How to Trade FuboTV After Surge in Volatility

FuboTV (FUBO) - Get Report has been all over the map lately, most recently spiking about 20% in Tuesday’s trading session.

The move came after a painful drop in the stock and I’m not just referring to the 13.4% decline on Monday.

Shares have been rallying after Needham analysts reiterated their buy rating and $60 price target and after the company announced better-than-expected preliminary results.

Fubo hit a high of $62.29 on Dec. 22 after rallying 125% in five days. The move was stunning and shares closed near the highs that day.

However, the stock slipped 15% in the following session, with short reports driving a bearish sentiment into the thesis.

As a result, Fubo stock fell for seven straight sessions, shedding more than 60% of its value in the process. And now as the stock bounces: Is this one a buy?

Trading Fubo

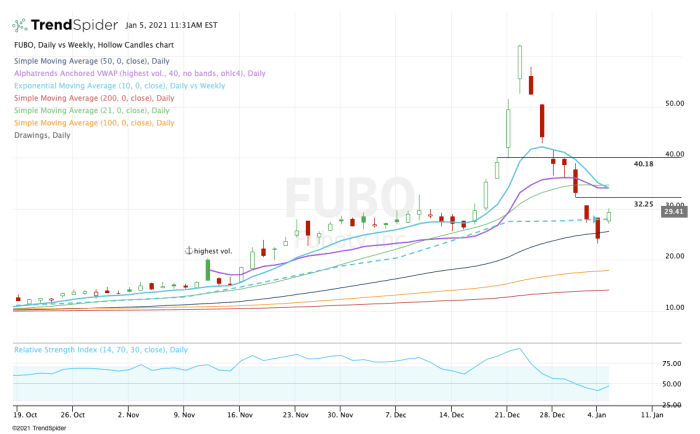

As you can see on the daily chart above, Fubo has been creamed from the highs. It paused at the 10-week moving average on Friday, broke below it on Monday and then closed below the 50-day moving average.

After such a big decline, it looked primed for a bounce. However, not many were looking for a 20% one-day rally.

With Tuesday’s surge, Fubo stock is reclaiming the key moving averages it recently broke. However, It’s struggling with the $30 mark.

A push above $30 likely puts a gap-fill in play up toward $32.25. Above that and a cluster of moving averages is in play near $34 to $35. That’s where Fubo finds its 10-day and 21-day moving averages, as well as a volume weighted average price (VWAP) measure.

Should shares squeeze above this mark, then $40 could be on the table, which most recently served as resistance.

On the downside, a break of this week’s low at $23.17 would be discouraging.

It would likely put $20 in play, followed by the 100-day moving average. Keep in mind, Fubo is a wild mover. It can fall or rise by double-digit percentages and that is considered normal with this name.

In other words, size appropriately when trading this name or avoid it altogether.