The market started off the year 2021 as well as January series on a positive note with the Nifty50 closing above 14,000 mark for the first time on January 1 supported by select buying in auto, FMCG, IT and healthcare stocks.

The BSE Sensex was up 117.65 points at 47,868.98, while the Nifty50 gained 36.70 points at 14,018.50 and formed small bullish candle which resembles Doji kind of pattern on the daily charts. The index rose 2 percent for the week and witnessed bullish candle formation on the weekly scale.

“Technically, the index has formed breakout continuation formation and the texture of the chart suggests uptrend likely to continue in the near term. We can expect further upside activity towards the 14,300 or 14,400 levels," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

On the downside, he said the Nifty would find big support between 13,800 and 13,700.

The broader markets outpaced equity benchmarks as the Nifty Midcap 100 and Smallcap 100 indices gained 1.2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,989.93, followed by 13,961.37. If the index moves up, the key resistance levels to watch out for are 14,048.43 and 14,078.37.

Nifty Bank

The Nifty Bank declined 38.15 points to close at 31,225.85 on January 1. The important pivot level, which will act as crucial support for the index, is placed at 31,147.9, followed by 31,070. On the upside, key resistance levels are placed at 31,344 and 31,462.2.

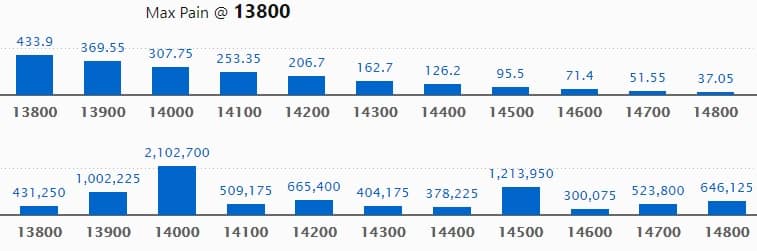

Call option data

Maximum Call open interest of 21.02 lakh contracts was seen at 14,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,500 strike, which holds 12.13 lakh contracts, and 13,900 strike, which has accumulated 10.02 lakh contracts.

Call writing was seen at 14,000 strike, which added 2.4 lakh contracts, followed by 14,200 strike which added 1.8 lakh contracts and 14,500 strike which added 1.5 lakh contracts.

Call unwinding was seen at 13,800 strike, which shed 74,025 contracts, followed by 13,500 strike which shed 27,750 contracts.

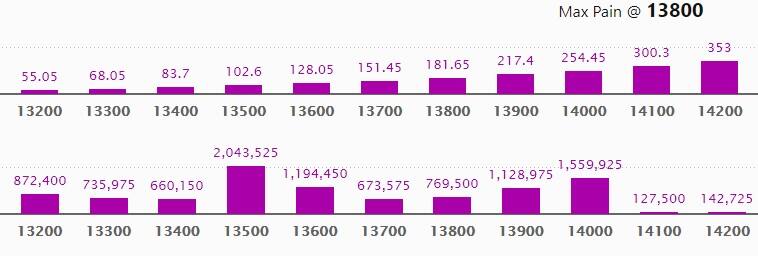

Put option data

Maximum Put open interest of 20.43 lakh contracts was seen at 13,500 strike, which will act as crucial support level in the January series.

This is followed by 14,000 strike, which holds 15.59 lakh contracts, and 13,600 strike, which has accumulated 11.94 lakh contracts.

Put writing was seen at 14,000 strike, which added 3.68 lakh contracts, followed by 13,600 strike, which added 2.93 lakh contracts and 13,500 strike which added 2.67 lakh contracts.

There was hardly any Put unwinding seen on the first day of January series.

