesday. Technically, this pattern indicates minor profit booking at the new swing highs. Though Nifty declined on Wednesday, the uptrend status of the market remains intact and there is no formation of any significant reversal pattern at the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The Nifty has been sustaining above the immediate support of 10 period EMA for the last 50 sessions, except two days of high volatility (December 21 and 22) as per daily timeframe chart. Presently, this moving average is offering support at 13,970 levels and this area is going to be crucial for the short term trend reversal," he said, adding the next upside resistance is at 14,310.

The overall market breadth was slightly down and the broad market indices like Nifty Midcap 100 index has closed higher by 0.55 percent and Smallcap 100 index closed on a flat note.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,042.67, followed by 13,939.13. If the index moves up, the key resistance levels to watch out for are 14,246.97 and 14,347.73.

Nifty Bank

The Nifty Bank continued to outperform Nifty50, climbing 75.60 points to end at 31,797.90 on January 6. The important pivot level, which will act as crucial support for the index, is placed at 31,569.96, followed by 31,342.03. On the upside, key resistance levels are placed at 32,004.07 and 32,210.23.

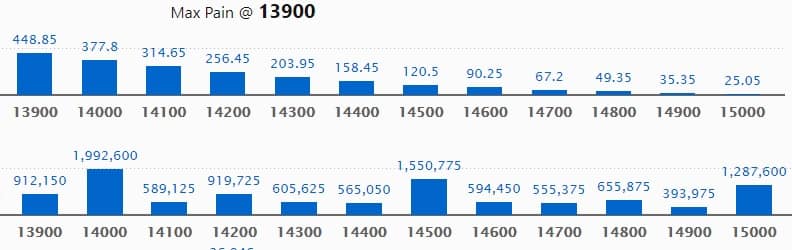

Call option data

Maximum Call open interest of 19.92 lakh contracts was seen at 14,000 strike, which will act as a crucial level in the January series.

This is followed by 14,500 strike, which holds 15.50 lakh contracts, and 15,000 strike, which has accumulated 12.87 lakh contracts.

Call writing was seen at 14,200 strike, which added 2.78 lakh contracts, followed by 14,500 strike which added 2.27 lakh contracts and 14,400 strike which added 89,550 contracts.

Call unwinding was seen at 14,100 strike, which shed 59,625 contracts, followed by 14,000 strike which shed 23,025 contracts.

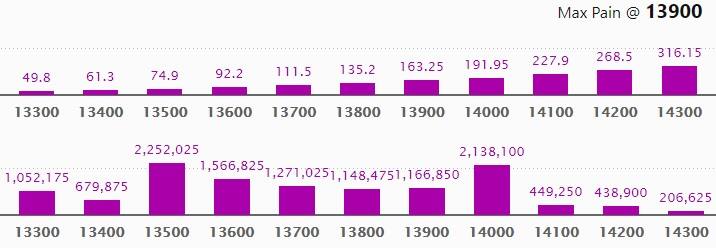

Put option data

Maximum Put open interest of 22.52 lakh contracts was seen at 13,500 strike, which will act as a crucial support level in the January series.

This is followed by 14,000 strike, which holds 21.38 lakh contracts, and 13,600 strike, which has accumulated 15.66 lakh contracts.

Put writing was seen at 13,800 strike, which added 2.23 lakh contracts, followed by 13,500 strike, which added 1.51 lakh contracts and 13,300 strike which added 1.33 lakh contracts.

Put unwinding was seen at 13,600 strike, which shed 80,100 contracts, followed by 13,900 strike, which shed 53,550 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

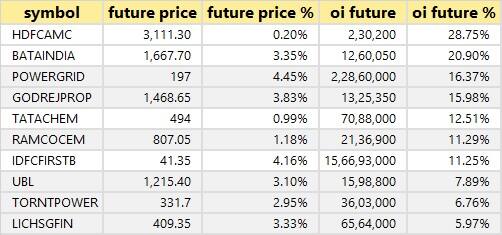

27 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

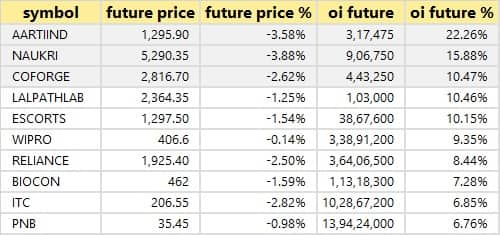

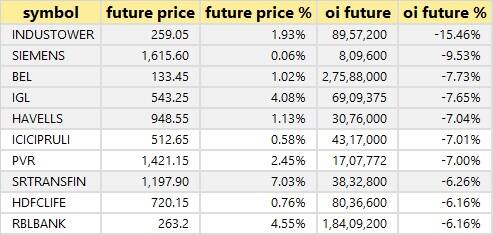

39 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

31 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

44 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

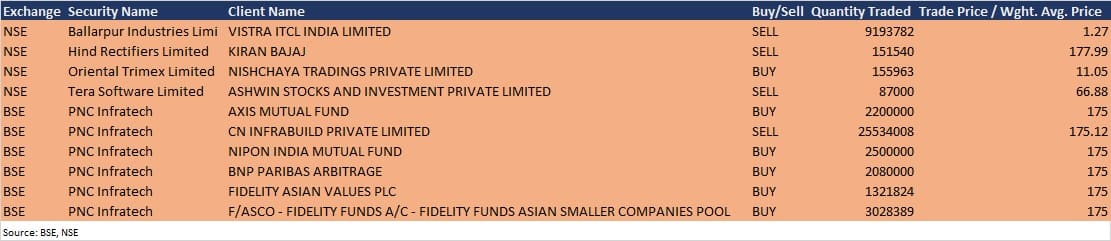

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Paisalo Digital: Company's officials will interact with Nippon Life India Asset Management on January 7.

Balrampur Chini Mills: Company's representative(s) would be attending a concall organised by Elara Capital on January 7 wherein they would meet the representatives of Unifi Capital.

Heidelberg Cement India: Company's representatives will have online meetings on January 7th with the representatives of various institutional investors/fund houses, being organised by Investec Capital Services (India).

Tata Power: Company will interact virtually with investors on January 7th in the Investec India ESG Conclave.

Mahanagar Gas: Company's officials will interact with Max Life Insurance on January 8.

Stocks in the news

Wendt: Promoters to sell up to 4.74% stake in the company via offer for sale on January 7-8, floor price set at Rs 2,200 per share.

Dish TV India: 1.84% stake pledged by promoter entities Direct Media Distribution Ventures Pvt Ltd & Veena Investments Pvt Ltd has been invoked.

Capital Trust: Credit rating of the company and its subsidiary, Capital Trust Microfinance has been reaffirmed by CARE as BBB Negative and the outlook is stable.

Maruti Suzuki: The production in December 2020 increased to 1.55 lakh vehicles, from 1.15 lakh vehicles in same month last year.

Kanpur Plastipack: Company incorporated wholly-owned subsidiary (WOS) - Bright Choice Venture.

Take Solutions: CARE revised the credit rating of the company to BB+ (Issuer Rating) with Negative outlook, from BBB (Issuer Rating) with Negative outlook.

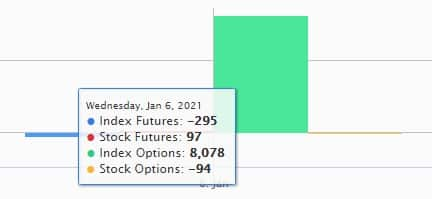

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 483.64 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 380.41 crore in the Indian equity market on January 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for January 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.