fando

Nifty showed the light at the end of the tunnel in its price action. The vibe of optimism from the coming times seem to have given the indices the boost in the last expiry of the year. This week was quite slow but the steam created though expiry was maintained though the final days of December expiry. More or less the entire December expiry was filled with upwards momentum.

There was a single session dip in the second half of the expiry but back-to-back rise in the rest of expiry brought back Nifty to recover the loss and inch higher than the levels that it fell from. For the December series Nifty ended at the highest level of the expiry and of the year 2020. The gains of almost 8% made it possible.

Bank Nifty did not disappoint either for December expiry. The bank index posted close to 6% rise in December series. However, the softer last two sessions of December series could not let Bank Nifty mimic the end of December & 2020 at the highest point. After a couple of expiries, the outperformance for Bank Nifty has toned down, which possibly led to this.

On the open interest front, Nifty futures continued to pump in optimism in the December series as well. The most damaging session also failing to invite any shorts in Nifty futures was a testimony of the strength that longs in Nifty futures have. For the December series the series of more longs than unwinding and a tad bit higher rollover compared to its 3M average led to over 5% increment in Nifty futures OI (Open Interest) EoE.

Bank Nifty on the other hand, had a bit rough second half both in terms of price as well as OI. The same fierce fall in the second half of the expiry got a different reaction from Bank Nifty futures participants. Bank Nifty added shorts on that day. The struggle in getting those shorts out of the system could not let Bank Nifty add any incremental OI for the December series.

As far as stock futures are concerned, most of the stocks saw a rise in price this expiry. However, on the OI front the story was different as more than 50% of the stocks lost OI EoE. From a simple Price-OI equation rise in price and fall in OI gets labelled as Short Covering, but looking at the longs in recent history, it does look like a profit booking drive for many of those who lost OI alongside price rise.

Slicing the futures into sectors we could see, most of the sectors this week witnessed unwinding this expiry. Cement stocks had shorts of ACC hidden in it with notable additions. FMCG added longs led by UBL and Asian Paints, Sun TV led longs in Media. LIC Housing Finance, HDFC led unwinding in NBFC, while Indiabulls Housing added longs. PSU banks had longs in Canara Bank, unwinding led by profit booking in SBI and short covering in PNB was even more. Private Banks saw profit booking in ICICI Bank and short covering in HDFC Bank.

Sentimentally speaking, OIPCR hovering around 1.5 is setting a bit humble tone for the coming days. Similarly, the week of expiry saw rise in Implied Volatility for Nifty as well. It could be the upcoming result season led excitement getting priced in.

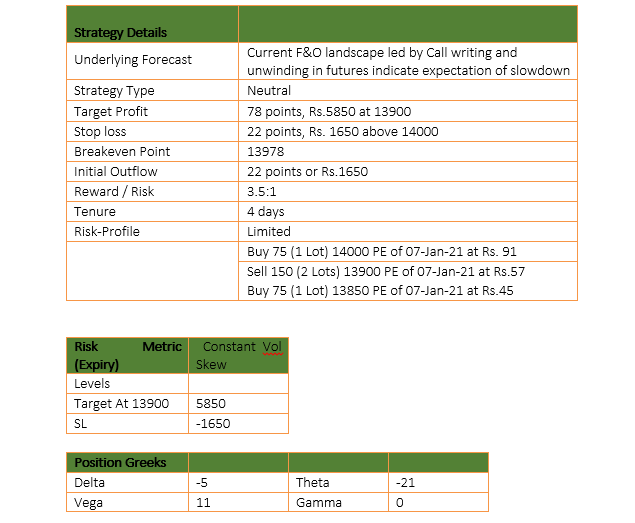

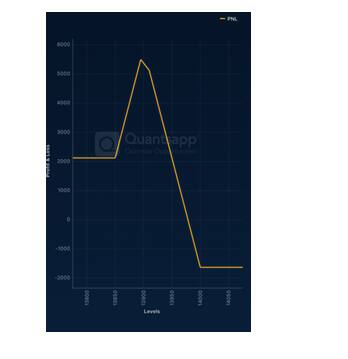

Finally, large number of aggregate futures booking profits and unwinding at higher levels indicates expectation of slow down. Heavy built-up at 14000 in multiple expiries indicate a struggle sustaining above 14000. Recent rise in the IVs in Nifty options indicate increment in risk assumption for Nifty. Such F&O landscape post expiry indicates expectation of a pullback or consolidation, hence a hedge against it via Modified Put Butterfly is advised.

Modified Put Butterfly is a 4-legged strategy where 1 lot of Put close to current underlying level is bought against that 2 lots of lower strike Puts are sold and 1 more lot of Put is bought but closer to the Put sold strike. This keeps the lower but constant profits in case of downward breakout. This is a fairly risk averse and a universal strategy.