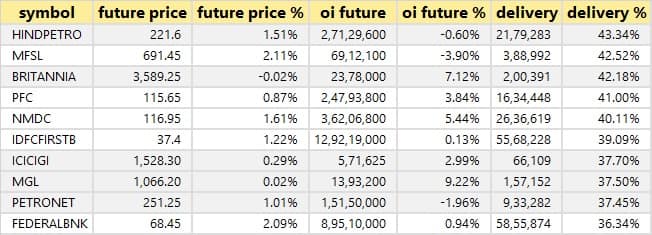

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

89 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

4 stocks saw long unwinding

Based on the open interest future percentage, here are the 4 stocks in which long unwinding was seen.

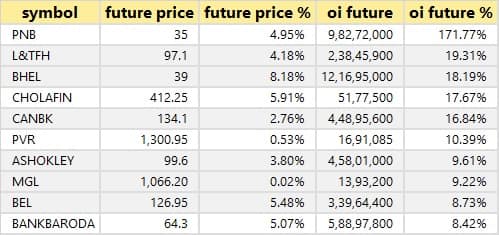

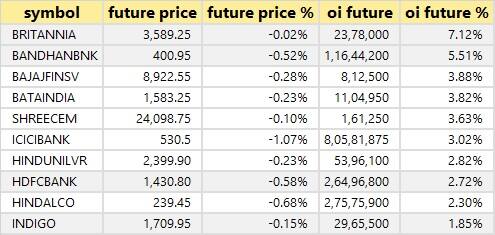

18 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

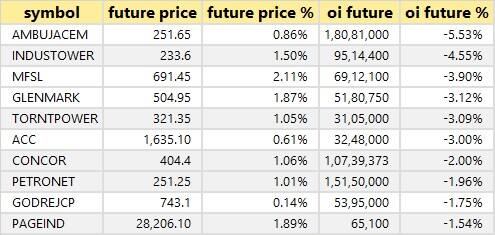

27 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

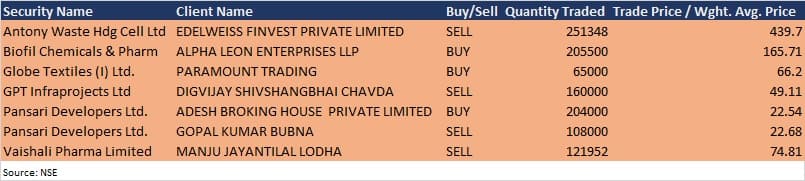

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Sanmit Infra: Board meeting is scheduled on January 6 to consider the allotment of shares pursuant to preferential issue, notice of EGM and any other item.

Shalby: Board meeting is scheduled on January 8 to consider December quarter results.

Stocks in the news

Eicher Motors: Total sales increased by 37% to 68,995 units of Royal Enfield in December 2020 against 50,416 units in December 2019.

Coal India: Provisional production in December rose by 0.5% YoY to 58.3 million tonnes.

GTPL Hathway: Company sold its entire 51% stake in GTPL Shiv Network for Rs 20 lakh share transfer agreement.

Adani Green Energy: Company received letter of award for 600 MW wind-solar hybrid power project.

Tata Motors: Sales in the domestic & international market for Q3 FY21 increased to 158,215 vehicles, compared to 129,381 units during Q3 FY20. But sales in December 2020 declined 4% to 32,869 vehicles YoY.

NMDC: Provisional production increased to 3.86 MT in December 2020, from 3.13 MT in December 2019, while sales rose to 3.62 MT from 3.04 MT in same periods.

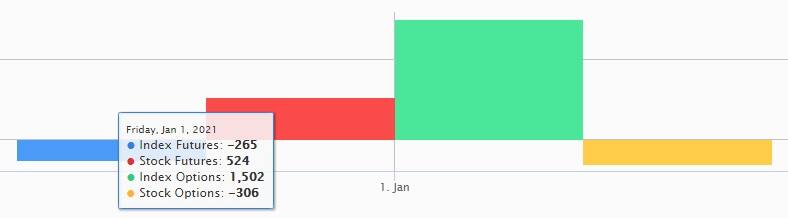

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 506.21 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 69.4 crore in the Indian equity market on January 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for January 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.