Union Finance Ministry. (PC-PTI)

The central government’s fiscal deficit for 2020-21 is likely to be around 7 percent of nominal gross domestic product, Moneycontrol has learnt.

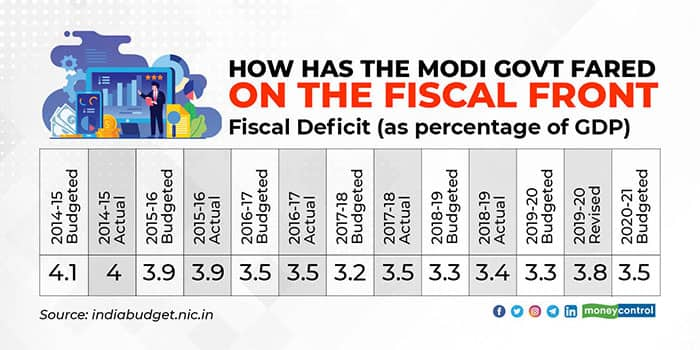

The budgeted target for the year, set before the COVID-19 pandemic, was 3.5 percent of GDP. For 2019-20, the revised estimate was 3.8 percent, but official figures at the end of April 2020 showed that fiscal deficit had touched 4.6 percent, a clear breach of the Fiscal Responsibility and Budget Management Act.

It should be remembered that the fiscal deficit will be a percentage of a lower nominal GDP than the Rs 225 lakh crore that the Budget had assumed for 2020-21. In the April-June quarter of this COVID-19 affected year, when real GDP contracted 23.9 percent year-on-year, nominal GDP contracted 22.6 percent. In July-September quarter, real GDP fell 7.5 percent while nominal GDP contracted by 4 percent.

Hence, a probable fiscal deficit of 7 percent of GDP is being seen as a disciplined approach by many in the government. The COVID-19 pandemic has given the Centre an excuse to go for an even higher budgetary slippage as economists, experts and industry seek an even higher public spending stimulus from the government.

“There has been an increase in spending on a number of schemes and programmes under PM Gareeb Kalyan Yojana and Aatmanirbhar Bharat. But part of that will be offset by savings and expenditure rationalization on other fronts. Additionally, tax revenues have picked up in the second half of the year,” a senior official told Moneycontrol.

For the Rs 1.7-lakh crore Gareeb Kalyan set of measures announced in March, the government’s additional outlay was around Rs 92,000 crore. In the Rs 21-lakh crore ‘Aatmanirbhar Bharat 1’ set of annoucements in May, the actual fiscal outlay by the Centre was estimated at Rs 2.3 lakh crore. The additional spending outlay in the Rs 2.65-lakh crore ‘Aatmanirbhar Bharat 3’ set of measures, announced before Diwali, was Rs 1.5 lakh crore.

As part of these measures, the Centre increased its outlay in a number of schemes like NREGA, food, cooking gas, housing programmes, and fertilizer subsidy, while the capital expenditure target of Rs 4.12 lakh crore has been pushed up by around Rs 32,000 crore.

However, there has also been expenditure rationalization. The spending per quarter of a number of ministries has been capped at 15 per cent of annual allocation, compared to the usual 25 per cent, and there have been curbs in travelling and other administrative expenditures.

Meanwhile, the revenue position is stronger now. Goods and Services Tax collections for December rose to Rs 1.15 lakh crore, the highest ever since the implementation of the nationwide tax in July 2017. This was the fourth consecutive month that GST collections outperformed compared to the comparable period in 2019. Corporate tax collections have also been highly encouraging.

However, in spite of the various announcements, government spending is not all that higher compared to 2019, a pre-pandemic year. Total expenditure for April-November was Rs 19.06 lakh crore or 62 per cent of the budget size of Rs 30 lakh crore. This compares to 65.3 per cent for the same period last year, when total expenditure for April-November 2019 was Rs 18.20 lakh crore versus a budget size of Rs 27.9 lakh crore.

Aditi Nayar, Principal Economist with ICRA Ltd, says that even to reach the budgeted expenditure of around Rs 30 lakh crore, the centre would be required to spend Rs 11.3 lakh crore in the last four months of FY2021, “Which is a considerable 31 per cent higher than the outgo in the same period of FY2020, and therefore may prove to be challenging to achieve," she said