Greggs has warned of the impact of school closures on sales as it revealed it was set for an annual loss of up to £15m for 2020 with profits not expected to bounce back until 2022.

The bakery chain, which has already cut 820 jobs as the pandemic took its toll, saw sales fall by 31% to £811m for the year to 2 January.

Chief executive Roger Whiteside said latest lockdown announcements meant there were "significant uncertainties in the near-term".

Greggs, which like other businesses has seen demand squeezed by COVID-19 restrictions, reported that sales in the fourth quarter of 2020 averaged 81.1% of the same period a year earlier.

That was an improvement on the 71.2% level seen in the third quarter.

But Mr Whiteside told the Reuters news agency: "I would imagine that sales would fall back down again.

"The difference between November's lockdown (in England) and this lockdown is the schools are closed, so there's no reason to leave the house to take the children to school.

"That's a further tranche of footfall that is lost."

Greggs will publish full-year results in March, expected to show a pre-tax loss for the first time in its 82-year history.

Its warning on the impact of the latest lockdowns comes after Next said this week it faced a £58m profit hit due to store closures.

Separately, Topps Tiles said on Wednesday that - unlike in the November lockdown - it had been told to close its tile aisles to stop browsing, though online or trade counter transactions could continue, and that this would have an impact on sales.

Greggs said it did not expect profits to return to pre-pandemic levels until 2022 at the earliest.

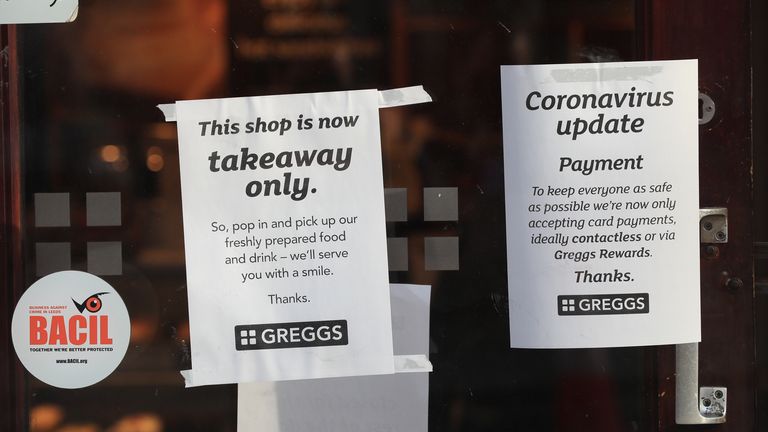

The bakery and fast food chain began reopening stores in the summer after closing them during the first lockdown.

Mr Whiteside says it has now "established working practices that allow us to provide takeaway food services" under different restrictions.

It has also developed a home delivery partnership with Just Eat and is offering products for home baking sold through Iceland stores.

Greggs plans to open around 100 net new stores in the year ahead.

The company's forecast annual loss for 2020 was lower than analysts had been expecting, and together with the fourth quarter improvement in sales helped lift shares by 8%.

Russ Mould, investment director at AJ Bell, said: "Its optimism for life beyond the pandemic seems justified by the latest business performance."